Predicting Bitcoin’s price has always been a hot topic for investors. Matt Crosby, lead market analyst at Bitcoin Magazine Pro, explores this topic in his recent video, “Truth About Bitcoin Stock To Flow, Power Law & Price Models“. Here, we break down Crosby’s key insights to help investors enhance their Bitcoin strategies.

Stock-to-Flow (S2F): A Useful Tool, Not a Crystal Ball

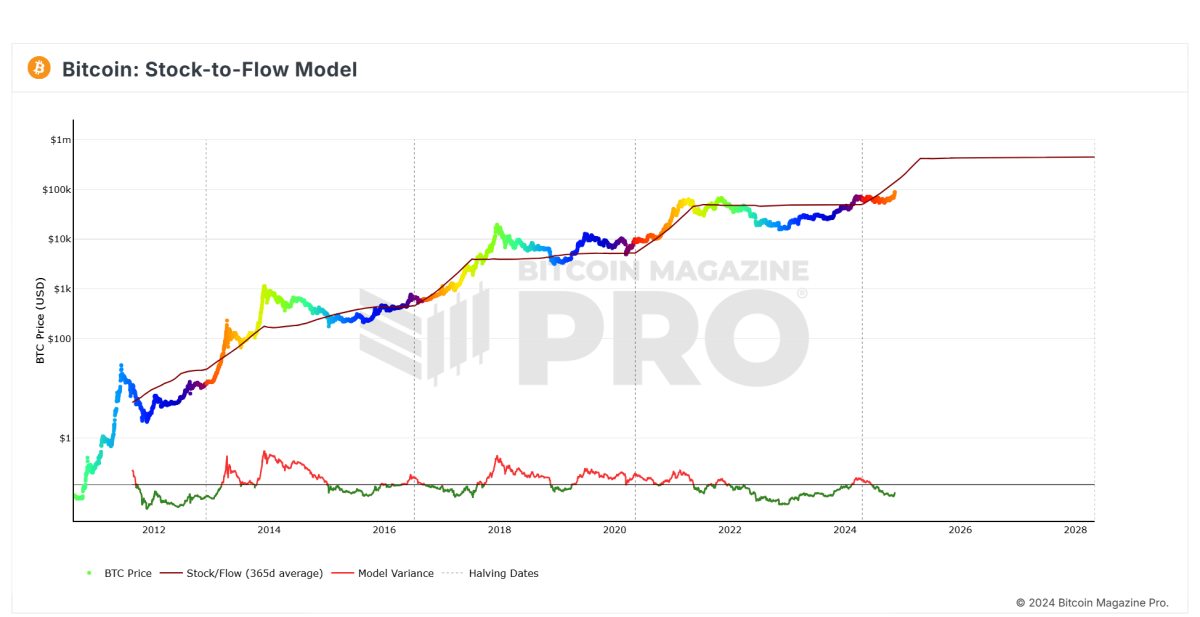

The Stock-to-Flow (S2F) model is one of the most popular ways to predict Bitcoin prices, and Crosby explains its benefits and drawbacks clearly.

Key Takeaways:

- What Is S2F? S2F assesses Bitcoin’s scarcity by comparing the “stock” (current supply) to the “flow” (newly mined coins), similar to how rare commodities like gold are evaluated.

- Updated Predictions: The Cross-Asset S2F model initially forecasted Bitcoin hitting $288,000 between 2020 and 2024. More recently, it suggested a possible valuation of $420,000 by April 2025.

- Limitations: S2F works until unexpected events—like global economic changes—disrupt Bitcoin’s usual patterns. Crosby aptly points out, “S2F works until it doesn’t.”

While S2F is a helpful guide, it’s essential for investors to consider broader market conditions and macroeconomic influences alongside it.

Bitcoin Power Law: The Long-Term View

Crosby also explores the Bitcoin Power Law, a model that uses a log-log chart to illustrate Bitcoin’s historical price patterns.

Why It Matters:

- Logarithmic Scaling: By using logarithmic scaling, the Power Law highlights Bitcoin’s long-term trend of reduced volatility and moderated growth.

- Limitations: This model offers insights for the long haul but is less helpful for short-term predictions or market surprises.

For investors aiming to diversify their portfolios and strategically time their investments, the Power Law provides context but should be used with other, more dynamic tools.

Real-Time Metrics: The Key to Adaptability

Crosby emphasizes the limits of static models like S2F and the Power Law, advocating for real-time, data-driven approaches instead.

Tools Investors Should Use:

- MVRV Z-Score: Measures market cap against realized cap, identifying when Bitcoin is overvalued or undervalued.

- SOPR (Spent Output Profit Ratio): Provides insights into market sentiment by tracking profit-taking behavior.

- On-Chain Metrics: Metrics like Bitcoin’s realized price and value-days-destroyed help detect market turning points.

These metrics give investors the tools to adapt their strategies to the market’s behavior in real-time rather than relying solely on predictions.

Why External Factors Matter

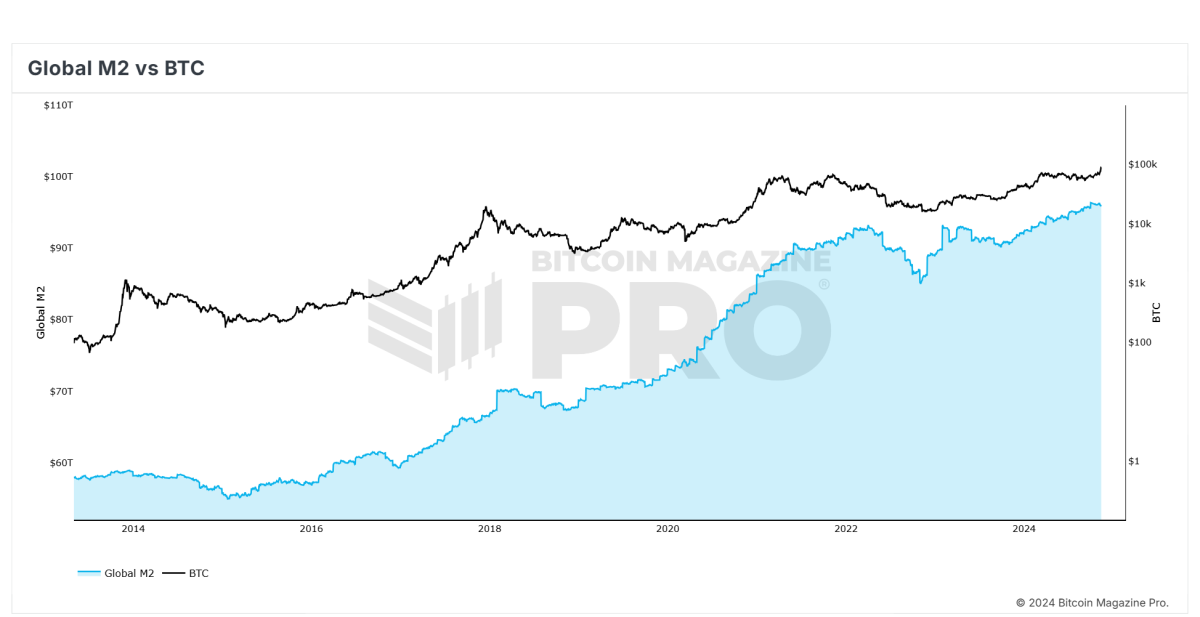

Crosby cautions against relying only on Bitcoin-specific data, emphasizing the importance of external factors:

- Global Liquidity: Bitcoin’s price often moves with global liquidity cycles, making macroeconomic awareness crucial.

- Institutional Adoption: Actions by major players such as sovereign wealth funds, corporate treasuries, or institutional asset managers can greatly influence Bitcoin’s price.

- Regulatory Changes: Government decisions to regulate or adopt Bitcoin can significantly affect its valuation.

Incorporating both macroeconomic factors and Bitcoin-specific metrics is key for a well-rounded analysis.

Final Thoughts: Stay Pragmatic

Crosby concludes by reminding investors that no single model can predict Bitcoin’s price with certainty. Instead, these tools should be used to provide structure and insight into an unpredictable asset.

Practical Tips for Investors:

- Use Multiple Models: Cross-check predictions using different models to gain a clearer understanding of the market.

- Embrace Real-Time Data: Rely on metrics like MVRV Z-score and SOPR for timely, actionable insights.

- Adapt to Change: Be ready to adjust strategies based on both internal data and external influences.

Bitcoin Magazine Pro offers advanced analytics and real-time data to help investors navigate this fast-paced market. To dive deeper into Crosby’s insights, watch the full video here: Truth About Bitcoin Stock To Flow, Power Law & Price Models.