Introduction

In an economic landscape increasingly characterized by monopolization and the dominance of institutionalized credit, innovative technologies and protocols are emerging that have the potential to change the foundations of our economy and society.

At the forefront of this are Bitcoin and Nostr—two groundbreaking protocols that together can usher in a new era of innovation, free from the financial constraints of the fiat system. This article examines the history and mechanisms that enable Bitcoin and Nostr to act as catalysts for innovation and human progress.

Innovation under Hard Metal Currencies

In the days of hard metal currencies, especially during the gold standard, innovation was primarily driven by individuals and private companies who were independent of the state apparatus and institutional lenders. Some of the greatest breakthroughs in science, philosophy and economics were made by private entrepreneurs.

- In 600 BC, a Greek named Thales observed that amber, when rubbed with silk, attracted feathers and other light objects. He discovered static electricity. The Greek word for amber is ‘ëelectron’, from which the words ‘electricity’ and ‘electron’ are derived.

- The Greek philosopher Plato (ca. 428-347 B.C.) is widely considered to be the first person to develop the concept of an atom, the idea that matter is made up of an indivisible component on the smallest scale. He also wrote a number of important books on science, philosophy, economics, politics and mathematics.

- Wei Boyang was a Chinese writer and Taoist alchemist of the Eastern Han dynasty. He is the author of The Kinship of the Three (also known as Cantong Qi), which is considered the earliest book on alchemy in China, and is noted as one of the first individuals to document the chemical composition of gunpowder in 142 AD.

- The car was invented in 1886 by German engineer and automobile manufacturer Carl Benz, who was inspired by Nikolaus Otto, who invented the first gas engine in 1861.

- The Wright brothers are considered the inventors and the first to fly a powered airplane on Dec. 17, 1903, in Kitty Hawk, North Carolina.

The creativity and ingenuity of the Wright brothers has been well documented:

The funds for the brothers’ ventures, including equipment, travel, and their testing site in Kitty Hawk, came from the bicycle shop they operated. They apparently spent just $1,000 over four years (1899-1903) to develop three flying machines, two of which had no engines. The Wright brothers lived during a time when the U.S. was on a gold standard, and saving allowed entrepreneurs to accumulate enough capital to finance innovations, giving them the time and resources needed to pursue their pioneering work in aviation. The ancient Greeks, such as Thales and Plato, also operated under hard metal currencies, contributing to a stable economic environment that fostered philosophical and scientific advancements.

Similarly, Wei Boyang exemplified the pursuit of knowledge during the Eastern Han dynasty in China, which experienced fluctuating monetary conditions, including periods of stability that contributed to intellectual growth in various fields.

Just as the Wright brothers benefited from a time when saving in sound money allowed individuals to focus on their innovations, today’s private entrepreneurs, startups, and bicycle shop owners find it increasingly difficult to earn enough to take the time to think about innovations and finance their implementation.

Inflation has significantly driven up labor and material costs, particularly in industries like aviation and automotive, where advanced technology and greater material requirements demand extensive research and development. As a result, entrepreneurs and freelancers often rely on third-party loans. The average cost of developing a Mercedes car today, for example, is more than two billion euros.

How the Fiat System Blocks Human Progress

The fiat-based monetary system has made it increasingly difficult for innovation to emerge without institutional funding. Monetary inflation erodes purchasing power, limits financing options, and creates obstacles for new ideas to flourish. This is problematic because the institutions that typically fund innovation, including large venture capital firms, banks, and universities, are mostly dependent on the state in one way or another (either because they are regulated by law or because they receive government funding) and therefore have an incentive to support projects that ‘follow’ the current political climate.

The result is a banal misallocation of capital and social stagnation, as can be observed in most countries around the world.

Credit, Fiat and the State Monopoly on Innovation

Credit has become part of a system of control that nation states use in conjunction with fiat money to maintain their monopoly position. Historically, technologies and social movements that undermined the monopoly power of the state and its affiliated institutions were typically banned. At the very least, there was usually an attempt to do so.

A good example is the way Bitcoin is treated by most states, how poorly it is spoken of in most universities, and how most banks used to consider it speculation at best. Because Bitcoin threatens the existence of these institutions. This behavior is generally observed among monopolists and initially makes it difficult for entrepreneurs to enter new disruptive markets like Bitcoin and shifts competition in favor of the monopolist (the state).

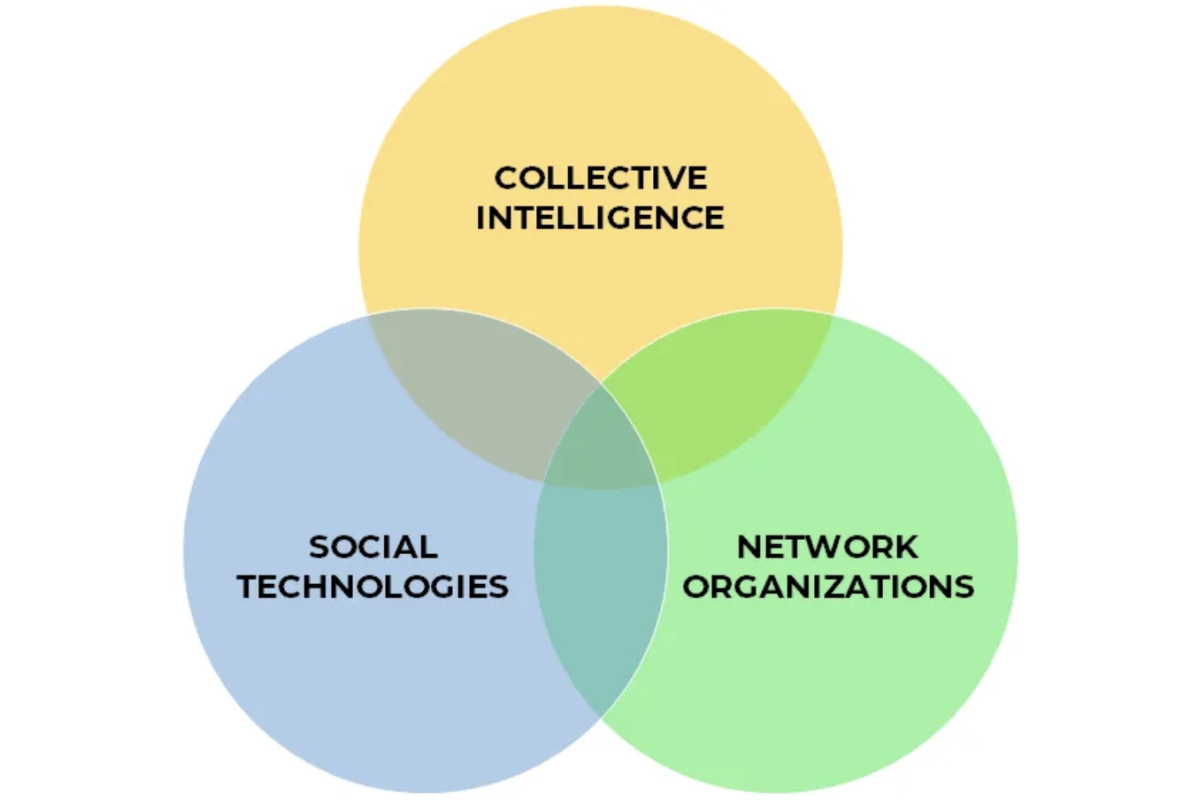

Money creation and the granting of credit are fundamental to maintaining the state’s monopoly position. As a result, the reliance on the institutionalized credit system to finance innovation has led to a dependence on a central authority (the state). This disrupts the progress and prosperity of humanity that results from a free market in which capital and information can be freely exchanged and suppresses the collective creativity of humanity.

Bitcoin and the weakening state monopoly on innovation

With the introduction of Bitcoin in 2009, the state monopoly on money was broken. Due to its limited supply and excellent monetary properties (absolute scarcity, durability, fungibility, divisibility, mobility, resilience, self-custody), bitcoin is the hardest money ever created. This allows entrepreneurs to preserve the value of their efforts, giving them time and, in the long term, capital to focus on problems and find and fund appropriate solutions. Which, in turn, creates opportunities for innovation to emerge from the free market in a bottom-up manner.

Innovation and communication

Innovation, especially in the age of the Internet, requires more than capital and people with time. There is a need for efficient and secure real-time communication and collaboration options for people around the world. Communication and collaboration are crucial for efficiently solving increasingly complex problems in a connected world.

Cunningham’s Law states that the best way to get the right answer on the Internet is not to ask a question; instead, to post the wrong answer because others will correct you. This underscores the importance of collective intelligence. The law is named after Ward Cunningham, who invented the Wiki software that allows users to create and collaboratively edit web pages or entries via a web browser. The most famous example is wikipdia.com.

Nostr: Communication as a tool for innovation

In late 2019, Lightning developer named Fiatjaf published his ideas on a censorship-resistant social network he called Nostr – “Notes and Other Stuff Transmitted by Relays”. With the actual launch of Nostr shortly after, a protocol that adds a layer of censorship-resistant information-sharing to the Bitcoin and Lightning protocol suite, a new territory of freedom opened up in the same tech-stack as Bitcoin and Lightning.

Although there were a number of other decentralized communication networks besides Bitcoin before Nostr (Bittorrent, Limewire, Napster, etc.), in my view none of them had the potential to have a universal long-term impact on collaboration to solve complex problems facing humanity. Nostr has the potential to enable bottom-up innovation and rapid problem-solving that no one can keep a lid on. With Nostr, market participants can communicate, collaborate, and reward each other in real time globally, more independently of nation-state control.

Even though individual applications that use Nostr can be switched off, the protocol itself cannot be effectively controlled or turned off by a central party.

The first widely used application of Nostr is a censorship-resistant social network that can be accessed through various clients. The most commonly used ones include Damus, Primal, Amethyst and Iris. The usability of each client is largely optimized for desktop or mobile. The network structure is similar to the way one can access the IMAP email protocol through various clients such as Gmail, Yahoo Mail, etc. (simplified example). Applications connect to many Nostr relays that are run by network participants with technical know-how. These relays distribute information, so if one relay fails, there are others that continue to run. The relays operate largely independently of each other, giving the network resilience because there is no central point of failure.

Although Nostr is not based on the Bitcoin blockchain, it utilizes peer-to-peer bitcoin payments via the Lightning Network. With Zaps, users can pay each other or tip posts they particularly like. People can now successfully save in bitcoin, communicate via Nostr, and transact with each other through Lightning—potentially independent of any central authority.

Even though. For a long time, I struggled to define the purpose of Nostr beyond its function as a “decentralized X.” However, I eventually realized that the possibilities are nearly endless. Nostr is a protocol for a freer Internet and society, poised to become the gateway to a truly free Internet. In this new landscape, we have the opportunity to innovate faster and reward ingenuity, making way for a more empowered and interconnected world.

There are countless Nostr applications currently being built. Nostrocket, for example, is a client designed to coordinate decentralized, Bitcoin-based economies by rewarding (in satoshis/bitcoin) contributors who work together to find solutions to global challenges. The application uses censorship-resistant communication via Nostr and direct bitcoin payments via the Lightning Network to help create economically sustainable organizations that solve problems on the critical path to a global Bitcoin standard. Nostrocket founder Gsovereignty is a very active member of the Nostr community and worth following.

Conclusion

The Bitcoin protocol was created as an alternative to the fiat system. A decentralized, permissionless peer-to-peer electronic cash system, outside the reach of the state. Satoshi Nakamoto created arguably one of the most important innovations by a private individual or group of people that humanity has ever produced, because he/they laid the foundation for anyone to be able to trade and act independently of the state. As a solid foundation for a freer economy, the Bitcoin network enables other network layers to “dock” to the base, creating new ways to use bitcoin and opportunities for users. The Lightning Network, as a second-layer payment protocol for fast transactions and micropayments, partially addresses the problem of how to scale Bitcoin so that it can be used by all of humanity.

The introduction of Nostr creates a new territory of freedom within the same protocol suite as Bitcoin and Lightning, enhancing Bitcoin’s usability for diverse applications. By facilitating seamless communication and collaboration, Nostr further aids in scaling Bitcoin, empowering us to innovate faster and reward ingenuity. With Nostr, innovation can potentially emerge from the free market again, and ingenuity can be rewarded once more. Thus, Bitcoin, Lightning, and Nostr provide a protocol suite for a freer Internet and society, with Nostr poised to become the gateway to a truly free Internet.

The use cases for Nostr seem endless. I invite you to explore the possibilities of the protocol.

I would like to thank Uncle R0ckstar for the inspiring conversations and encouraging words.

Follow me on Nostr

This is a guest post by Leon Wankum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.