Unit of Account

Unit of account is the thing that measures the value of goods and services. It’s an essential function for something to be [or become?] money. In simple terms, it is a standard measure of value, a common scaling system through which the value of products can be calculated and compared.

Countries typically have distinct units of account, identified as the national or regional currency, such as the euro (EUR) or the British pound (GBP). At the same time, internationally, the U.S. dollar (USD) is the unit of account that is mainly used for global invoicing and setting prices internationally.

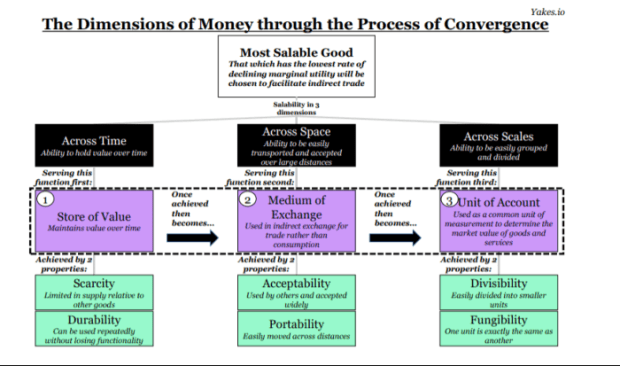

Unit of account is one of money’s three universally agreed functions of money that Bitcoin Magazine is reviewing; the other two are store of value and medium of exchange.

What is a Unit of Account

A unit of account is whatever forms the standard measure for comparing prices with incomes or assets; it allows money users to assess the value of money and is the common denomination for transfer value across different types of goods and services. When a unit of account is defined by the same measure or denomination (such as a specific currency), it’s easier to compare the value of various assets and transactions.

Having a standard measure makes it easier to determine the value of two different items, such as the price of a house and a car. Knowing the car’s cost and the house’s price makes budgeting and transactions easier to assess.

It also allows us to process mathematical operations, such as calculating profits, losses and income, giving numerical values to what we produce, trade and consume.

Typically, what we identify as a unit of account is money — in recent times, backed by governments and national currencies. It’s what we use as a standard measure for all our daily transactions.

Money as a Unit of Account

Money as a unit of account is also used to measure a country’s economy. For example, the American economy is measured in U.S. dollars, the Chinese in yuan and so forth. Internationally, things tend to be simplified with the U.S. dollar as a unit of account, making it easier to compare different economies.

Money is the standard measure used in economics and financial markets to establish how much people can borrow or lend, and keep track of their assets’ value. Applicable interest rates are also calculated in the same unit of account.

Finally, money is also used to calculate the net worth of individuals, businesses and organizations of different types, including the monetary value of their assets.

Essential Elements of a Unit of Account

To gain acceptance as money by the market, a good typically goes through a three-stage process: starting as a store of value, progressing to a medium of exchange and finally becoming a unit of account to establish its quantifiable monetary value.

We’ve seen that a unit of account is used as a standard unit of measurement for the market value of goods and services and to be salable. For a good to be defined and credible as a unit of account, it must have the following properties:

Divisibility: As a unit of account, money must be divisible into smaller units to facilitate transactions, express the value of goods and services more accurately and effectively, and compare various items’ values more easily.

Fungible: Fungibility is an essential characteristic of a unit of account and occurs when two units of the same currency are interchangeable. Hence, the value of one unit of account is identical to another of the same kind. One dollar bill, for instance, has the same value as another dollar bill. Often seen as a property of a medium of exchange, its importance lies in its function rather than its classification.

How Does Inflation Affect the Unit of Account?

Inflation doesn’t make the Unit of Account (UoA) function worse; however, price instability does make it challenging to compare the worth of goods and services over time. The unit of account serves to facilitate the understanding of supply and demand dynamics in the economy, but its reliability is severely eroded by inflation.

As a result, market participants may struggle to make informed decisions regarding consumption, investments and savings.

What Makes a Good Unit of Account?

Money that is divisible, and fungible makes a good unit of account. Money not impacted by inflation would make an even better unit of account. People often argue that we should have a type of money that’s measurable, stable and constant, like the metric system.

If the unit of account was standardized like the metric system, it would be much easier to accurately and consistently assess the value of goods and services over time. However, value is subjective and shifting, and the world’s circumstances differ over time, so there cannot be any guarantee that value is always represented in the same way.

While we will never have a type of money that becomes as measurable as the metric system, we can have money that has a preprogrammed, inelastic supply and is detached from the real-world value of things.

Bitcoin as a Unit of Account

If a type of money has the primary properties discussed, is accepted globally and is also censorship resistant, it’s potentially the best unit of account ever created.

Bitcoin, however, is still relatively new and has a lot of maturing to do before it can be recognized as a consistent unit of account. Since Bitcoin has a fixed maximum supply of 21 million coins, it is not subject to the same inflationary pressures of traditional fiat currencies, which can be printed ad infinitum by central banks. This should provide a level of predictability and certainty for businesses and individuals when assessing the value of goods and services, making long-term financial planning easier and more reliable.

Furthermore, the lack of inflationary pressures on the unit of account would also promote more responsible economic decision-making by governments and businesses. Since the temptation to print more money to fund government programs or stimulate the economy would be removed, policymakers would have to find other ways to manage economic growth, such as through innovation, productivity and investment.

In addition, If bitcoin were to become the global reserve currency, it would promote greater international trade and investment by eliminating the need for currency exchanges and mitigating the risk of currency fluctuations. This would make it easier and less expensive for individuals and businesses to transact with one another across borders, facilitating greater economic cooperation and growth worldwide.

Overall, a unit of account not impacted by inflation would offer a stable foundation for the global economy, enabling businesses and individuals to plan for the future more confidently while promoting more responsible economic decision-making and international trade.