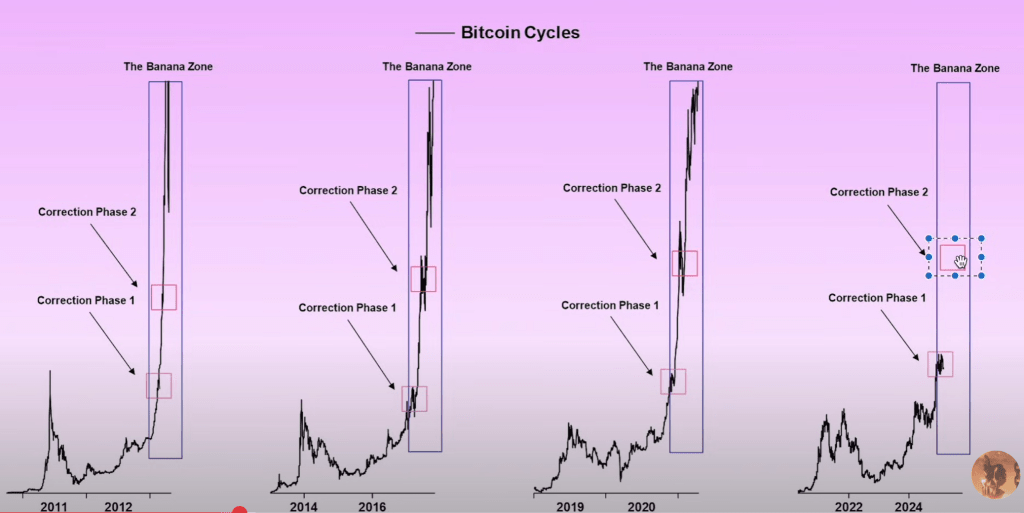

In a market update, prominent crypto commentator Rekt Capital examined Bitcoin’s latest dip through the lens of previous bull cycles, asserting that it closely resembles the 2017 pattern of multiple corrections en route to a parabolic top. Speaking in a video titled “Where’s The Bitcoin ‘Banana Zone’? – An Update,” the analyst referred to the “banana zone” as “effectively a term of endearment for the parabolic phase of the cycle when it comes to Bitcoin’s price action.” He described the current retracement as a natural but extended correction, emphasizing that it is “still on track” despite many traders feeling discouraged.

Will Bitcoin Enter ‘The Banana Zone’ Again?

Rekt Capital drew parallels between the present dip and historical market behavior, spotlighting the cyclical tendency for Bitcoin to experience two or more corrective periods once it breaks into new all-time highs. Citing the 2017 rally, he noted that there were instances of “34% to 38% to 40%” pullbacks, at least four in total, before the ultimate peak was reached.

He also referenced 2013’s bumpy ascents and traced them against today’s price movement, explaining that “when we break to new all-time highs, it can get a little bit bumpy” both around old highs and immediately following new ones. Despite the current drawdown of 32% (max height), he maintained that “we’re going to see additional upside after this corrective period like we’ve seen in the past” and classified the market’s present position as part of the first of two probable corrections in the current price discovery phase.

Throughout his analysis, Rekt Capital underscored the importance of patience, noting that what might feel like a prolonged drawdown is not “out of the ordinary” for Bitcoin which historically endures multiple phases of uptrends and retracements on its way to a peak. “What’s out of the ordinary,” he said, “is that it’s taking longer, but it’s going to enable that next price discovery uptrend in the future.”

He provided historical context by looking back at mid-2017 and other phases when Bitcoin underwent repeated downturns that ranged from around 30% to 40%. According to him, these corrections often deepen as the cycle progresses, although the final one before the next major move can sometimes be shallower.

The analyst also delved into technical indicators such as the 21-week and 50-week exponential moving averages, suggesting that Bitcoin’s price has begun forming a triangular market structure as it becomes “sandwiched in between the 21-week EMA and the 50-week EMA.”

He drew comparisons to the mid-2021 period, when a similar formation preceded a 55% downside move that eventually broke out into another bullish phase. “We ended that period with a weekly close and post-breakout retest of the 21-week EMA into support,” he recounted, predicting that a similar situation could see Bitcoin rally toward the $93,500 level if the move above the 21-week EMA holds.

In addressing concerns that the market is entering a bear cycle, Rekt Capital asserted that “it’s not a bear market like everybody is saying.” While he acknowledged the emotional toll of large pullbacks and the prevalence of conflicting signals in the media, he advised keeping a level head and focusing on strong indications such as moving-average confluence, historical correction ranges, and the fact that “we’re in this first price discovery correction” rather than any final downturn. According to his outlook, the crypto’s price is still following the overarching blueprint set by previous bull runs, even if it is “a little bit of a deep one” and has disappointed traders hoping for more immediate parabolic momentum.

Rekt Capital concluded his commentary by stressing reaccumulation phases are part of a lasting bull-market framework rather than the onset of a prolonged downtrend.

At press time, BTC traded at $85,914.