Bitcoin Magazine

Miles Suter: Cash App Now Offers Best Bitcoin Pricing, Higher Withdrawals for Users

Cash App, the popular digital wallet and payments app, announced a series of changes to its Bitcoin offering, including a massive increase in withdrawal limits, lower fees, new funding rails, and lots more in an exclusive interview with Miles Suter, Product Lead at Block Inc.

“Our mission is to make living on bitcoin simple and practical,” Suter told Bitcoin Magazine. The company, which today serves over 58 million active users, recently announced a deep set of upgrades to the app, further integrating Bitcoin into the user experience while improving quality of life for Bitcoiners on the app, and unlocking further functionality.

The most awaited and noteworthy update is likely the expansion of the withdrawal limits, which were raised to 10,000 a day from 2,000 and 25,000 a week from 5,000 for eligible customers. This update was rolled out by default to the vast majority of users, who should have access to it now. Suter also mentioned that those who do not see the withdrawal limit expansion can reach out to him or support for further review of eligibility.

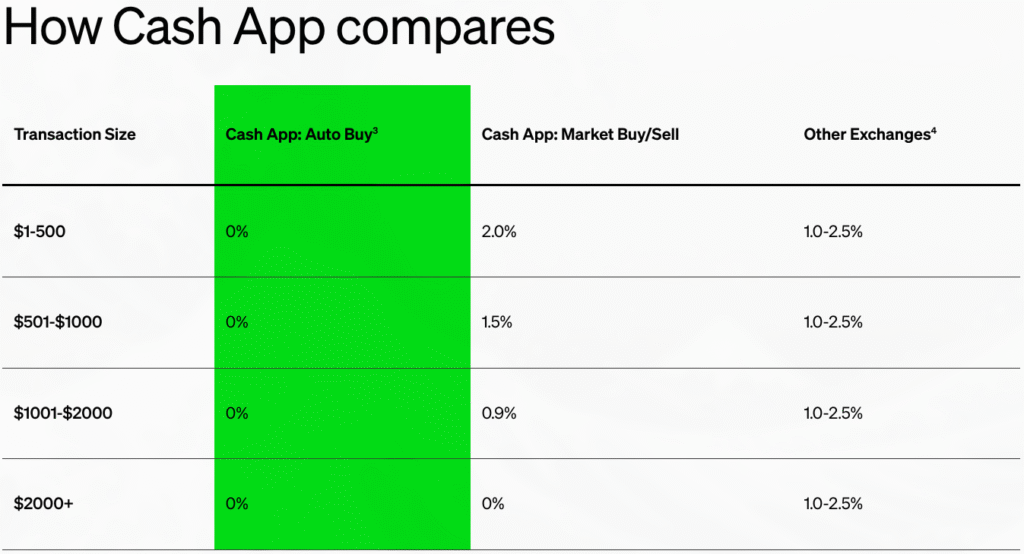

However, a lot more changed under the hood. Fees and clearing prices also improved with “no spreads” on pricing, according to Suter, one of many user experience updates that may lead the charge across the industry in terms of interface design.

Spreads are gaps in the price of an asset like Bitcoin, depending on whether you are buying or selling. Usually, they are the result of order books that match buyers and sellers on a list sorted by exchange rate. A small spread between the most anyone is willing to pay for some bitcoin and the least anyone is willing to accept for theirs, is normal in most exchanges. But it can also be confusing and appear like inconsistent pricing. Many exchanges hide a small commission in this spread, as they look for low-friction profits. Cash App appears to be eliminating this from the user experience, in turn giving users a single price point for both sides of the market.

This pricing update, alongside the 0% fees, might make Cash App the most cost-effective way to buy and sell Bitcoin within the United States. Suter goes as far as to say Cash App now has the “best price in the world” for purchases over 2,000 dollars.

Funding Rails and Stablecoins

Funding rails also got an expansion in this update. Historically, Cash App was built to work with debit cards, a strategy that likely unlocked fast retail adoption but came with various funding limits. Suter was excited to share that new funding rails have been added to Cash App, including ACH, which unlocks deposits as high as 10,000, and also integrated wires for large purchases. As such, this is more than a quality of life upgrade for Bitcoiners inside Cash App, it is a historic milestone for the company, which has been servicing retail and small to medium merchants since 2013.

When asked about Cash App’s relationships with banks, an area of the Bitcoin industry that many companies and users still struggle with, even during the friendly Trump administration, Suter said that users should have no issue sending and withdrawing from Cash App to U.S. banks. Suter explained that banks are very conservative and hyper-focused on preventing fraud, an understandable business choice for them, but one that highlights “the brittle nature of our current system, where everything is permissioned,” and a clear example of “why we believe having zero intermediaries in Bitcoin is very important.”

Putting a finer point on the topic of funding rails, Suter also expressed interest in stablecoin integration, though no timelines were given on the release date of this particular feature. He was also very clear about how stablecoins would be integrated into the app and that users would not be exposed to a myriad of choices in terms of blockchains or ticker name denominations. Instead, all values would be presented as dollars, and all major stablecoin blockchains would be supported in the background. This implies that fees paid in blockchain’s native token will not be shown to users, removing a long-standing pain point that the broader industry has failed to address. Included in this stablecoin integration discussion was the mention of dollars on top of Bitcoin’s Lightning Network, though no details were discussed.

2026 Road Map

Looking ahead for the year as we enter 2026 at full speed, Suter expressed a clear vision to further integrate Bitcoin into Cash App, making it available in seamless ways to its large userbase, “we want Bitcoin to be a foundational currency within Cash App. So you can live your life on Bitcoin.”

In order to achieve that, Cash App is laying the groundwork to make not just accepting Bitcoin but paying with Bitcoin completely automated. That means any store using Square payment terminals should be able to accept bitcoin via Lightning payments, using the same QR codes and payment flow as with fiat. While any Cash App user should be able to pay lightning invoices by scanning QR codes, even if they don’t have bitcoin on their account. That’s right, automated conversion of USD to BTC, and BTC to USD at checkout, so that everyone can pay how they want and receive the currency they choose. In Suter’s words, “we want all customers and users to be able to receive and send bitcoin without needing to know about it or hold it.”

This approach solves a few friction points that have held back the payments use case of Bitcoin since its inception. On the one hand, if users are not holding bitcoin when they spend, there’s no tax event, Cash App does the conversion on behalf of the merchant, so the sender has no bitcoin sale tax event. Suter did not go into details but mentioned this particular issue as an important piece of the puzzle, saying that “Block Inc will pay the lightning invoice on your behalf. No tax liability, no price fluctuation”.

On the other hand, merchants who choose to accept bitcoin as payment are likely to get it more often, as anyone using Cash App will effectively have it to pay with. If a merchant, for example, decides to only accept Bitcoin as payment, all Cash App users will be able to purchase from them, even if they don’t have Bitcoin on their account. Merchants may also give discounts on purchases with Bitcoin, something customers will be able to benefit from by using Cash App without having to hold any Bitcoin.

This whole design may introduce millions of Americans to Bitcoin who otherwise are not really familiar with it, “there’s moms out there who have never used bitcoin,” Suter noted, “I want to make it so every Cash App user has a lightning URL that matches their Cash App username”.

On the active Bitcoiner side of the market, Suter commented briefly on the growing market for Bitcoin-backed loans, saying that the company is actively “exploring” and “engaging customers online” on the use case, and “customers want it”. The company is exploring various ways of offering Bitcoin collateralized loans, including perhaps a line of credit, though details remain scarce. Suter highlighted this use case as an important financial tool for Bitcoiners to “live on bitcoin”, thus aligning with the company’s vision. While no more was said on the topic, Suter did casually add that an announcement was coming for Bitcoin Vegas in May.

This post Miles Suter: Cash App Now Offers Best Bitcoin Pricing, Higher Withdrawals for Users first appeared on Bitcoin Magazine and is written by Juan Galt.