Bitcoin’s latest drawdown from its all-time high is being compared to 2022 across crypto Twitter (the similarities are obvious), but some technicians argue the similarity is mostly superficial. In a series of posts, TexasWest Capital CEO Christopher Inks said the current move looks like a completed five-wave decline tied to a positioning washout, not the kind of structurally driven breakdown that defined the 2022 unwind.

Bitcoin Vs. 2022: Similar Chart, Different Story?

Inks’ core claim is about where the market sits in the broader pattern. “One of the differences between the current drop off the ATH and the 2022 drop of ATH is that we just appear to have completed 5 waves down,” he wrote. “Back then the same area everyone is referencing had already completed five down, the three wave correction, and then broken down further.”

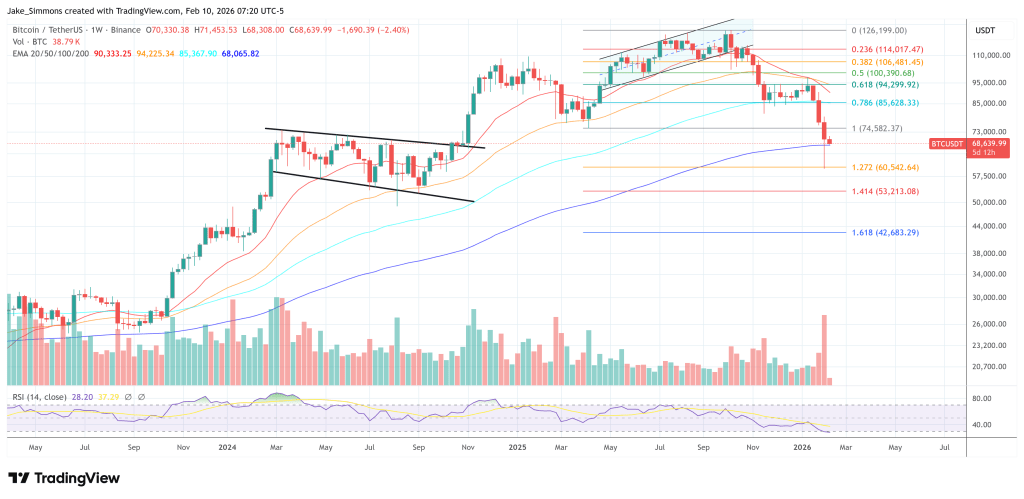

On his weekly BTCUSD chart, Inks annotated what he sees as a five-wave decline into early 2026, followed by sideways consolidation around a “weekly pivot,” after what he described as a sharp recovery late last week. The implication is less about calling a definitive bottom and more about sequencing: if the five-wave leg is complete, the next phase is typically corrective or base-building rather than an immediate continuation lower.

Inks also separated the catalysts. The 2022 breakdown coincided with the TerraUSD depeg and ensuing market dislocation, a reflexive shock that tightened collateral and impaired liquidity across venues. By contrast, he framed last week’s selling as risk reduction rather than crisis fallout.

“Another difference between the two periods is that the former coincided with the TerraUSDT depeg and break down which was a market structural event that was the catalyst for the Bitcoin breakdown at that time,” Inks wrote. “As I’ve been mentioning, last week’s breakdown was a degrossing (risk-off position reduction). These are two wholly different market moves.”

“Does this guarantee that the low is in? Of course not, but if you’re comparing two events then you should compare how they occurred and not just that the price action looks kinda similar,” he added. “That way, if price does something other than what it did last time you won’t be running around in disbelief screaming ‘manipulation’ and ‘what’s going on!’”

Inks said Bitcoin failed to reclaim a weekly close back inside the prior range around $75,000, leaving open the possibility that the selloff was a “terminal shakeout” rather than the start of a deeper trend. His roadmap, however, was explicitly time-based: he wants to see the low hold for “the next 2–3 weeks” with “declining volumes on the pullbacks,” plus a higher low on the weekly timeframe and “compression below resistance instead of rejection.”

He also tied the move to rates positioning. Inks pointed to a two-year Treasury note futures chart that, in his view, remained coiled rather than breaking higher alongside the risk-off episode, another data point supporting the idea that last week’s selling was “pre-resolution positioning rather than post-crisis fallout.”

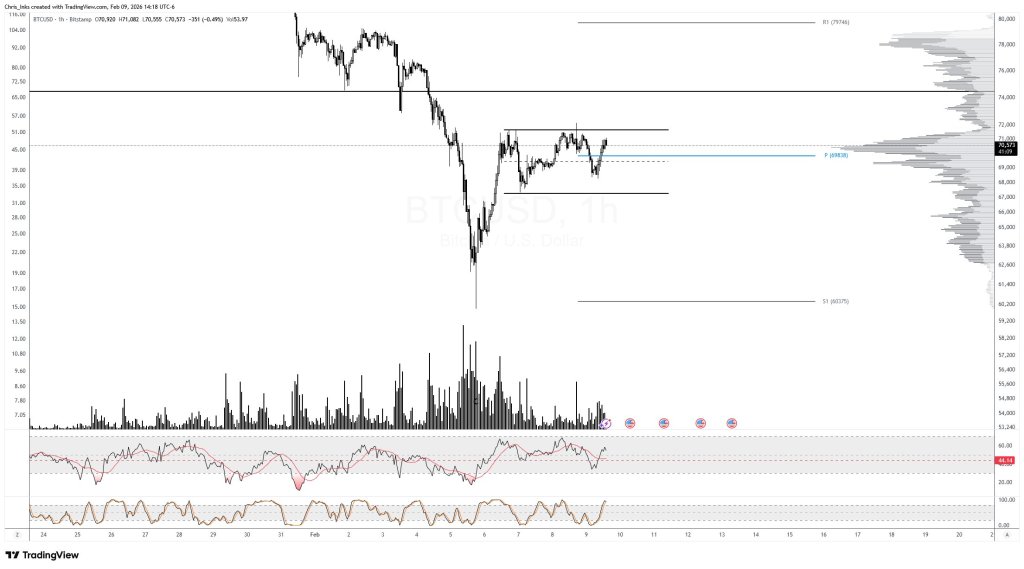

With regards to the lower timeframes (1-hour chart), Inks urged for patience: “Bitcoin continues to consolidate sideways around the weekly pivot, within the range shown. Not surprising after Friday’s strong recovery. Takes time to build confidence after something like that. And if you are hoping the low is in, then that’s what you should prefer to see rather than continued move straight up without building bases to provide support on pullbacks.”

At press time, BTC traded at $68,639.