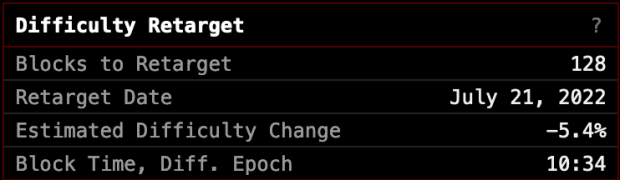

This will be the third mining difficulty downward adjustment in a row with four downward adjustments over the course of the last five difficulty epochs.

The below is a direct excerpt of Marty’s Bent Issue #1240: “Another downward difficulty adjustment is on the way.” Sign up for the newsletter here.Bit

Don’t look now, but July 21, 2022, should bring a downward difficulty adjustment of around 5%, which will be the third consecutive downward adjustment and the fourth over the course of the last five difficulty epochs. Marking the longest streak of downward adjustments since this time in 2021, when miners were forced to unplug and migrate out of China as quickly as possible.

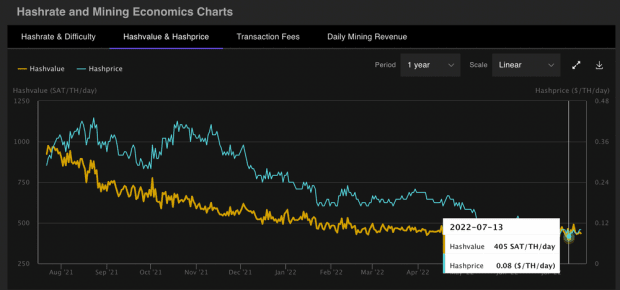

With the global macro outlook deteriorating over the course of 2022 and the bitcoin market experiencing a mass deleveraging event in the wake of Ponzi blow ups with many lenders who were exposed to one particular Ponzi scheme — 3 Arrows Capital — getting completely wiped out and bringing the bitcoin price down with them, bitcoin miners have been feeling the pain. The downward pressure on the price of bitcoin has pushed the hash price down with it; hitting a low of $0.08 TH/day exactly a week ago.

Hash price has since recovered to $0.10 TH/day with the recent pump in price, but it is pretty clear that many players in the mining industry are feeling the pain. The two indicators I am looking at to gauge the pain are publicly-traded miners’ bitcoin treasuries — the holding or selling — and the price of ASICs. Over the course of the last two months, publicly-traded miners have sold tens of thousands of bitcoin to service debt and retain a cash runway for their businesses. At the same time, the price for ASICs as measured in dollars per terahash has been absolutely cratering, reaching levels not seen since late 2020.

I am personally seeing top-of-the-line machines being sold for $25-$30/TH this week. For context, these same caliber machines were selling for well over $100/TH right before the China ban and right around $100/TH in December 2022 when the dust created by the China ban settled. The price of ASICs is falling rapidly as miners who prefer not to sell bitcoin (or don’t have any to sell in the first place) decide to sell their machines instead to cover expenses and debt obligations. There are currently tens of thousands of machines that have not even been opened yet, sitting in warehouses across the United States. Some publicly-traded miners used their access to capital markets to secure massive ASICs futures orders that have been delivered over the course of this year. Some of those miners have been having a hard time finding the necessary capacity to plug all of those machines in in a timely manner. With mining stocks getting absolutely hammered alongside the price of bitcoin it is proving to be too costly to hold onto those ASICs, which are declining in value as well.

On top of this, miners with relatively high electricity prices have seen their operations turn unprofitable. If they are not able to stomach losses for consecutive months, they will shut off and liquidate their assets (ASICs). Hence, the extremely low ASIC pricing that the market is seeing right now.

I expect the price of ASICs to continue to fall throughout the summer as markets continue to tank and bitcoin hangs in the low $20,000 range. These fire sales from desperate miners and the manufacturers present an incredible opportunity for anyone in the mining industry with significant capital and the ability to execute. Your Uncle Marty thinks we’ll look back on late summer 2022 as one of the best times in bitcoin’s history to get into mining. If individuals or companies scoop up ASICs at these levels, are able to lock in reasonable electricity pricing, plug their machines in quickly and the price of bitcoin recovers at some point later this year, the amount of time it will take for these machines to ROI will be very short.

We’ll keep you freaks abreast of the situation as it unfolds. Until then, enjoy the downward difficulty adjustment! A beautiful reminder that Bitcoin works as designed and that you’re probably going to stack more sats if you’re a miner who is up and hashing right now.