The Bitcoin Asia conference held on May 9 and 10, 2024 in Hong Kong demonstrated a significant milestone in the adoption of bitcoin as a legitimate medium of exchange.

This article outlines the strategies and technologies implemented to facilitate seamless bitcoin transactions for goods and services over the two days, leveraging the capabilities of self-custodial payment processing through BTCPay Server.

Executive Summary

Throughout the event, 212 Bitcoin transactions were processed, involving four vendors and totaling 7,714,253 sats, equivalent to 36,974.63 HKD.

The average transaction was approximately 36,560 sats (about 175 HKD). Notably, the system maintained full operational uptime with zero failures in bitcoin base chain or lightning network transactions.

What is BTCPay Server?

With banks, you have no option between self-custody or custodial payment processing.

For example, if you wanted to run a self-custody business with fiat, you would have to run a cash payments-only business, which comes with huge risk of theft when centralizing capital in one place. This would also limit your customer base.

To expand our economic outreach beyond our local economies, we created payment networks and payment processors that allow for digital transactions.

But what have been the consequences of implementing custodial payment systems over time? Why can’t we have a digital self-custodial payment processor? What innovations, freedoms, and data do customers & businesses have to sacrifice due to custodial payment processing? What if my digital form of payment (e.g., credit card, Apple Pay, Venmo) declines even though I have the funds in my account? What valuable data — both financial and personal — am I now giving away for free because of these services?

With BTCPay Server, we can facilitate the experience of cash-like transactions digitally, meaning we can make digital payments peer-to-peer. Transactions do not require personal information from the payer, nor do they require an intermediary. This eliminates the risks that come from both transacting with cash and depending on an intermediary.

BTCPay Server is free to use and completely open source, meaning BTCPay Server is not a company — it’s simply code.

BTCPay Server is a bitcoin payment processor that allows businesses and individuals to receive payments directly, without relying on third-party services.

Unlike traditional payment processors, BTCPay Server does custody funds and does not charge any transaction fees.

BTCPay Server is a highly adaptable payment processor. It can be integrated into existing systems with APIs, and both individuals and businesses can tailor their payment processing experience to meet specific needs, ensuring a seamless integration into their operational frameworks.

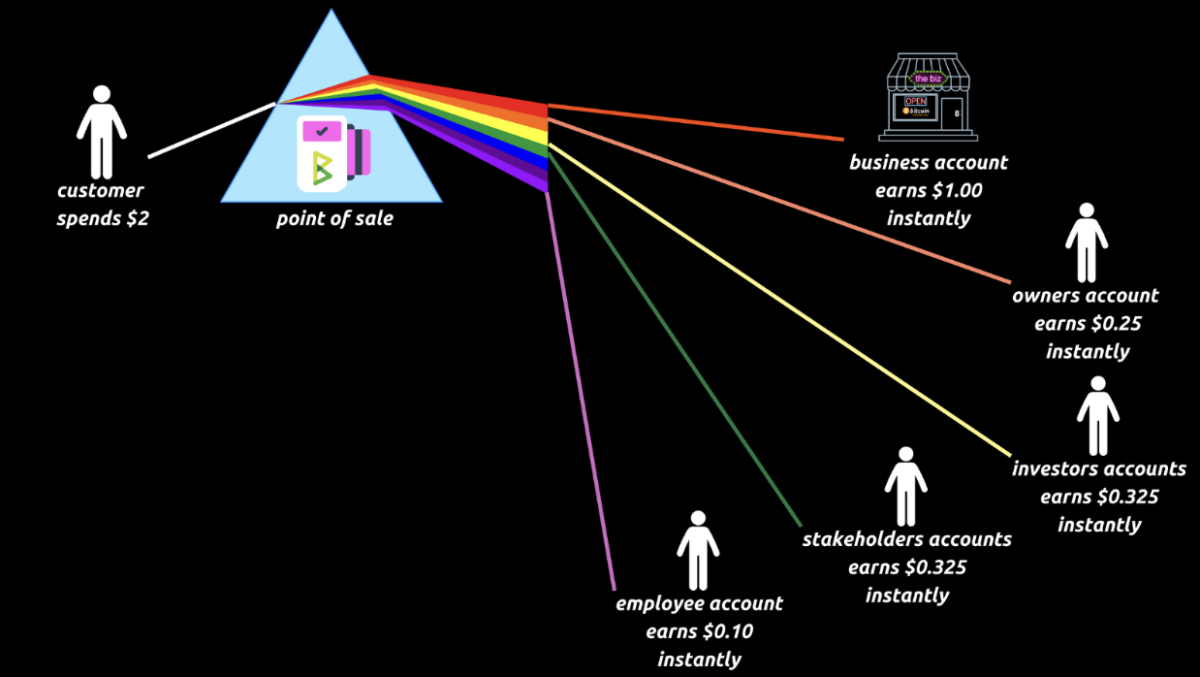

In addition to the features listed above, BTCPay Server supports what are known as Prism Payments.

This functionality allows for the trustless distribution of funds across multiple accounts at the point of sale. This innovative approach fundamentally rethinks the flow of money, enabling real-time compensation for stakeholders and employees.

How to Use BTCPay Server

Step 1: Setup a BTCPay Server

For a comprehensive guide on setting up a BTCPay Server, see this full step-by-step tutorial on YouTube.

Step 2: Ensuring Liquidity and Price Stability

At the time of writing, the Lightning Network is the only Bitcoin scaling solution that maintains bitcoin’s cash-like properties in making payments with BTC.

The Lightning Network facilitates instant settlement, doesn’t require any KYC and offers near non-existent fees, much like the experience of using cash.

For the Lightning Network to function, it needs liquidity. Providing liquidity often means running and managing a node yourself, but BTCPay Server does this for you.

At the conference, BTCPay Servers nodes, in conjunction with Blink, which served as a liquidity provider for the conference, operated flawlessly, ensuring no payment failures.

In addition to utilizing an extra liquidity provider, we also employed a price hedging solution in case we experienced bitcoin price volatility during the conference.

This risk needed to be addressed because vendors who accepted bitcoin at the conference wanted to be paid out in their local currency once the conference ended.

A bearish scenario for a vendor would be receiving a $10 payment bitcoin at the time of sale while the price of bitcoin was high, and then, during the course of the conference, bitcoin’s price could have dropped 50%.

In this type of situation, when it was time to perform a settlement in the local currency for the vendor, they would only receive $5 in their local currency, which is unacceptable.

To mitigate this risk, we used “stablesats“, a Blink feature that allows for instant conversion into a synthetic version of a stable currency (such as the Hong Kong dollar) at the point of sale.

More information on Blink features and services here.

Step 3: Deploying Physical POS Machines

Despite the digital nature of bitcoin transactions, physical point-of-sale (POS) machines were deployed to give a familiar checkout experience to attendees and vendors.

We used POS machines from Bitcoinize. These devices also facilitated the issuance of physical receipts upon request.

Step 4: Simplifying Bitcoin Access with Bolt Cards

To facilitate seamless bitcoin transactions at the conference, we also utilized Bolt Cards.

These custom “Bitcoin Asia” edition cards, enabled attendees to convert fiat currency into bitcoin for use within the event. The cards allowed for straightforward NFC tapping at POS devices.

Step 5: Training for Merchants and Employees

A training session was conducted before the conference to familiarize vendors with how to use BTCPay Server.

The 10-minute session was effective, with minimal questions from participants.

A group chat was set up for support, which remained largely inactive due to the smooth operation of the payment system.

A full video of the training session is available here.

Conclusion

Thanks to free and open source software like BTCPay Server and innovative solutions from companies like Blink, transacting with bitcoin transactions at the Bitcoin Asia conference was incredibly easy.

The success of using BTCPay server at the Bitcoin Asia conference demonstrated the potential for wider adoption of bitcoin in everyday commerce.

Consider using such solutions for your next event or within your local economy.