Analyzing bitcoin derivatives gives a window into the state of the market conditions and can provide clues for when bitcoin has reached an absolute bottom.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

This article covers some of the recent action in the bitcoin derivatives market, as well as touches on the evolving relationship between bitcoin and the legacy financial system.

The action in global capital markets has been intense, with massive volatility across currencies, more selling in bonds and a brief bullish deviation for bitcoin, which excited the bulls.

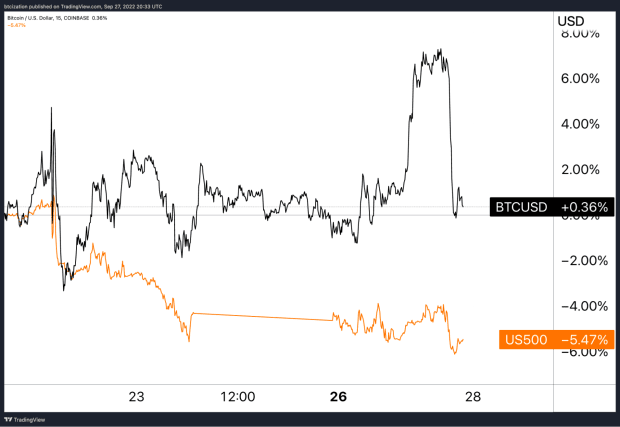

As bitcoin pushed back above $20,000, there was some chatter of a potential decoupling, as bitcoin was up over 7% while U.S. equity markets were down approximately 4% over the last week. While we would certainly love to see a moment where bitcoin finds relief during an increasingly tumultuous environment in the legacy financial system, we remain skeptical on this outcome over the near future, as the data just doesn’t support it.

We cannot emphasize enough that the current trading environment for bitcoin is less about bitcoin itself and more about the dollar. As yields across maturities and currencies are soaring higher, the value of global assets is collapsing in tandem, which will subsequently lead to a day of reckoning where everything sells in tandem.

As we like to say it, the everything bubble is unwinding, as the asset sitting at the base of it all, the U.S. Treasury bond, continues to bleed.

Let’s return back to bitcoin for a moment. What was the period of outperformance from, and can we expect more of it soon?

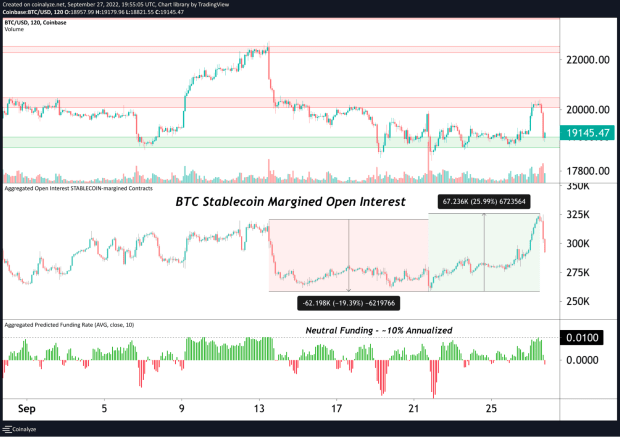

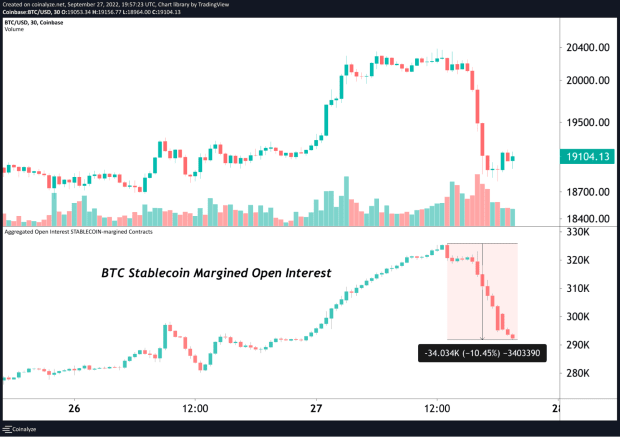

The simple answer is that the type of buying that was occurring — long positions in the bitcoin futures market — is never one of sustainable nature.

Tens of thousands of bitcoin worth of net buying became net sellers in hours, as the surge in open interest that led to the increase in market price quickly fell underwater.

Our belief in regards to the bitcoin derivatives market and its insight into the state of the market cycle is the following:

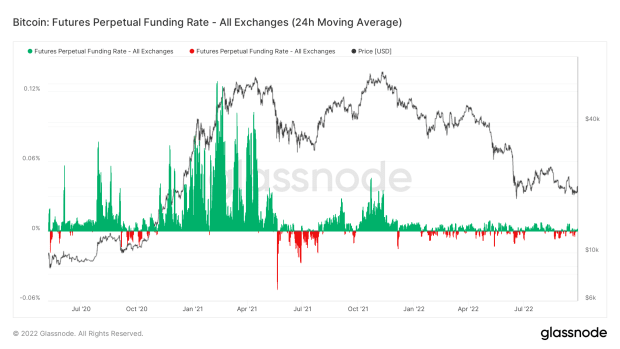

When the variable interest rate is significantly negative, the brunt of the spot selling and leverage unwinding has occurred. The variable interest rate across the perpetual futures complex can give us insight as to whether the bulls or bears are overaggressive.

When the funding rate is significantly negative, it can be because of both closing long positions driving the price below the spot market or due to aggressive short positions pushing the price lower. The funding rates in today’s market environment are much more muted than the craziness seen in 2021.

Our expectation is that a volatility in legacy markets would lead to a large liquidation in bitcoin derivatives, driving the price below spot markets, while short traders piled on. This would be seen by a drastically negative perpetual futures funding rate (variable interest rate that incentivizes traders to settle prices close to the spot market rate).

We haven’t seen that, in terms of the level where the 2020 and 2021 markets bottomed.

The market isn’t there today, in our estimation.

Related Issues:

- 1/21/22 – The Daily Dive – Bitcoin Below $40,000

- 3/8/22 – The Daily Dive – Bitcoin’s Risk Free Rate

- 3/9/22 – The Daily Dive – Negative Derivatives Sentiment

- 5/20/22 – BM Pro Daily – State of Bitcoin Derivatives

- 8/12/22 – Rising Speculation – Evaluating The Explosion In Derivatives Interest