With the price of bitcoin being so down, opportunities abound for bitcoin mining operations with structured cash and efficient operations.

This is an opinion editorial by Ruda Pellini co-founder and president of Arthur Mining, an ESG-focused bitcoin mining company.

I recently saw an article that cited the level of leverage and debt of the world’s leading Bitcoin mining companies. Since they are listed companies, it is easy to find their financial statements and prove the obvious: this is a counter-cyclical business that requires a lot of efficiency and professional management.

For those who are still wondering what mining is, let me quickly explain: the term mining makes an analogy to the process of extracting gold and metals, since bitcoin miners are the “producers” of this digital commodity. In practice, mining consists of allocating computing power and electricity to ensure the bitcoin network functions, validating transactions and serving as the backbone of this decentralized system.

Investing in bitcoin mining is different from buying the asset directly. On the one hand, when investing in mining you have constant and predictable cash flow and physical assets that can be liquidated in the event of market stress, making the investment more attractive to more cautious investors accustomed to investing in cash flow generating businesses. On the other hand, besides the risk related to the asset, there are also risks of the operation itself.

Currently, bitcoin is down more than 65% from its November 2021 peak. Moments like this generate apprehension and make the investors ask themselves: is it an opportunity to increase my investments or a risk?

For bitcoin mining operations with structured cash, the moment represents a great opportunity! To quote Warren Buffet: “It’s only when the tide goes out do you learn who was swimming naked.”

The Impact Of Bitcoin Price On Mining

In general, bitcoin miners have their cash flow reduced as the price of bitcoin falls, so at first glance it is counterintuitive that lower prices are beneficial to a mining company.

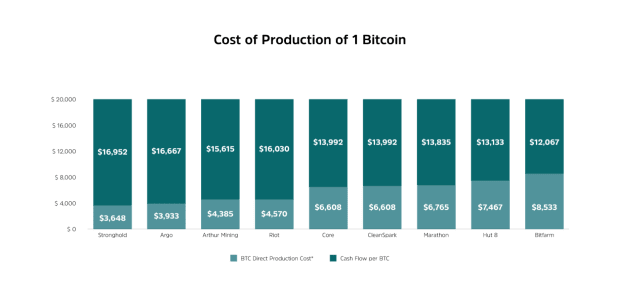

However, since we are talking about an industry, more important than the market price is the cost of production.

Within the production costs, the biggest cost is the cost of electricity, which is the main input for this data processing activity. Therefore, those who can get a good price for energy and efficiency can remain profitable even in unfavorable market conditions.

Since not all miners can achieve this same level of efficiency, in scenarios like this one many end up having their production cost very close to the market price of the asset, leading them to liquidate their assets and exit the market.

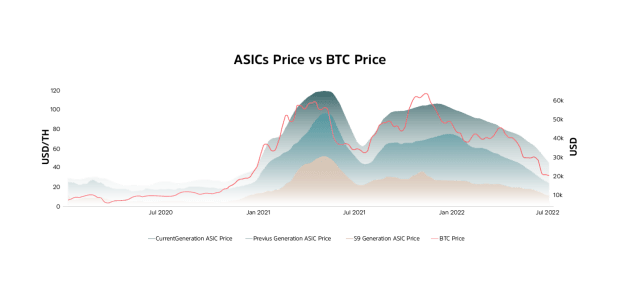

Because of this, as in most commodity markets, this market is also counter-cyclical, and these down times are the best times to expand operations. There is a positive correlation of the price of mining computers with the price of Bitcoin, where the price ends up being adjusted in a greater variation than the asset itself.

While the price of bitcoin fell about 47% from April to August of this year, the price of computers used in mining fell about 60% in the same period.

The Bitcoin Mining Companies

Particularly, I understand the mining industry in much the same way as the network infrastructure (cable) industry of the 1990s, where there were basically three major cycles of expansion and consolidation.

The first cycle was marked by geeks and technology enthusiasts, who started internet businesses and literally cabled and set up the first network infrastructures. This has also happened with bitcoin miners since 2009.

In the second cycle, we had the entry of players interested in maximizing capital quickly, ignoring the importance of efficiency by focusing only on the accelerated expansion of their structures and on short-term results.

In the third cycle, we had the consolidation of the industry, with the entry of players focused on efficiency and long-term vision, encouraging the entry of venture capital and the professionalization of the market. In the United States, the 50 largest cable companies of the late 1990s were consolidated into four by the end of 2010.

Most of today’s large mining companies entered the second cycle, with too much focus on the short term and not enough efficiency. This results in businesses that are not very robust and are very vulnerable to times of stress.

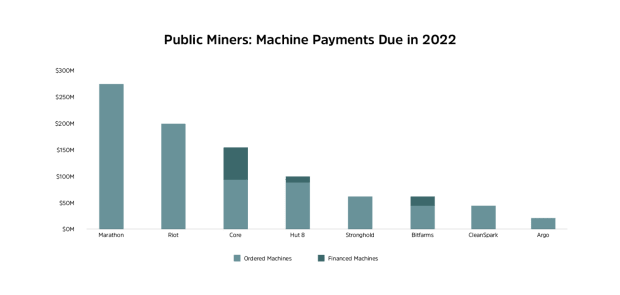

During bitcoin’s big up cycle between 2020 and 2021, many mining companies took advantage of rising margins to leverage themselves and expand their operations. This is very common in many industries, but in this case in addition to leveraging in dollars, a good portion of the listed miners ended up keeping their cash in bitcoin in an attempt to maximize their results.

According to estimates from Luxor Technologies, estimates indicate that listed mining companies have between $3 and $4 billion in loan agreements used to finance infrastructure expansion and computer purchases.

Produce On The Uptrend, Sell On The Downtrend

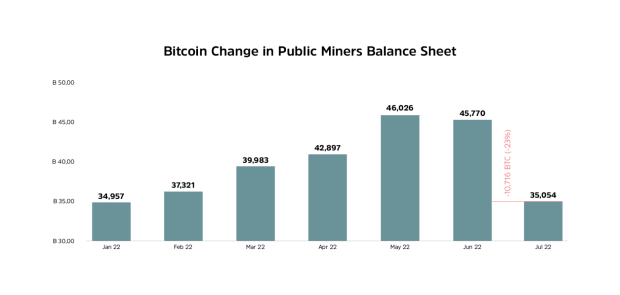

Mistakenly, these players did not consider that, as in any commodity producer, if you are able to increase your production capacity, it makes sense to sell the stock you produce and reinvest it, rather than keeping the asset you produce on your balance sheet.

In order to be able to honor these commitments, mining companies began to liquidate their liquid assets first, in this case the bitcoins held on the balance sheet. This move further increased the selling pressure during June and July, pushing prices to new lows.

Basically, the result of the cash management strategy adopted by these mining companies was to mine high and sell low, resulting in further financial losses in addition to the operational losses caused by the bitcoin price declines.

After selling the bitcoin from the balance sheet, the less efficient mining companies will need to sell computers to honor payments and maintain the operation, opening up space for more efficient mining companies to incorporate these assets and operations.

Time To Expand

As with other commodities, bitcoin mining is an anti-cyclical business. As a result, the best time to grow is during periods of low prices, when inefficient miners face problems and exit the market.

At the current moment the equipment is at a great discount and the investments made now will bring returns faster. So, despite the negative news and the last few months of falling prices, this is a moment of great asymmetry, with reduced risk and high potential returns to make investments in bitcoin mining.

We are in a moment of great opportunities and those who invest now will be winners in the long run. In short, for businesses that are well structured and have strategic advantages that ensure efficiency, all the turbulence of this harsh winter points in the direction of a very favorable spring for growth.

This is a guest post by Ruda Pellini. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.