The Bitcoin landscape is no stranger to debates and predictions. Two dominant theories are currently at the forefront: the 4-Year Cycle and the Elliot Impulse Wave. However, a comprehensive analysis by the esteemed crypto analyst CryptoCon, suggests a fascinating intersection of these two theories.

The Dueling Bitcoin Price Prediction Theories

At the heart of the debate are two camps. The first, the 4-Year Cycle proponents, believe in Bitcoin’s 4-year journey from cycle tops to bottoms, with a predicted zenith in 2025. The second camp, the Elliot Impulse Wave advocates, are forecasting a powerful parabolic top either this year or by early 2024.

CryptoCon’s meticulous analysis, which encompasses TA, on-chain data, market psychology, and more, offers a fresh perspective. “I believe it may be possible to see the best of both worlds for each group of thinkers,” he posited.

A significant portion of the 4-Year Cycle theory hinges on the halving’s impact on Bitcoin’s price. “When the Bitcoin supply is reduced approximately every 4 years, this should trigger a supply decrease which causes price to rise,” CryptoCon elucidated. However, he also raised a counterpoint, noting the diminishing influence of miner supply output on Bitcoin’s price, especially given its current market size.

Historical Parallels, Signals And Indicators

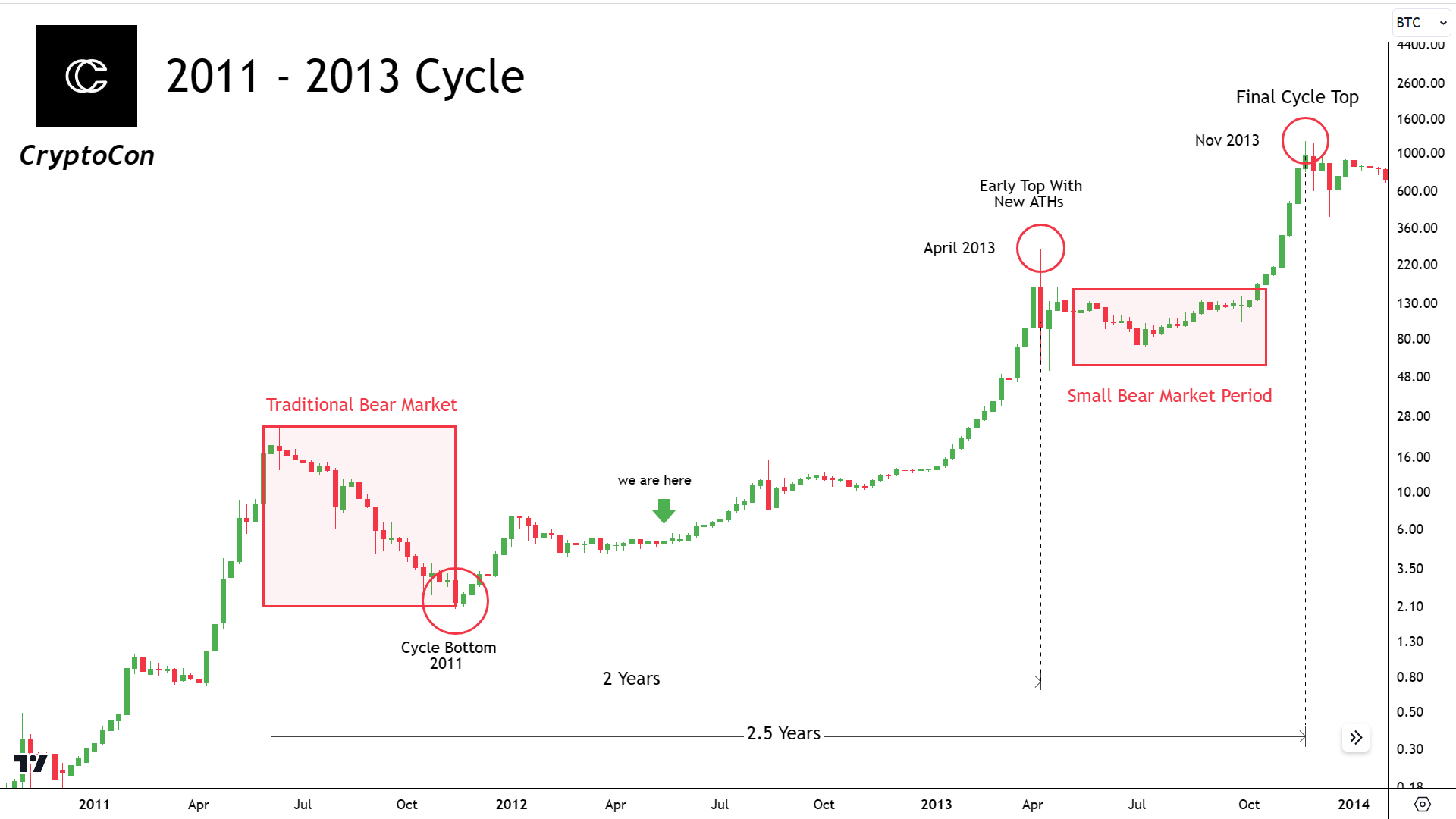

CryptoCon drew attention to the 2011-2013 cycle, a period that didn’t adhere to traditional patterns. This cycle experienced both an early and a later top. Could this be a precedent for the current cycle? “Both of these groups of people seem to forget one particular cycle that seemingly defied all of the rules. 2011 – 2013,” he recalled.

Two compelling signals were central to his analysis: the DXY Correlation Coefficient and the Vigor Signal. Historically, these have been precursors to a price parabola. “The parabola signal has triggered. This has been the start of every price parabola by definition,” he emphasized, underscoring their reliability. Historically, when Bitcoin has shown a low correlation with the US dollar, significant price movements have been observed.

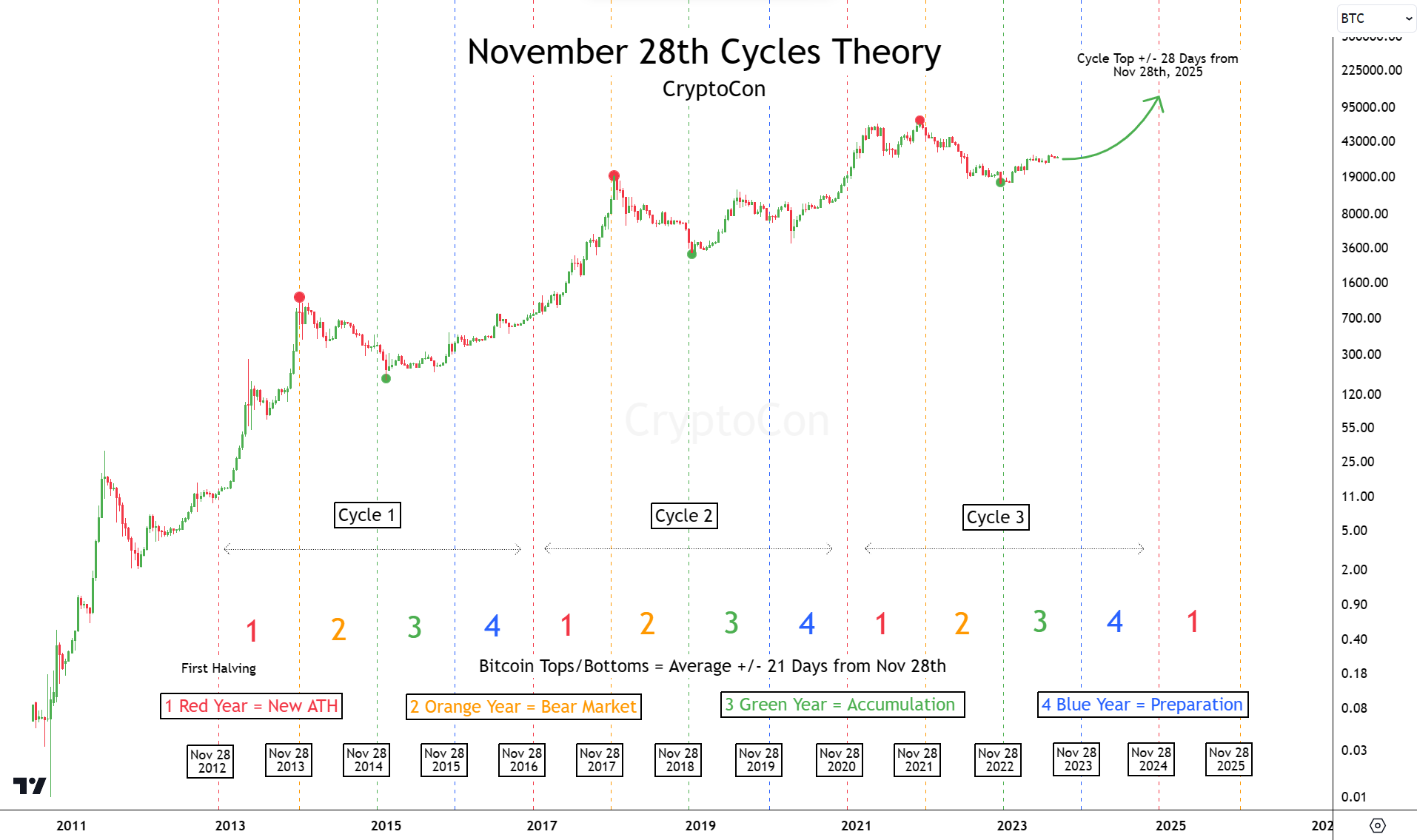

The November 28th Cycles Theory, rooted in the date of Bitcoin’s first halving, has also been a consistent predictor of Bitcoin’s price movements for a decade. It segments the Bitcoin price journey into four distinct phases: Green, Blue, Red, and Orange years (see chart below), each with its own characteristic price behavior. “With its level of accuracy, there’s no reason to expect it to fail this cycle. Telling us the true cycle top will come late 2025,” CryptoCon confidently stated.

CryptoCon’s Trend Pattern Price Model, which uses patterns in angles degrees from cycle highs and lows to predict future ones, projects a price of $130,000 by the end of the November 28th Cycle’s Theory timeframe. He was quick to caution against over-reliance on fundamentals, stating, “Although many would say there is no limit to price with fundamentals, I think this is an absolutely ridiculous argument.”

Converging BTC Predictions

Synthesizing all this data, CryptoCon envisions a scenario where both the 4-Year Cycle and the Elliot Impulse Wave theories might harmoniously coexist. He anticipates an early top around April 2024, potentially reaching $90,000, followed by a mid-cycle bear market. The final top, he predicts, could touch $130k by late 2025.

CryptoCon’s analysis, while detailed and comprehensive, also comes with a dose of humility. “This is what I believe is possible. Absolute? Hardly,” he remarked. As the Bitcoin community continues its fervent discussions, one thing remains clear: Only time will truly reveal the course Bitcoin’s price will take.

At press time, the BTC price stood at $29,466.