Arguably the most important takeaway from yesterday’s FOMC meeting was that the U.S. Federal Reserve (Fed) is no longer forecasting a recession, which led to a cautious rally in Bitcoin and crypto markets today. Fed Chairman Jerome Powell’s statement during the FOMC press conference seems to have eased investor concerns, leading to a swift recovery in both tradfi and crypto. However, historical data suggests that caution may be warranted as the potential for recession remains a looming concern (although Powell said otherwise).

Signals For A Recession Remain Strong

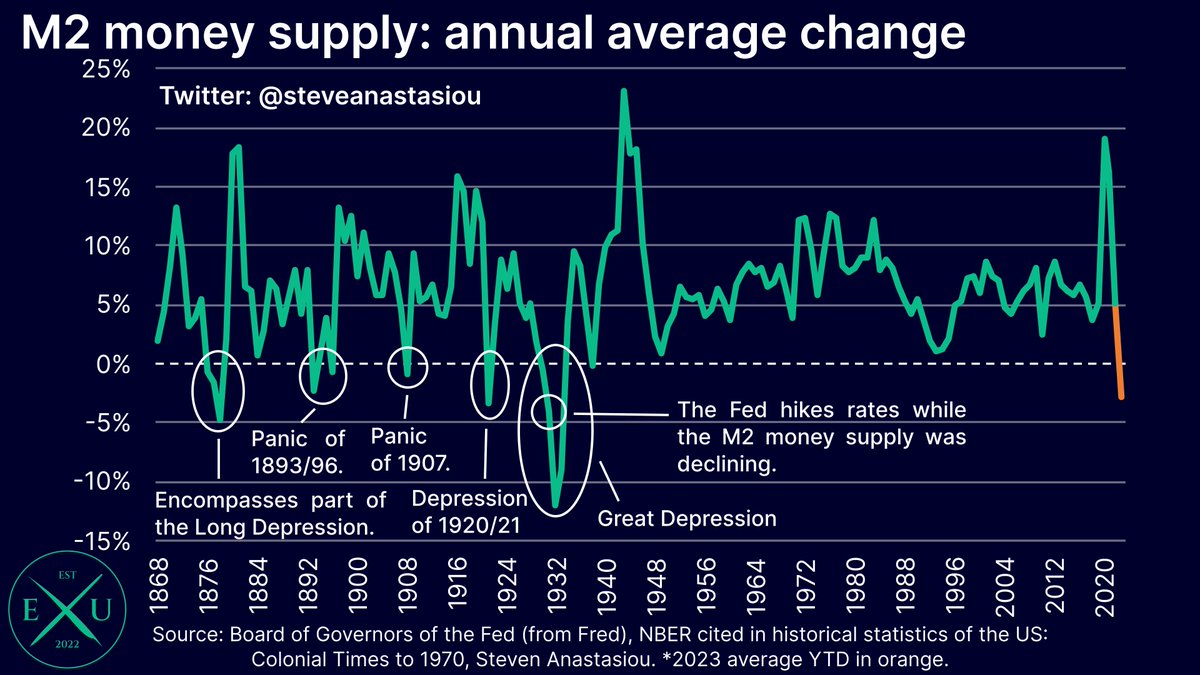

Prominent financial experts have raised their voices about the current economic situation. Steven Anastasiou, a noted economist, warns about the significance of the recent decline in the annual average M2 growth, which stands at -2.7% YoY. He draws parallels with some of the most challenging economic periods in history, stating, “With M2 falling, history suggests that continuing with aggressive tightening is a dangerous proposition… a falling M2 money supply has generally been correlated with economic depressions & panics.”

Anastasiou also highlights the deflationary pressures in the economy, as reflected by the 12 consecutive monthly declines in the US Consumer Price Index (CPI) growth rate. Drawing parallels to a deflationary bust seen in 1920-21, he emphasizes that “now is not the time to be delivering any additional tightening.” As we know, Powell did the opposite yesterday, raising the federal funds rate to a level not seen in 22 years.

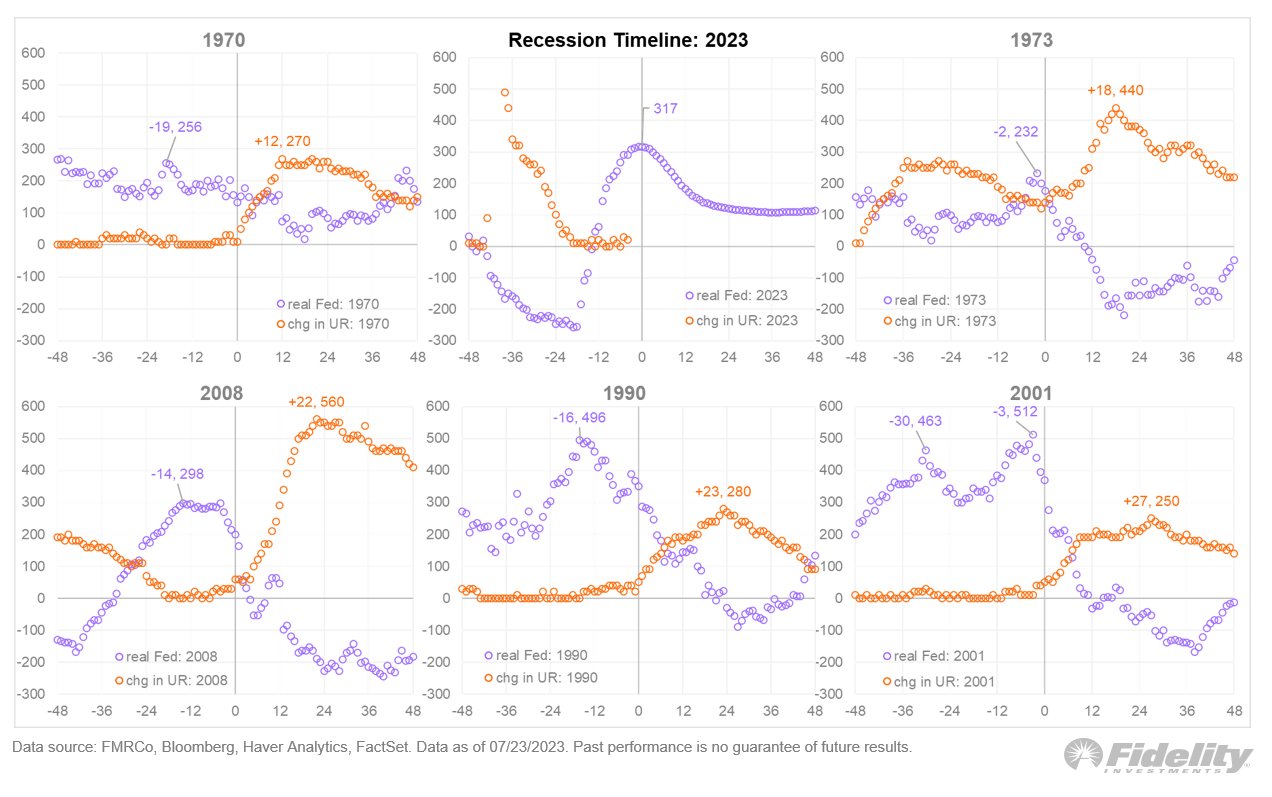

Jurrien Timmer, director of global macro at financial giant Fidelity, shared insights from historical data on recessions. He notes that the lead times between changes in monetary policy and the subsequent economic consequences can vary significantly. Looking at past cycles, he observes, “The monetary policy cycle tends to lead the economic consequences to varying degrees.” The lead time ranged from 2 months to as much as 19 months, depending on the economic circumstances.

During the 1970 cycle (when structural inflation was getting underway and the Nifty Fifty was born), “peak policy” led the recession by 19 months. In 1973-74, it was only 2 months. In 1990, (the S&L crisis), it was 16 months. In 2001, (tech bubble) it was 3 months, and in 2008 (GFC) it was 14 months.

Another warning signal is the inverted yield curve, known for reliably foreshadowing economic recessions. The inverted yield curve is currently hitting levels unseen in over 40 years (since 1981), screaming recession. Gold bug Peter Schiff therefore remarked:

The talking heads on CNBC all agree that if the U.S. enters recession, it will be a baby recession. Not only is recession a certainty, but it won’t be a baby. It will be the grand daddy of recessions. It will be so large that a more appropriate term to use will be a depression!

Impact On Bitcoin And Crypto

Amidst these economic concerns, the crypto is writing green numbers across the board. However, a recession is meaning uncertainty for Bitcoin. Unlike traditional assets, Bitcoin has not experienced a recession, leaving investors uncertain about its resilience in times of economic turbulence. While some tout Bitcoin’s “safe haven” potential, others argue that it might behave more like a risk asset, making it less attractive during a recession.

Macro analyst Henrik Zeberg and the founders of Glassnode, Yann Alleman and Jan Happel, believe that “we are going to have the largest Crisis since 1929. First Deflation – later Stagflation. But first – #BlowOffTop”. In this scenario stocks, Bitcoin and crypto could rally hard before a recession “suddenly” hits the market.

However, no one knows how the economy will react this time. Therefore, the coming two months and their macro data (CPI, PCE, jobs, unemployment rate, earning, etc.) will be indicators for Bitcoin and crypto investors to follow (just as J-Pow tirelessly repeated yesterday – “data dependency”).

At press time, the Bitcoin price continued its slow grind up, trading at $29,523.