Bitcoin’s slide to $60,000 on Feb. 6 triggered a sharp surge of exchange inflows that on-chain analyst Darkfost called a capitulation event, with short-term holders and small “shrimp” wallets leading the move. It wasn’t just retail panic either—flows jumped on venues that pros actually use.

Darkfost said the selloff “reignited investor anxiety” after BTC revisited a price level “not…since October 2024,” alongside a broader drawdown “exceeding 50% from the last all time high.” It wasn’t only where BTC traded. It was how fast it got there. “The acceleration of this correction created a clear fear driven dynamic,” he said. People rushed coins onto exchanges. That only added fuel to the liquidation fire. “Unsurprisingly, Short Term Holders were the first to react emotionally.”

Bitcoin Capitulation Event

What stood out: short-term holders were piling into Binance deposits first—the usual ‘quick to flinch’ group. On Feb. 6 alone, Binance inflows attributed to STHs on a 7-day sum basis “exceeded 100,000 BTC,” surpassing activity seen during the April 2025 correction, he said.

Across venues, the scale was larger still. From Feb. 4 to Feb. 6, nearly “241,000 BTC were sent to various exchanges,” Darkfost wrote. It’s tough to interpret that as anything but selling pressure. In his view, the resulting wave of deposits compounded volatility already elevated by forced liquidations and de-risking.

While Binance tends to capture large swaths of retail-driven flow, Darkfost flagged a concurrent surge on Coinbase Advanced, which he described as widely used by institutions, active traders, and professional desks. On Feb. 6, BTC inflows there hit roughly “27,000 BTC.” That’s a real spike.

That’s the part that messes with the easy “retail panic” story. When you see it on both Binance and Coinbase, it’s probably not just one crowd freaking out. Darkfost put it bluntly: “nervousness…not limited to retail investors.”

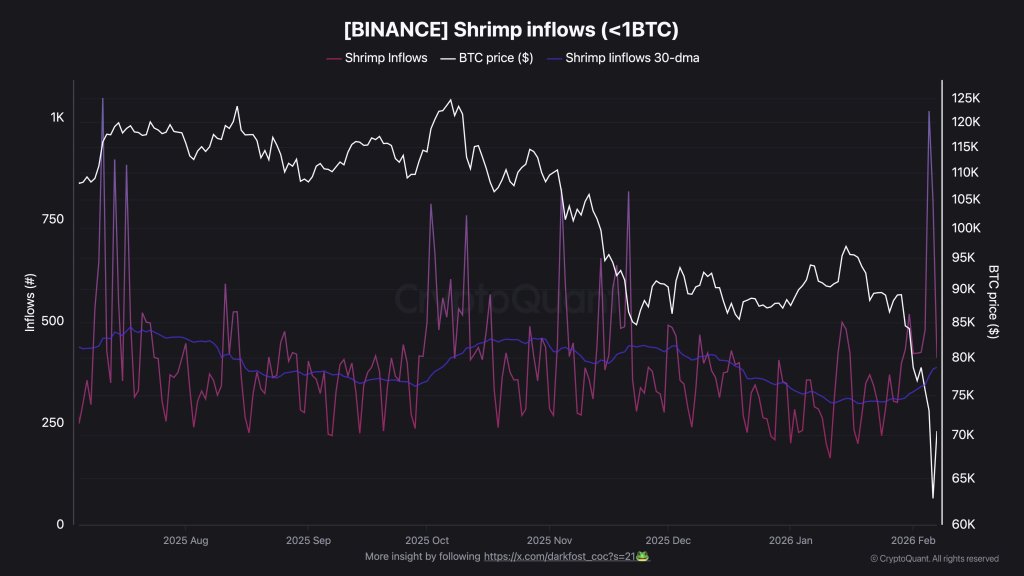

In a separate post focused on small holders, Darkfost argued that retail participation had been unusually muted for much of the cycle, then abruptly reappeared during the drop. He looked at Binance deposits from wallets under 1 BTC—the “shrimps,” usually the most jumpy.

On Feb. 5, shrimp inflows to Binance exceeded “1,000 BTC in a single day,” versus a monthly average “closer to 365 BTC,” according to Darkfost. He noted the last comparable spike was in July 2025, but in a very different market regime, when Bitcoin was still pushing toward new highs. Same kind of flow, totally different mood.

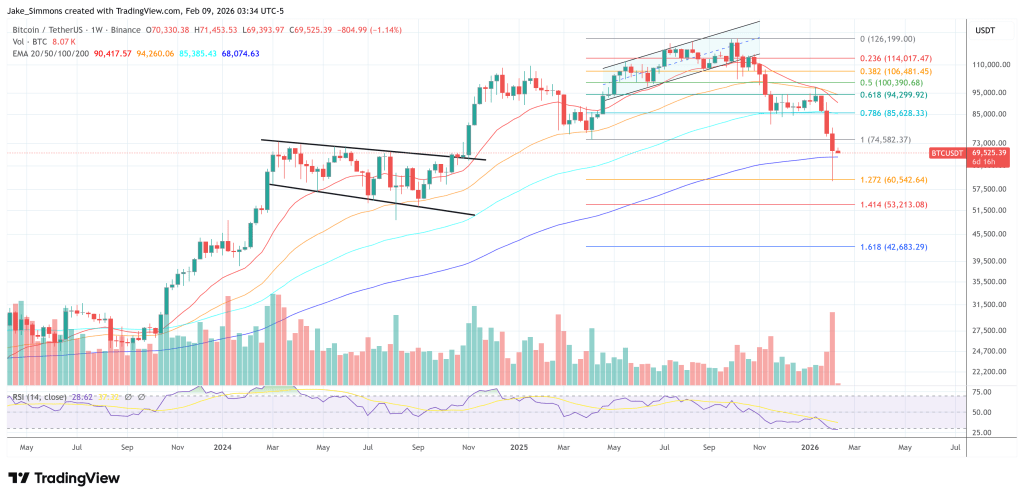

Darkfost also tied the move to cost-basis dynamics that have increasingly squeezed holders as the correction deepened. He said Bitcoin “has put all STH under pressure and is now beginning to test LTH,” adding that the first long-term holder cohorts—6 to 12 months and 12 to 18 months—were already underwater with cost bases of “$103,188” and “$85,849.”

He pointed to a reaction after price reached the realized price of the 18-month to 2-year cohort at “$63,654,” calling it “likely an area of interest for these holders.” He also noted that their rising cost basis suggests higher-cost coins have aged into that bracket.

His take: this was an exhaustion flush, and it won’t reset overnight. “These capitulation moves have pushed BTC into an extreme oversold zone that the market will now need time to absorb and digest,” he wrote. After briefly slipping below $60,000, Bitcoin rebounded and was “trading again around $71,000.” Darkfost said that stabilization lined up with retail flows drifting back toward their average.

That takes one obvious source of sell pressure off the table. The bigger question is whether this was the low—or just a breather in a nasty, high-volatility regime.

At press time, BTC traded at $69,525.