“The institutions are coming.”

Anyone who’s been in the Bitcoin space for any significant period of time has heard some prominent figure within the space utter this phrase.

In August 2020, when MicroStrategy, an American-based business software company, announced it would be purchasing bitcoin to add it to its treasury, many thought that was the beginning of the institutional stampede.

But it wasn’t.

Sure, Tesla bought some bitcoin the following year, only to dump 75% of it soon after.

And so from 2020 through 2023, MicroStrategy was an anomaly. During these years, the company — led by Bitcoin permabull Michael Saylor — remained the only major corporation on Earth to convert a notable portion of its treasury into bitcoin.

Saylor’s vision to get MicroStrategy on a bitcoin standard hasn’t wavered, though.

Instead, he has doubled down and continued to guide MicroStrategy as it has put more bitcoin on its balance sheet. He’s also hosted a conference — MicroStrategy World: Bitcoin for Corporations — every year starting the year after his company made its first bitcoin purchase as a means to show other companies how to emulate MicroStrategy.

This year’s edition of the conference — held on May 1 and 2 in Las Vegas, NV — marked the beginning of a new era, according to Saylor, an era in which the time has come for institutions to follow MicroStrategy’s lead.

The Age of Bitcoin For Institutions and Corporations Has Begun

In Saylor’s keynote presentation on the second day of the conference entitled “There Is No Second Best”, he termed 2020-2023 the “crazy years” in the Bitcoin space.

He explained that these years were part of a period of “crypto chaos,” a period from which bitcoin emerged as the dominant and most trusted crypto asset.

What follows the crazy years, Saylor said, are the years in which institutions and corporations embrace Bitcoin, and he told Bitcoin Magazine in an X Spaces on April 30, the day before the conference began, that he believes this new era began in January 2024, when 11 spot Bitcoin ETFs launched in the United States.

Let’s not just take Saylor’s word that a new day has dawned, though. Let’s consider what Hunter Horsley, CEO of Bitwise, one of the 11 financial institutions that launched a spot Bitcoin ETF in the US, had to say about institutional interest in bitcoin.

“The bitcoin ETFs have really brought bitcoin into the realm of possibility for a lot of traditional financial institutions,” Horsley said on a panel during the second day of the conference.

“A lot of traditional and reputable firms have started engaging with bitcoin in a way they never have before, but so few of them are saying anything about it. If you just scroll through your LinkedIn or you read press releases, you would think that nothing has changed versus last year, but, for now, most — or many — are preferring not to have it be public,” he added.

JUST IN: $3.5 billion Bitwise CEO says "A lot of traditional and reputable firms have started engaging with #Bitcoin in a way they never have before, but so few are saying anything about it."

"Banks are reaching out to us" 👀 pic.twitter.com/h0jjhrzZQ6

— Bitcoin Magazine (@BitcoinMagazine) May 2, 2024

Alexander Leishman, CEO and CTO, of Bitcoin exchange River, also pointed out in his presentation that while buying bitcoin has traditionally been a retail investor-driven phenomenon, more and more businesses are beginning to dip their toes into the bitcoin waters, as well.

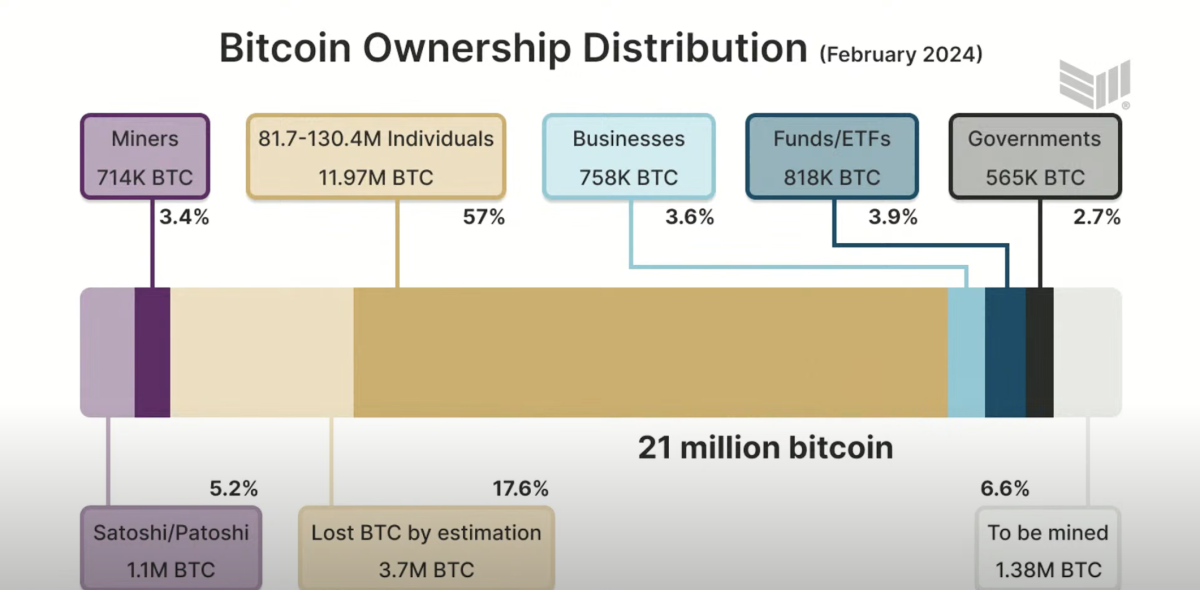

In one of his slides, Leishman pointed out that the percentages of businesses and funds/ETFs that hold bitcoin may not seem like a lot, but they’re bigger than they’ve been in previous years.

“We have businesses, funds and ETFs and governments, these large institutions, these blue and black bars. These bars have gone from virtually nothing to where they are today, but they’re continuing to grow,” Leishman said.

“Retail is not really driving the recent rally in the bitcoin price. Consumer interest in bitcoin is nowhere near its all-time highs. So, what is driving this price increase? We think that one big factor is institutions,” he added.

According to David Marcus, CEO of Lightspark, in the near future, institutions won’t just be looking to hold bitcoin on their balance sheet or offer it to their customers, but they’ll start using it for payments.

Lightspark Is Using Lightning To Link Businesses Globally

To conclude the first day of the conference, Saylor sat down for a fireside chat with Marcus, former executive at PayPal and former lead for Facebook’s abandoned cryptocurrency project Libra, to discuss how the Lightning Network will connect businesses across the world.

Lightspark made headlines the day before the conference began, as it announced Coinbase would be using Lightspark to integrate Lightning for its US users.

According to Marcus, Coinbase was just the first of many companies that would soon be harnessing the power of Lightning.

“In a world where you’ll have hundreds of millions if not billions of people that have an address for money that can be settled in real time in the currency that they’re choosing, you can imagine all kinds of new applications [for businesses],” said Marcus about companies using Lightning to not only send sats, but digitized versions of fiat currencies, as well.

"The time is now to enable fast cheap, realtime movement of Bitcoin and other assets [on Lightning]."

-David Marcus, CEO, LightSpark @lightspark#BitcoinforCorporations— MicroStrategy (@MicroStrategy) May 1, 2024

“Streaming money to endpoints is one of them. New forms of payments for merchants that would reach new audiences or new client bases that they couldn’t reach [previously]. The ability to create brand new business models to enable people to actually contribute to anything that you’re building from anywhere around the world,” he added.

“It will have an impact on the world that is going to be as important as the internet itself was in its own time for communications.”

Marcus also touched on how companies are more multinational in nature than individual Bitcoin users and will greatly benefit from moving value around the world in real time via Lightning.

It was difficult not to be bullish on Bitcoin and Lightning after listening to Marcus and Saylor converse.

It was also difficult not to be bullish on Bitcoin not just as a store of value and a medium of exchange, but as a platform for trust after Cezary Raczko, Executive Vice President of Engineering at MicroStrategy, revealed its plans for MicroStrategy Orange, a decentralized identity (DID) platform built on the Bitcoin blockchain.

MicroStrategy Orange

MicroStrategy Orange is an enterprise platform that empowers organizations to employ DID applications, built directly on the base layer of Bitcoin.

It’s the first technological innovation involving Bitcoin that MicroStrategy has been a part of.

“The platform consists of three fundamental pieces,” said Raczko. “At the heart of it, is a service cloud hosted that allows you to issue those identifiers to your users in your organization. It also allows you to deploy applications that run on MicroStrategy Orange. The Orange SDK allows you to integrate the applications into your own services. And the Orange apps are going to be prepackaged solutions that address specific digital identity challenges.”

This news came as a pleasant surprise to many at the conference, as it illustrated that MicroStrategy wants to continue to lead the way with Bitcoin adoption — outside of its store of value use case — as we enter this new era of businesses and institutions adopting Bitcoin.

Normalizing Bitcoin For Corporations

Conversations both on and off the conference stage revolved around Bitcoin maturing from a taboo entity, to something that’s becoming more normal, making it more difficult to ignore for companies and institutions.

In conversations I had with Bitcoin industry leaders like Becca Rubenfeld, COO of AnchorWatch; Sam Abbassi, founder and CEO of Hoseki; and Nathan McCauley, co-founder and CEO of Anchorage Digital, I learned that companies and institutions that once wrote Bitcoin off as being little more than a scam or fad, are now beginning to inquire about how they can adopt it.

“It’s exciting to be at a stage of adoption where access to bitcoin is being expanded to businesses and their clients,” Rubenfeld told Bitcoin Magazine. “This event is particularly oriented to that, which allows conversation to be focused on the benefits and challenges unique to that new set of Bitcoin owners.”

While it’s taken some time for corporations to come around to Bitcoin, it’s clear that we’re at the onset of an era in which they’re beginning to see the value in it.

Even if companies and institutions aren’t necessarily ready to adopt a bitcoin standard the way that MicroStrategy has, it does seem that more are willing to have some exposure to bitcoin the asset or begin using Lightning for payments or apps that utilize the Bitcoin blockchain.

For this, we have Michael Saylor and the team at MicroStrategy to thank.