Introduction:

The latest Q1-2024 Hashrate Index Report by Luxor Technology delves into the Bitcoin mining sector’s performance after the Fourth Bitcoin Halving. This report offers critical insights into key metrics such as Bitcoin Hashrate, Hashprice, Hashrate Forwards, and Bitcoin Mining Stocks, highlighting the Bitcoin mining industry’s adaptability – and also the challenges that lie ahead for miners in a 3.125 BTC block subsidy world.

Bitcoin Hashprice and Hashrate Fluctuate

Now that the Fourth Halving has passed, Bitcoin miners have their eyes on two metrics in particular: hashprice and network hashrate.

Hashprice is a measure of how much revenue miners can earn per day when hashing with a full-pay-per-share mining pool. All else being equal then, we should expect the halving, which halves the Bitcoin block subsidy, to cut hashprice in half.

This didn’t happen immediately, though. Hashprice experienced extreme volatility in the run-up to and immediately after the Halving. In the hour that the Halving took place, hashprice dipped to $74/PH/Day, but it swiftly rose to a peak of $183/PH/day as transaction fees roared from Runes trading activity. The Runes hype was short-lived, and hashprice soon plunged to a record low of $44/PH/day before stabilizing at its current level of $50/PH/day. The prior all-time low for hashprice, $55/PH/day, occurred in 2022 during the fallout of the FTX debacle, and the new hashprice reality underscores the brutal economics miners now confront.

Which leads us to the next major metric that the Halving has impacted: Hashrate. Over Q1-2024, Bitcoin’s 7-day average hashrate increased 19% to 611 EH/s, and it would increase another 6% in April to an all-time high of 650 EH/s. With the dust settled after the Halving, Bitcoin’s hashrate has fallen 10% from its all-time high to 580 EH/s.

Given that mining margins are compressed and summer is upon us – which will likely necessitate power draw curtailment from industrial-scale mining farms in places like Texas, a headwind for hashrate growth – we should expect Bitcoin’s hashrate to experience only marginal growth this year.

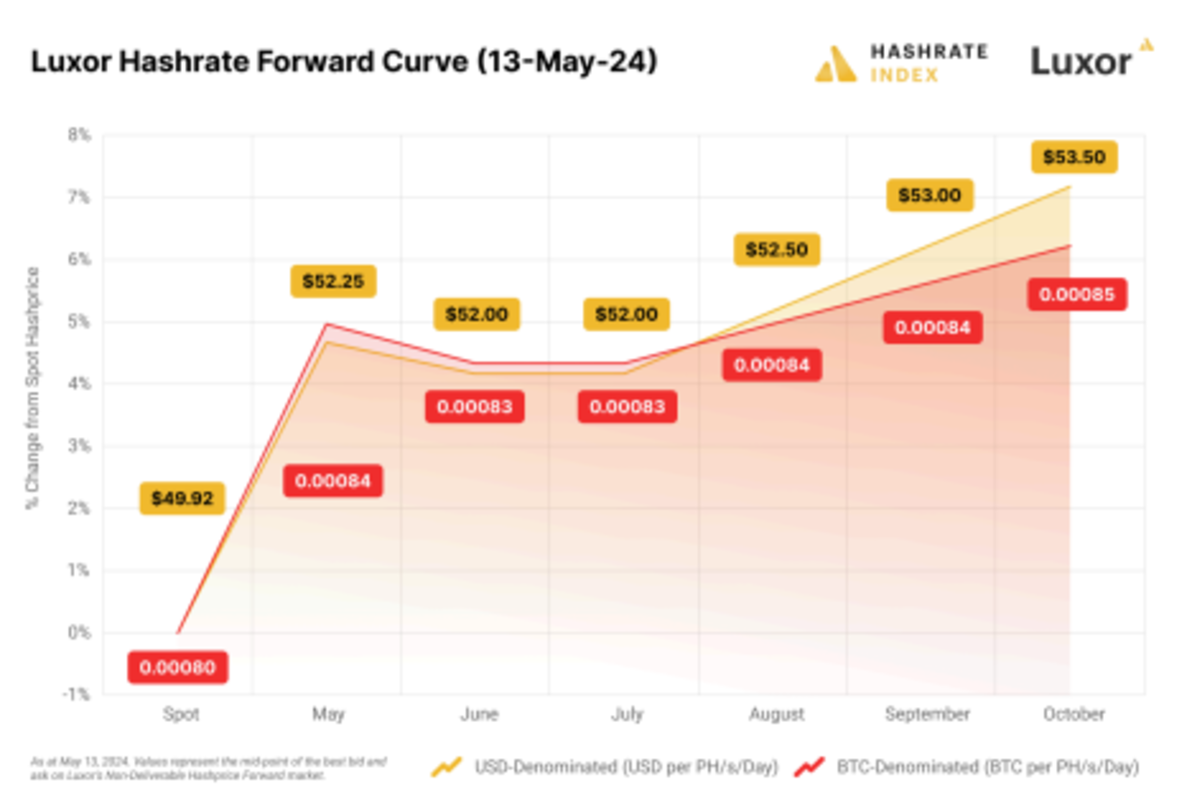

Hashprice is Trading in Contango

Notably, traders in hashrate markets believe that the bottom is in for hashprice (for now, at least).

Luxor’s Hashrate Forwards, a Bitcoin mining derivative which allows miners and other participants to buy and sell hashrate for fixed prices at future dates, are trading in contango, which means that hashrate traders expect hashprice to be higher in the coming months than the current spot price. This suggests a bullish sentiment among Hashrate Forwards traders, who expect an increase in hashprice potentially due to higher transaction fees or a decrease in mining difficulty.

As we stated in the last section, it’s possible that curtailment in mining hotspots like Texas could cause hashrate to temporarily come offline, thus improving hashprice and mining margins.

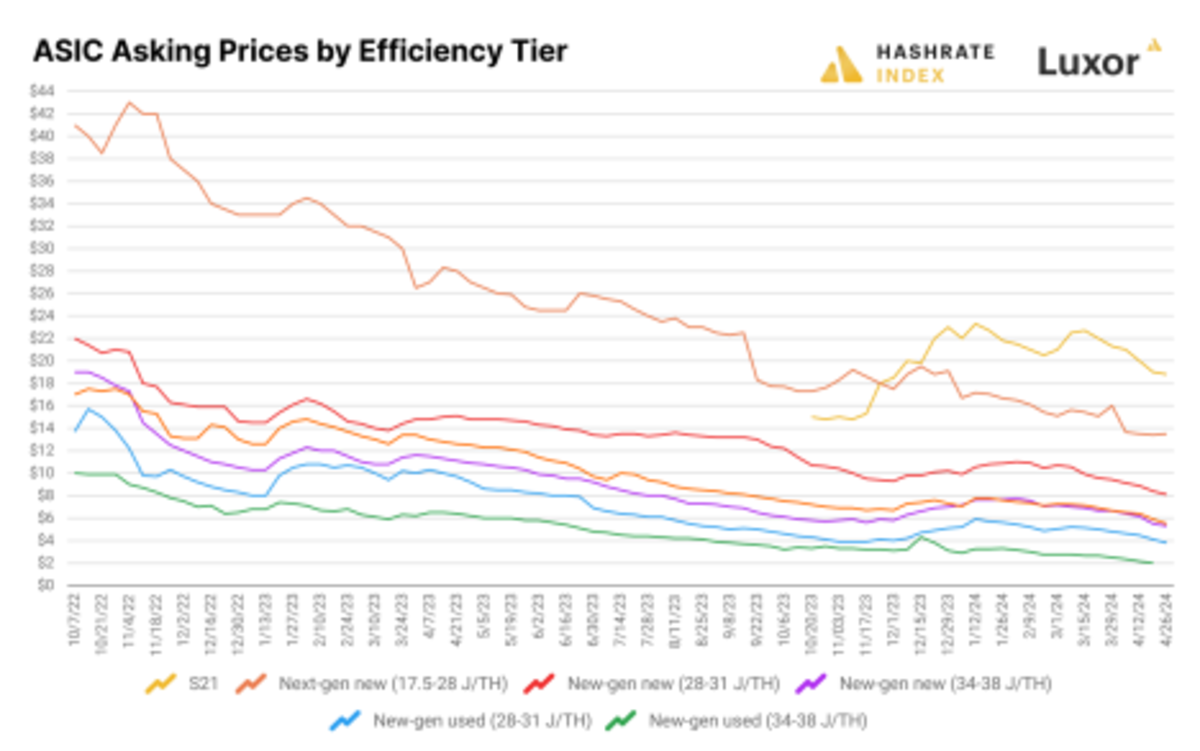

ASIC Markets are Undergoing Price Discovery

The ASIC market experienced a significant slowdown as the Halving approached, with notable price drops across various models despite a higher average Hashprice in Q1-2024. Unsurprisingly, price premiums for the Antminer S21 compared to other models increased, indicating a strategic shift among Bitcoin miners towards more efficient hardware to mitigate the decline in post-Halving revenues.

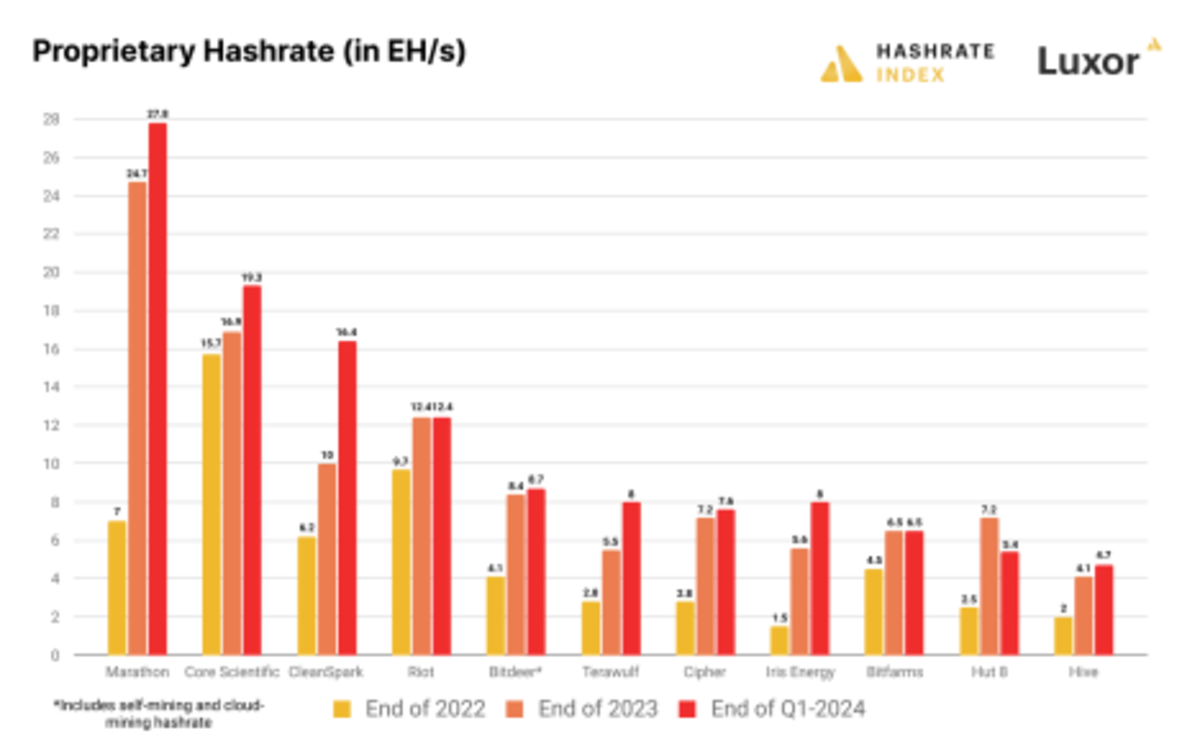

Bitcoin Mining Stocks are in a Hashrate and Efficiency Arms Race

All major public Bitcoin miners increased their hashrate throughout 2023, yet certain miners have taken more aggressive steps to boost their hashrates in the early months of 2024. With the block subsidy now halved, it is imperative for miners to equip their ASIC fleets with the newest hardware to remain competitive in the hashrate arms race and lower their operating costs per unit of hashrate.

Predictions and Outlook for 2024 and Beyond

Barring a significant uptick in Bitcoin’s price and/or a transaction fee bullrun, 2024 will be a challenging year for Bitcoin miners. Now more than ever, transaction fees will have a critical role in a miner’s bottom line.

In terms of coping with the new normal, those who didn’t do so in 2023 will need to get creative with their operational strategies. Beyond optimizing their fleet’s power efficiency with the latest ASIC models and securing more favorable power contracts, they can employ after-market firmware to optimize their ASICs, adopt more sophisticated hedging strategies, and look for alternative revenue streams or places to cut operating costs.

In the US and Canadian context, we anticipate consolidation driven by mergers and acquisitions as companies take advantage of fire sale prices for ASICs and mining facilities. As the mining sector continues to mature, mining will become even more entrenched in and integrated with energy systems, and we believe that the current Halving epoch will accelerate this integration as miners are driven towards the source of electricity production to tap the lowest possible power costs.

This is a guest post by Alessandro Cecere & Colin Harper. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.