Why is this British isle undergoing hyperbitcoinization, and what could this mean for the U.K.’s monetary future?

This is an opinion editorial by Bitcoms, a Bitcoiner and contributor to Bitcoin Magazine.

The British Backdrop

Just days after the anachronistic spectacle of the Queen’s funeral — a bizarre echo of Britain’s long-lost imperial might — the pound sterling fell to an all-time dollar low. A few years before Elizabeth II was crowned, a pound was worth more than $4. Shortly after she was buried, a quid barely bought a buck.

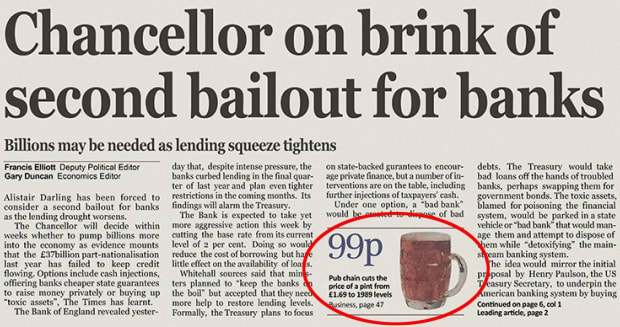

Add in the steepest rise in gilt yields in living memory and double digit inflation — higher than any other developed nation — and Britain’s current financial predicament looks worse than even the 2008 crisis. Back then the Chancellor may have been on the brink, but at least he could still buy himself a pint of beer for less than £1.

Already well over £4 on average U.K.-wide, the price of that pint looks set to climb a lot further: With the Bank of England already returning to easing, inflation may well get worse before it gets better. For us Brits, even drowning our sorrows is becoming ever more unaffordable.

Across the world, when a local currency keeps on losing a lot of value, people are turning to Bitcoin. Ordinary inflation-ravaged citizens from Istanbul to Buenos Aires increasingly use it to preserve purchasing power and transact with one another. Is something similar about to happen in a G7 economy?

On the face of it, this doesn’t look imminent in the U.K. From misleading reports of destructive energy use to intrinsic lack of worth to conflation with the cryptocurrecy casino, most Britons happily drink the mainstream media’s anti-Bitcoin Kool-Aid. As a result, Brits are generally distrustful of bitcoin not just as an asset but more especially as money. “How can it be money if it’s not legal tender? What’s the use of money no one accepts?” And so on.

Unsurprisingly, then, few merchants across the country display the orange B. In my home city of nearly three million inhabitants, I know of only one solitary bar where you can buy a beer with bitcoin. So much for seeking solace with your satoshis — Great Britain is a long way from mass adoption of bitcoin as a medium of exchange.

Britain’s Bitcoin Island

But there is a little bit of Britain bucking the wider trend: the Isle of Man, home of the Manx, where a significant number of businesses already accept payments in sats. But how many? And why? The day after the Queen’s funeral, I went there with my old pal @bitcoinshire to find out, and to see if we could survive for a few days on nothing but Bitcoin.

The Basics

The island’s first hotel to accept satoshis is the comfortable Ellan Vannin, where they serve first-class Manx kippers for breakfast and where we were the first ever bitcoin-paying guests. They only recently started accepting bitcoin, having noticed more and more orange stickers popping up in local shop windows. Their motivation seems twofold: a belief in bitcoin as the future, as well as the possibility of extra business from Bitcoiner tourists like us.

As @bitcoinshire had forgotten to bring a toothbrush, we took a walk up the hill to Karsons. As far as we could gather from one of the friendly pharmacists, the owner’s interest in bitcoin was why they’d started to accept it a few weeks previously. Eager to be helpful, she also suggested we spend a few more sats on flu jabs. We politely declined.

Dropping back into town, we grabbed some food at Street Kitchen, a lunchtime eatery with a good selection of pan-Asian dishes. Being British, we washed that down with a cup of tea at Froth, a nearby coffee shop. Having been accepting Bitcoin for a couple of months, Froth now sees a small but steady stream of sats-paying customers most weeks.

So far so good: Using only Bitcoin, we’d secured good shelter, been well fed and watered, and even kept ourselves clean. It was now time to turn our attention to higher things.

Moving Up Maslow’s Hierarchy

Once they’ve sorted out the basic needs of life, the thing we British traditionally want next is a car. So we walked out to Rex Motors, where after a few months bitcoin seems well embedded — they even have dual pricing on their website. They told us they’d already sold quite a few motors to locals who had chosen Rex just because they accept Bitcoin. We particularly liked the look of their British prestige marques, but unfortunately a Jaguar or a Bentley was beyond our planned budget for the trip.

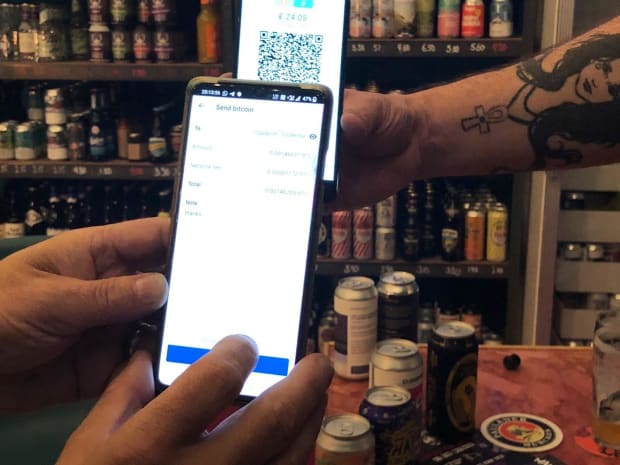

Spitting feathers after the walk back, we repaired to the Thirsty Pigeon, a traditional British boozer where cordial barmaids pull perfect pints of cask-conditioned best bitter. Traditional except for the fact they take Bitcoin, of course. Only a few yards away, Bottle Monkey has a more progressive selection of beers for consumption on and off the premises. Their reasons for accepting Bitcoin remain unknown because “Chief Monkey” wasn’t around, but the genial “Squirrel Monkey” was on hand to sell us some excellent New England IPAs and stouts for satoshis.

At dinnertime, we didn’t only receive a warm welcome from the co-owner of pizza and pasta joint Monapoli — we got a wide-ranging discussion about Bitcoin and the future of money. They are keeping the bitcoin they take rather than converting it into pounds, as are the next day’s breakfast smoothie venue Freshly Squeezed, where they’ve been accepting sats for six months and a fair few Bitcoiners come in most days. This HODLing approach is a smart strategy — a passive, fee-saving and low-hassle cousin of dollar-cost averaging for businesses.

Everywhere we went and whichever payment solution we used, the Lightning Network was always rock-solid reliable. Every transaction worked first time without a hitch, and near instantly, at least as quick and as user friendly as the common tap-and-pay traditional finance methods we Brits tend to use when paying with fiat.

Why Are The Manx Embracing Bitcoin?

After a takeaway lunch from Timeout, it was clear that being a bitcoin-only tourist on this British Isle is a piece of cake. Little wonder: With many dozens of merchants already accepting sats and a population of only 86,000, the island is far more hospitable to Bitcoiners than the mainland. But why is this?

Some Brits presume the Isle of Man’s tax regime, which is more generous than in most of Britain, makes accepting Bitcoin easier or more attractive. But this doesn’t really stand up to scrutiny — for example, merchants on the island still need to charge and account for VAT on transactions just as they do on the British mainland. Others think it must be a down to a local government scheme, but it isn’t: while the Manx authorities are generally positive towards technology and innovation, and may well see Bitcoin as part of that, there is no specific initiative in place. Others suggest it has something to do with laxer local banking rules, which must be more amenable towards bitcoin businesses. But this doesn’t hold water either: while most merchants we spoke with use local Bitcoin exchange Coincorner and its innovative Bolt tap-and-pay Lightning card, this doesn’t seem to be materially different from merchants on the mainland using the same Coincorner services.

Based on our conversations, the biggest driver to Bitcoin adoption has been the open-minded entrepreneurial spirit of Manx merchants and their willingness to shape their own financial future. A decent concentration of local Bitcoiners might be helping. Additionally, the sustained enthusiasm and hard work of the Coincorner team in educating and onboarding local merchants has clearly played an important role. But the result is now a grass-roots, bottom-up Bitcoin community, bootstrapped from nothing. As such, what the Manx are building here looks authentic and durable. Sure, it’s early days, and there are some gaps — an orange B in a grocer’s window or on the side of a bus would be a welcome addition. But the fact remains Bitcoin is now firmly established as a functioning medium of exchange in a vibrant part of the world’s sixth largest economy.

What Might This Mean For The Rest Of Britain?

The Manx Bitcoin community may be small, but the island is already one of the leading locations in Europe to transact with your satoshis. And there’s no legal or practical impediment to similar levels of penetration on the British mainland. In fact, Bitcoin businesses like Coincorner and organizations like Bridge2Bitcoin are already working towards just that, putting in the hard yards on the ground to build mainland merchant adoption. Just as on the Isle of Man, there is the same compelling case for merchants across the U.K. — the possibility of extra Bitcoiner business; lower transaction fees compared with TradFi payment cards; and instant final settlement, not days or weeks later as with most TradFi providers.

But it isn’t only merchants who stand to benefit from adopting Bitcoin. With the value of sterling falling faster than ever in the past half century, every Briton should consider the merits of using hard money which inflation won’t steal.

When the Queen’s portrait first appeared on decimalised sterling banknotes in the early 1970s, a pint of beer cost 13 pence. By January 2016, when Lightning Labs was founded to develop Bitcoin’s instant payment network, a pint had gone up to £3.48, or about one hundredth of a Bitcoin. Just six years of mostly so-called low inflation later, that pint is already a fifth more expensive in pounds, but fifty times cheaper in satoshis.

There are no guarantees, but looking at sterling’s woeful past and present performance, the pound in your pocket looks a bad bet. Over time, banking on Bitcoin — at least to some extent — is a much more promising proposition. For both British merchants and their customers, introducing Bitcoin for day-to-day transactions will work wonders for such a transition.

The Isle of Man is already showing the rest of Britain the path to such a financial future. Can British mainlanders also move with the times, or will they stay stuck in the monetary past?

This is a guest post by Bitcoms. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.