Introduction

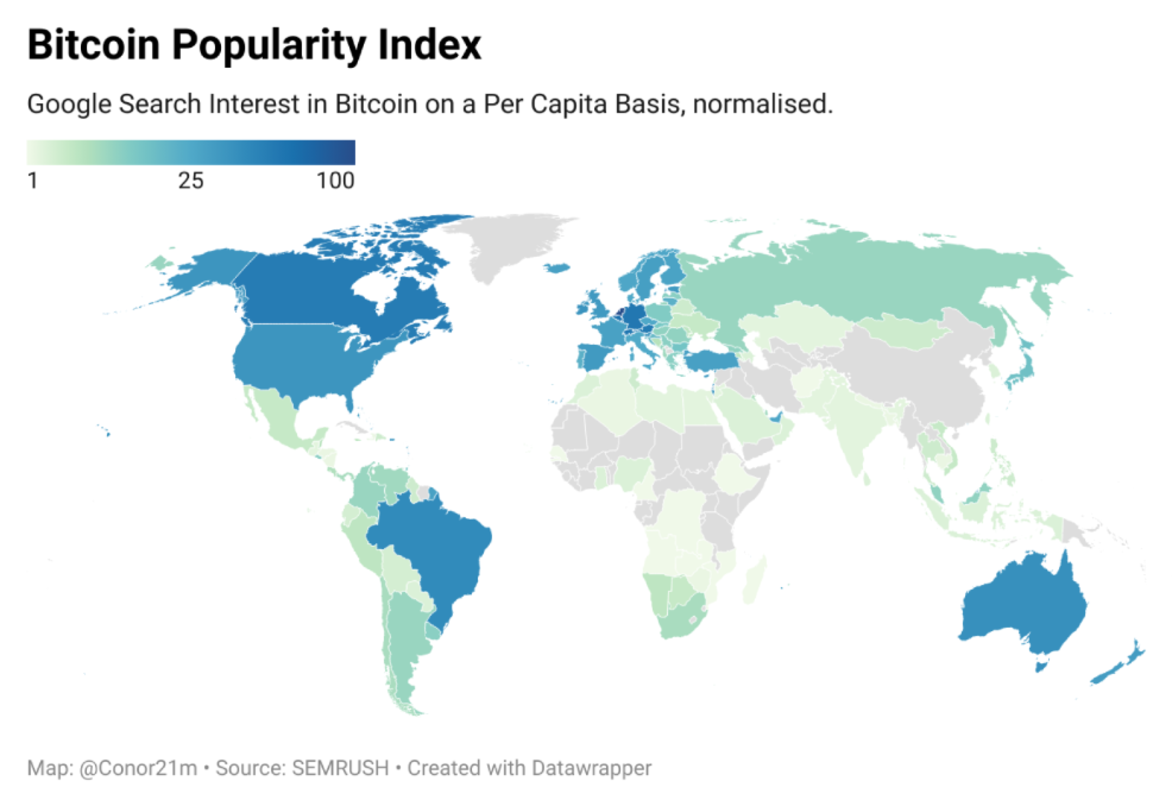

Introducing the Bitcoin Popularity Index (BPI), the first comprehensive search study of its kind. This index has been curated in an attempt to measure the global reach and impact of Bitcoin through a broad analysis of Google search queries.

Unlike many studies that offer absolute data or blend various aspects of cryptocurrency, the BPI data aims to deliver insights of Bitcoin interest specifically, by considering factors such as language diversity, Google’s browser dominance and population sizes. This approach allows us to gauge not just the raw interest but also the relative intensity of Bitcoin engagement across different nations. We can therefore highlight which countries are punching above their weight, relatively speaking.

While not intended as a definitive answer, the BPI serves as a useful exercise—perhaps the best snapshot we have amid imperfect data. By integrating these various elements, the Bitcoin Popularity Index offers a unique perspective, shifting away from generic metrics to provide a richer, more contextual understanding of how Bitcoin’s adoption is advancing worldwide.

You can download the infographic here.

Key Findings

- The USA scores the highest number of queries with 14,432,650 queries per month, followed closely by Brazil with 12,400,260. Germany, India and Turkey complete the top 5.

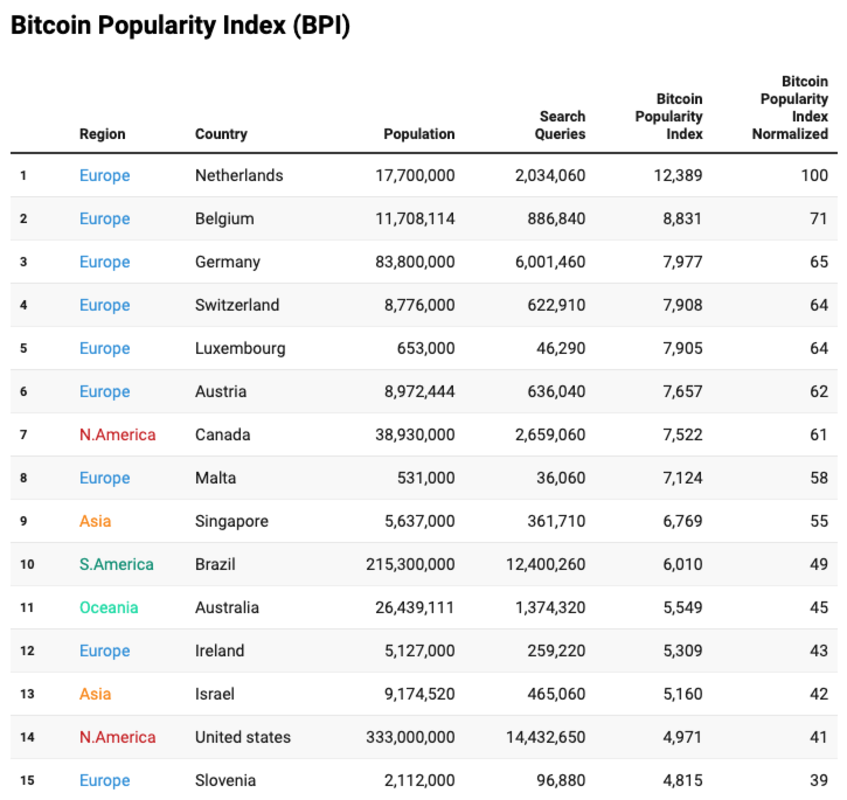

- The top 7 positions and 8 of the top 10 are occupied by Western European countries (as per EuroVoc’s regional definitions).

- “Western” countries around the world have an average BPI of approximately 3,720 (compared to 1,250 elsewhere), indicating a relatively high popularity of Bitcoin.

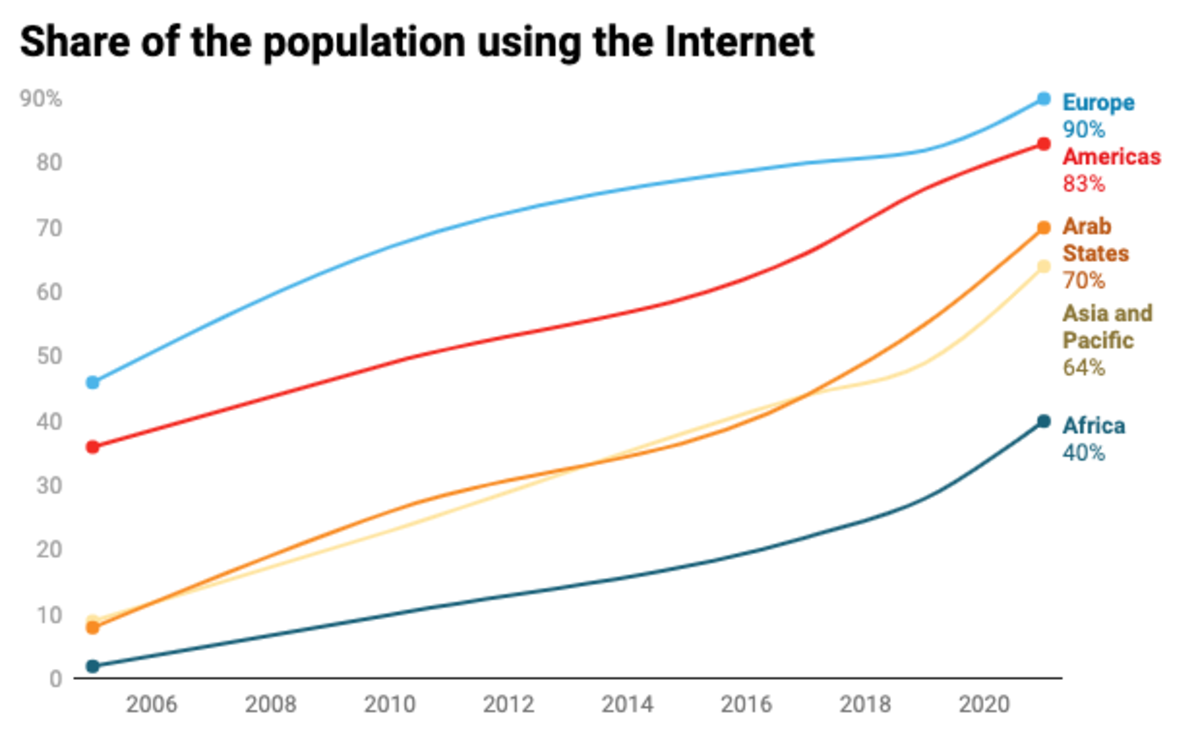

- Africa has the lowest BPI scores among the continents. This is unsurprising given that internet penetration in Africa is only 40%.

- The most prominent Bitcoin queries are price queries, and more often than not the price of bitcoin against the dollar. In Egypt, however, bitcoin is more frequently priced in bars of gold instead of the dollar or the Egyptian pound.

- The total number of monthly Bitcoin-related queries is nearly 77 million, with direct searches for “Bitcoin” approaching 10 million.

- The ratio of Bitcoin-to-Ethereum queries is 9:1.

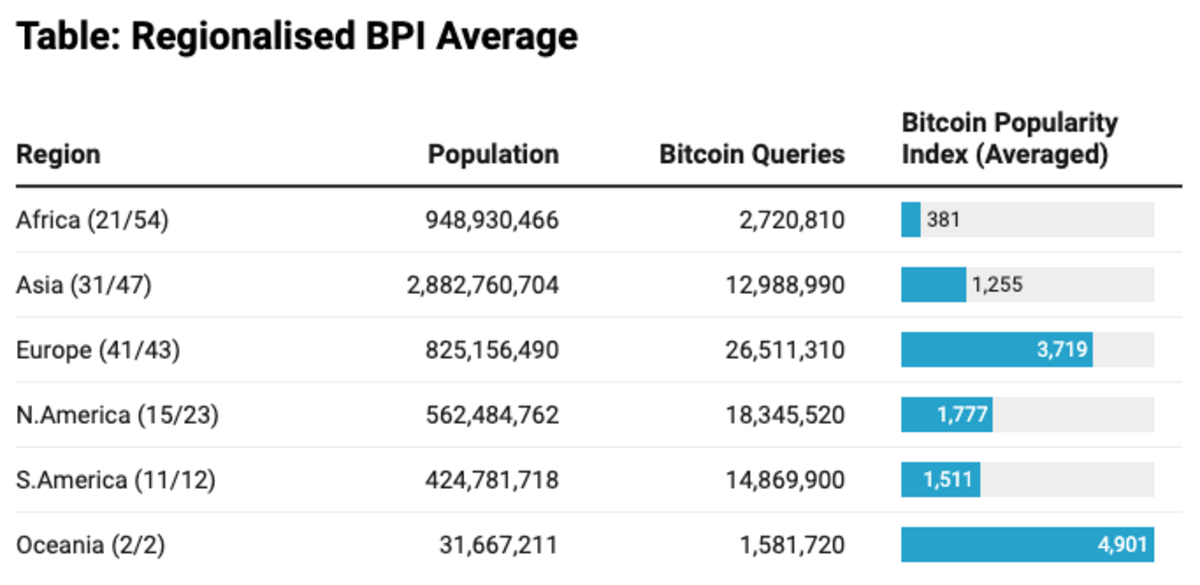

A Comparison of Continents

Oceania leads with the highest average BPI at about 4,901, indicating a very strong popularity of Bitcoin in this region. This data is derived from just two countries (New Zealand and Australia), both benefiting from high levels of internet penetration.

Europe follows with an average BPI of 3,719 from 41 countries, showcasing the relative strength of Bitcoin popularity across the continent, placing it well above most other regions.

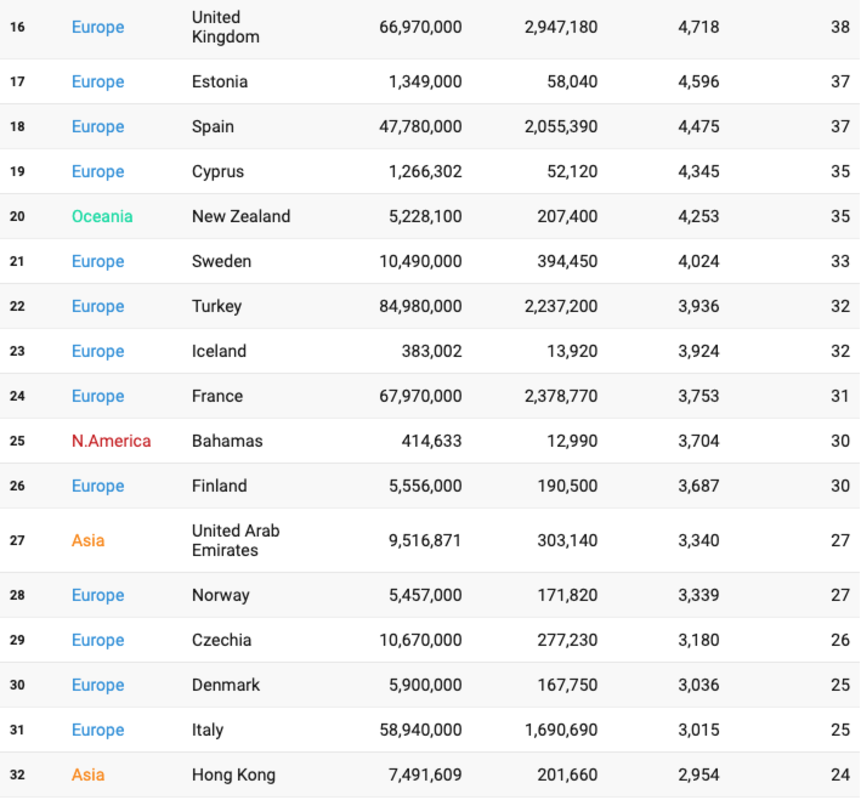

The Top 50 Countries

Countries 1-15

Countries 16-32

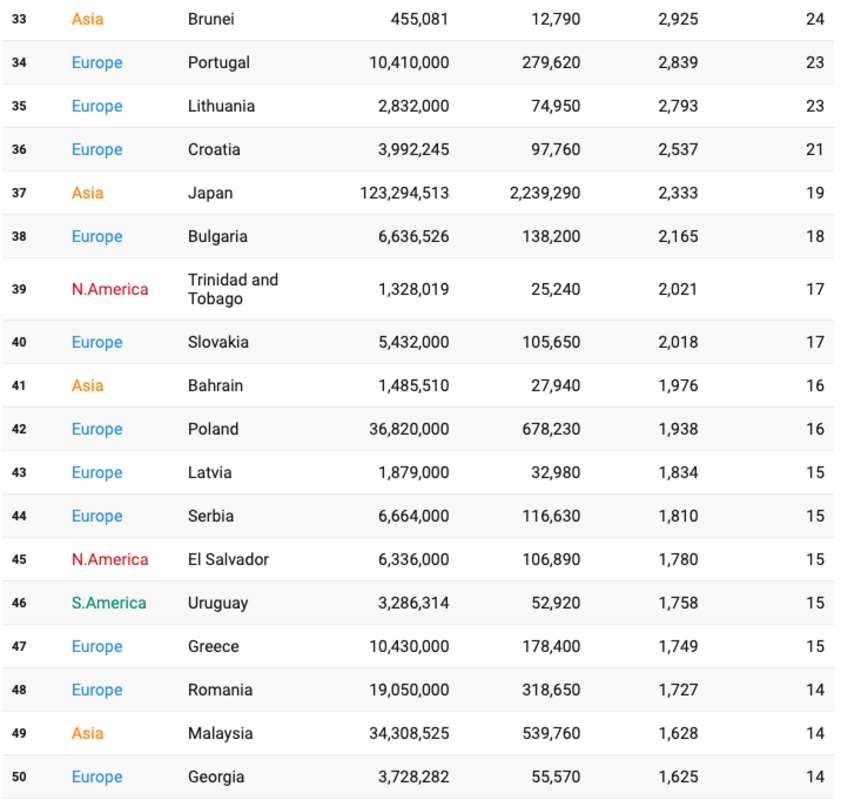

Countries 33-50

Methodology of Data Collection

- Selection of Data: Given that Google withholds all search query data for terms relating to cryptocurrency, identifying the most reliable dataset was important. In an effort to be as comprehensive as possible, datasets from SEMRUSH, Ahrefs, DataOs, Moz and Google Trends were all downloaded and researched. SEMRUSH proved to be the most reliable based on its accuracy and depth, which is consistent with SparkToro’s study as well as SEMRUSH’s own research on search volume data.

- Data Comparison and Selection: Although the results were often similar for the most part between SEMRUSH and Ahrefs, the two largest available datasets. There were significant discrepancies between the two for many terms. The data for some countries showed more than an 80% difference. This variability made it impractical to blend the data or fill in gaps for countries where SEMRUSH provided no data, as the differences were too substantial to reliably aggregate.

- Query Configuration: Broad match queries for “Bitcoin” and “BTC” were utilized across alphabet groups including Latin, Arabic, Hebrew, Cyrillic, Japanese, Devanagari, Perso-Arabic, Cyrillic, Tamil, Sinhala, Chinese and Thai.

- Incorporation of Demographic and Search Engine Data: Population figures were integrated from Worldometers, and Google’s market share data was sourced from Statcounter. For the purposes of this study, the Google market share was recalculated to 100% for all countries to standardize the impact of search engine usage on the data.

- Calculation of Per Capita Search Volume: With the aforementioned data, a per capita search query volume for each country was calculated. This step was crucial for normalizing the data across different populations, allowing for a like-with-like comparison of Bitcoin interest irrespective of country size.

- Data Visualization: The final results were categorized and plotted on a Chloropleth map using the visualization tool Datawrapper. This allowed for a clear visual representation of Bitcoin popularity across different countries, highlighting regions with particularly high or low levels of engagement.

The percentage of a country’s population using the internet wasn’t factored into the calculations, since those without internet access are less likely to show interest in Bitcoin. Africa’s most recently published internet adoption rate is 40%, comparable to the rates in Europe and the United States of America in 2005. Although this rate remains low, it is increasing, as is the adoption of Bitcoin.

Scope of Data and Limitations

The Bitcoin Popularity Index (BPI) offers comprehensive insights; however, it is constrained by the absence of data from 77 countries, including China, Iran, Cuba and 33 African nations — particularly Tanzania, Kenya and Sudan. This lack of data from key regions can result in an incomplete global perspective on Bitcoin engagement.

Furthermore, the BPI is based on third-party estimations, as Google does not share specific search query data for Bitcoin or other cryptocurrencies. VPNs can play their part too by obfuscating where searches originate from, but this is not expected to have impacted the results too much.

The data is erroneous in a small number of countries, as “BTC” is the name of a phone company in the Bahamas, an internet provider in Botswana and a shopping mall in Slovenia.

Summary

The Bitcoin Popularity Index (BPI) provides a detailed look at global interest in Bitcoin through the lens of Google search queries. While this study employs the best available data, it is important to note that it is not intended to definitively answer which country has the strongest Bitcoin adoption. Rather, the BPI serves as a gauge of general interest and engagement with Bitcoin across different nations.

The data reveals that Oceania has the strongest BPI scores, though Europe shows the greatest strength across the board, with 41 out of 43 countries performing strongly. It is also evident that search data is stronger in countries with higher internet penetration, thus creating a data bias favouring such countries.

A valuable follow-up to this study would involve examining other metrics that could provide further insights into Bitcoin adoption. Some examples of those metrics include the number of Bitcoin nodes, Bitcoin Lightning Network nodes or hashrate distribution. Such data points could offer a more comprehensive understanding of how deeply Bitcoin has permeated different regions and could help paint a fuller picture of its global adoption.

Furthermore, the goal is to make the BPI an annual calculation, providing a comparative approximation of how Bitcoin interest and adoption progress across all surveyed countries on a yearly basis.