Where a Lightning-powered microtransaction paywall beats a Value4Value bitcoin ask: A nuanced breakdown.

This is an opinion editorial by Will Schoellkopf, author of “The Bitcoin Dog” and host of the Bitcoin podcast “It’s So Early!”

When it comes to paywalls versus #value4value, is it really all or nothing?

Author’s note: My aim is not to attack anyone personally. I will use specific people’s quotes for my examples, but my intent is to respectfully challenge ideas, not attack people. Healthy debate of ideas in good faith helps Bitcoin, so I hope they understand.

In Gigi’s article, “The Freedom of Value,” he breaks down what’s broken with the monetization of information, “The problem with the internet is that information wants to be free.”

As a content creator, in my case a writer, this problem with the internet hits home. It’s a lot of work to write good content, and I don’t work for free. I look to be compensated for my proof-of-work. As the Joker says, “If you’re good at something, never do it for free.”

Gigi breaks down the problem of just trying to sell information (like a written book/article) behind a paywall into two distinct reasons, the “MTX problem” (Mental Transaction problem) and the “DRM paradox” (Digital Rights Management paradox).

I acknowledge the “DRM paradox” has no solution: “content will only stay locked behind paywalls if it sucks. If it’s good, it will be set free.”

Additionally, Gigi explains: “The MTX problem, with MTX being short for ‘mental transaction,’ refers to the problem of irreducible mental transaction costs inherent to every transaction. Every time you hit a paywall, you have to make a conscious decision: ‘Do I want to pay for that?’”

Since Gigi “believe[s] that the MTX problem is a bigger deal than the DRM paradox,” that will be the focus of this article. Gigi acknowledges the traditional solution to spare the consumer of the headache of mental transactions is the subscription model, but then so many different subscriptions are needed for exclusive content that it becomes impractical again.

With an open mind, willing to see not just black and white but entertain shades of gray, please consider how lightning microtransactions, deployed the right way, can work towards solving the mental transaction problem. As Nick Szabo states:

“A micropayments system assumes a solution to the mental accounting problem. If somebody could actually solve this problem … the savings would be enormous even in existing business … not to mention all the new possibilities possible by lower transaction costs.”

To begin, why do people enjoy just outright buying a book? Nick Szabo answers this concisely: “A flat fee constitutes an embedded, implicit insurance contract.”

When I offer my ebook at a flat price, the reader is safe. They know they own it and can read it at their leisure. However, this flat price creates a barrier to entry. It becomes all-or-nothing if they want to read the ebook. But if I break this barrier into pieces, and make each chapter a mini paywall pay-per-click lightning transaction, then the reader only pays for what they enjoy!

Enter: the pay-as-you-enjoy model. If the reader enjoys the chapter, they can pay-per-click to read the next one, and the next one. If they’re done reading before having reached the end, they’ll have spared themselves from having to pay to read the whole book. It wasn’t all-or-nothing!

Through pay-as-you-enjoy, the reader loses the insurance that I won’t increase the cost per chapter as they continue to read through the book over time, but hold onto that thought for a bit.

Nick Szabo points out the flaws of the pay-per-click monetization model: “There has been floating for a while the idea of ‘pay per click,’ a micropayment for every click on the Web to pay its owner for content. However, since there has been no chance to browse the content, there is no way to directly ascertain whether it meets tacit preferences: there is no accurate customer observable explicit preference. Browsing a preview or book cover is still inaccurate, and entails increasing mental costs the more accurate it is.”

Again, I’m building towards a solution to the mental transaction problem. “Attribute observation costs” are still present, and that’s ok. There’s no attribute observation cost in Value4Value because the reader can keep reading without paying anything at all. No cost per click. Even still, Value4Value confronts the same final problem that pay-as-you-enjoy tackles head-on. As Nick Szabo concludes:

“Assuming, for the moment, perfect information on the product at hand, and no uncertainty as to future cash flows, a third and more basic source of customer cognitive cost remains, namely the cost of making decisions with a large, but nevertheless very incomplete, set of alternatives.”

Even if the reader already knew everything about the content, and knew for sure their budget, how can they know for certain they should spend their money on this instead of something else?

In practice, consumers just make decisions because they have to. The mental transaction problem persists because they’re either deciding whether to give value back once they’ve finished reading, or they’re freed of this because they’ve already spent the money to read the work in the first place.

Value4Value is just delaying the mental transaction problem until after the reader has finished reading. As Adam Curry explains, “The Ask is the most important piece of the puzzle. The #1 reason why people do not give to charities and the like is because they weren’t asked, and the same is true for the Value4Value model.”

Since part of the Value4Value loop is “The Ask,” it hasn’t fixed the “costly decision making” piece of the Mental Transaction Problem. Versus pay-as-you-enjoy, my readers can finish reading and feel good that they’ve paid a price I felt was fair, rather than wrestle internally on who to support.

In fact, with lightning, I think we’ve come close to solving the intelligent agent problem Nick Szabo describes:

“There seems here to be a fundamental cognitive bottleneck. One proposed solution to this has been “intelligent agents”. But since these agents are programmed remotely, not by the consumer, it is difficult for the consumer to determine whether the agent is acting the consumers’ best interests, or in the best interests of the counterparty — perhaps, necessarily, at least as difficult as reading the corresponding full statement of charges. Furthermore, the user interface to enable consumers to simply express their sophisticated preferences to an agent is lacking, and may represent another fundamental cognitive bottleneck.”

Nick describes an “intelligent agent” as someone the consumer delegates to make purchases on their behalf – sparing them the headache – but then they still have to explain to the agent what they enjoy. As part of pay-as-you-enjoy, once the consumer sets up their budget (their “flat fee” insurance mentioned above), they are free to engage in pay-per-click reading without worry about overspending! This agent which deducts sats per click is not programmed remotely, but by the consumer. Moreover, the consumer sees the author’s monetary policy up front when they set their budget. They know the price per chapter, but also how much to spend to get one month of free access – an incentive to give the author what they see as the full value for their work! The pay-as-you-enjoy user interface is slick. The consumer sets their budget and then it’s pay-per-click!

Nick Szabo summarizes the MTX problem as the following:

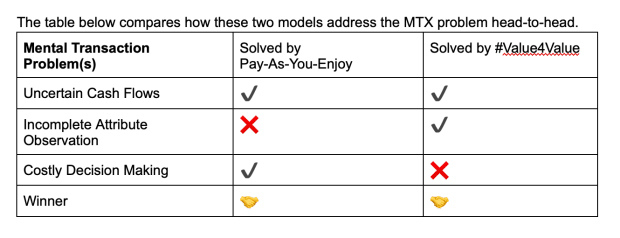

“We have seen how customer mental transaction costs can derive from at least three sources: uncertain cash flows, incomplete and costly observation of product attributes, and incomplete and costly decision making. These costs will increasingly dominate the technological costs of payment systems, setting a limit on the granularity of bundling and pricing. Prices don’t come for free.”

In the table above, they are tied. However, when it comes to written content like books, I think pay-as-you-enjoy has the edge.

As Adam Curry points out, only ~4% of people give value back. For him and his established podcast audience, he thinks that’s ok. He says, “Somehow, however, it all works out in the end.”

This “Somehow” is misleading. He emphasizes the need for the “Feedback Loop.” “Gone are the days of static broadcasting.

- Ask

- Acknowledge

- Repeat”

Books are not living, breathing documents. They’re static. If acknowledgment and the feedback loop are needed to monetize 4% of your readers, that’s a lot of pressure for new authors without a large following or way to give acknowledgment back.

I’ll spare my readers the costly decision making at the end of the work. I’ll let them pay-as-you-enjoy! And I’ll implement a donate button and a boost button as well so they can give extra value back if they particularly like a scene!

You can try out lightning enabled pay-as-you-enjoy at BitcoinDogBook.com, powered by Mash! In a followup article, I present a technical architecture breakdown of how content creators can implement the same model!

This is a guest post by Will Schoellkopf. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.