Bitcoin Magazine

US Dominates Bitcoin Hiring in 2025 as Singapore Jumps 158%, Bitvocation Data Shows

Bitvocation’s 2025 Bitcoin jobs report has just been released, and it shows continuing growth for the industry, as non-developer roles gain steam and Bitcoin-only companies grow 5% to become 47% of the broader crypto job market.

Bitvocation is a jobs board and resources platform for the Bitcoin job market. They offer a highly curated feed of job offers, as well as career tips, specializing in network-driven hiring. They look to help Bitcoin startups as well as larger companies in the industry. According to a press release shared with Bitcoin Magazine, Bitvocation is not a recruitment agency. “We don’t headhunt. We are building a “strategic Bitcoiners reserve” to make hiring more efficient and help startups find the right talent faster.”

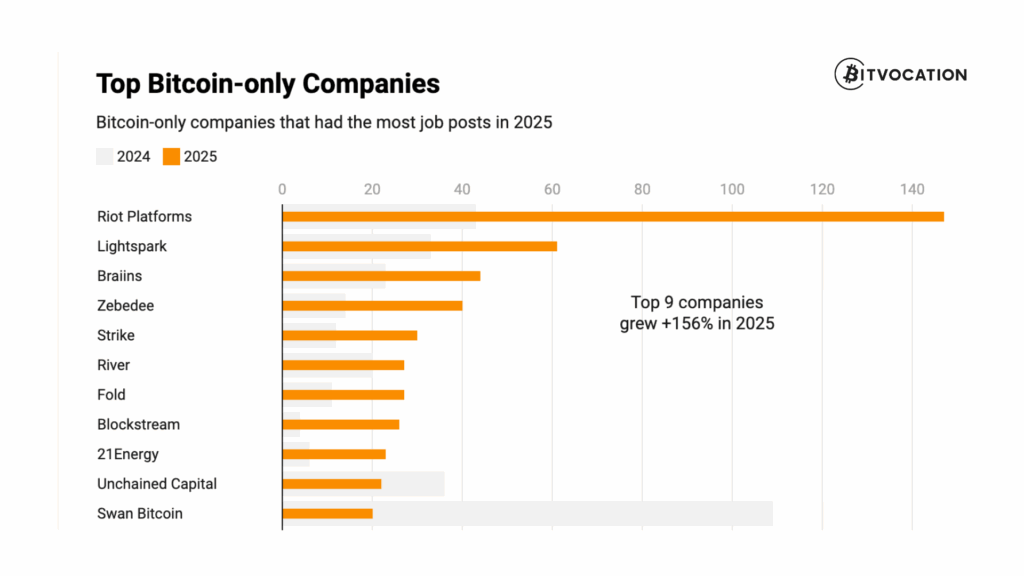

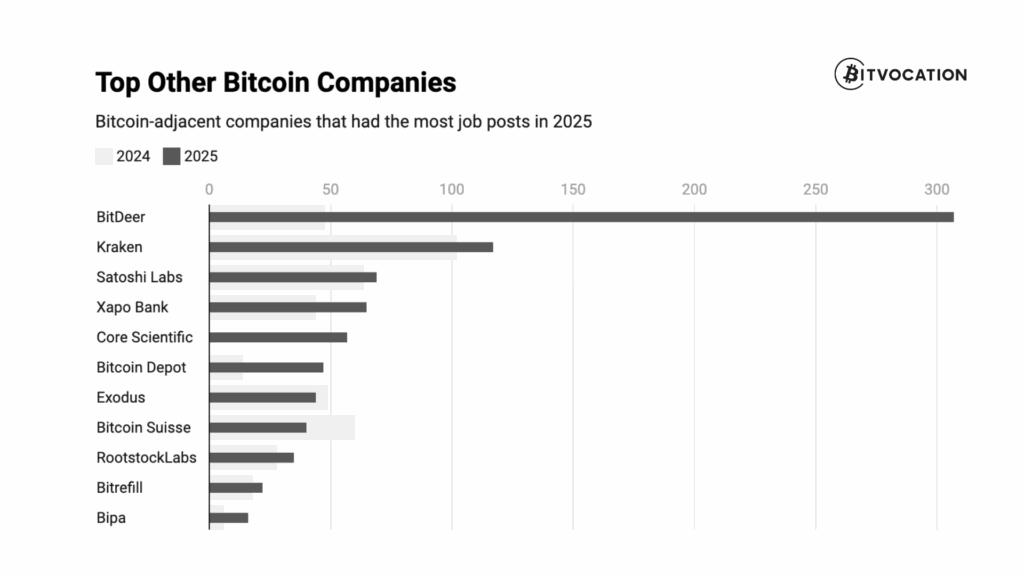

The 2025 jobs report shows a variety of interesting trends in the Bitcoin and broader crypto industry. Bitvocation counts a total of 1,801 jobs; 6% more than 2024’s 1,707 jobs report findings. Bitcoin-only companies grew 5% from 2024, vs 53% of Bitcoin-adjacent jobs. They sort Bitcoin-only vs Bitcoin-adjacent companies based on the following criteria:

- Bitcoin-only products – Core offerings are exclusively focused on Bitcoin, not competing cryptocurrencies.

- Publicly stated commitment – The company explicitly identifies as Bitcoin-only or Bitcoin-first in its mission or communications.

- Ecosystem contribution – Active involvement in Bitcoin development, open-source projects, or the Bitcoin community.

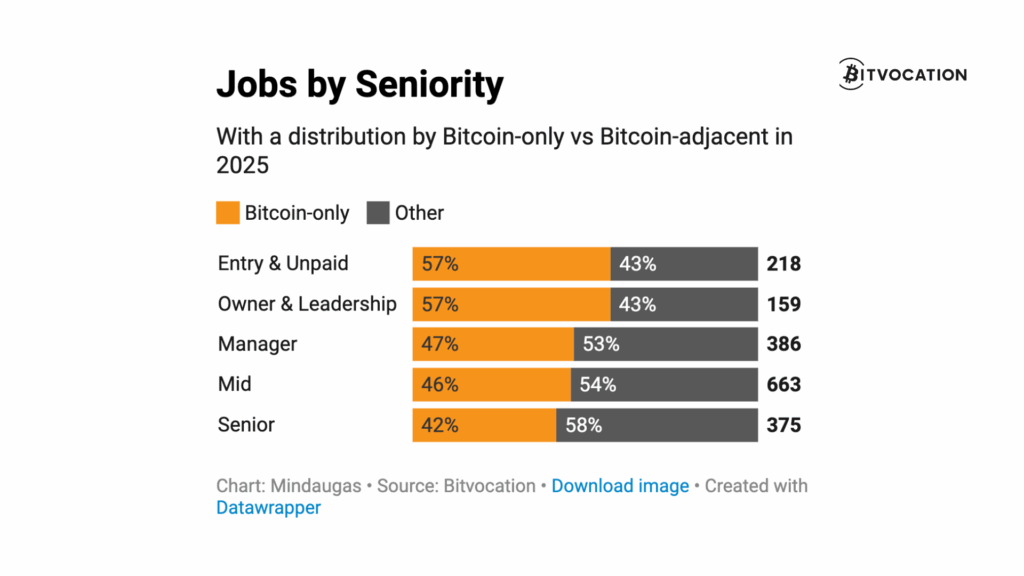

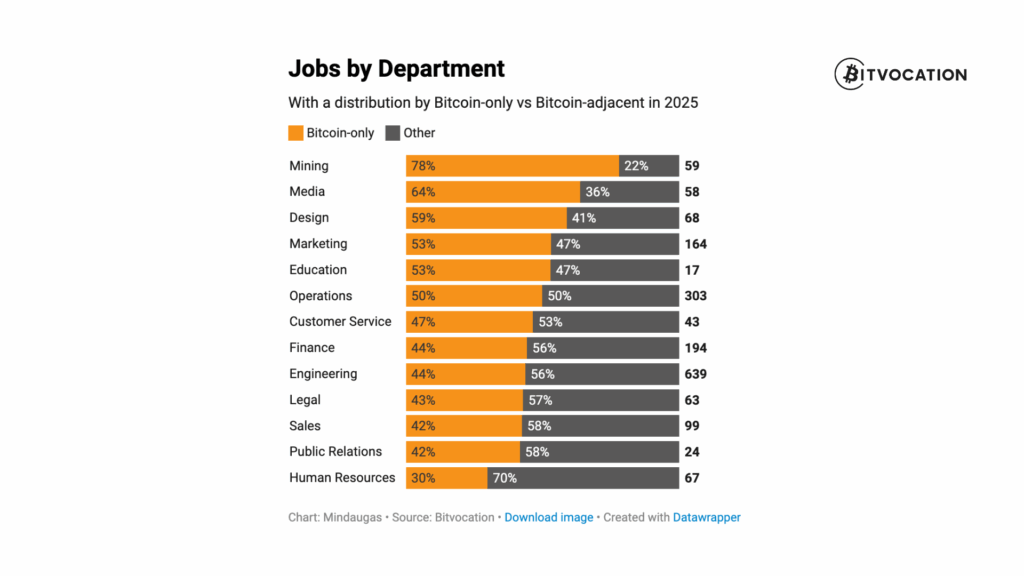

Most surprisingly, non-developer jobs grew 74%! Making a strong statement, you don’t need to be a developer to work in Bitcoin. Media, design, marketing, education, and operations dominate job openings among Bitcoin-only companies. 663 of the 1801 jobs are for mid-seniority positions, though jobs span the full range of seniority, providing opportunities to a wide range of applicants.

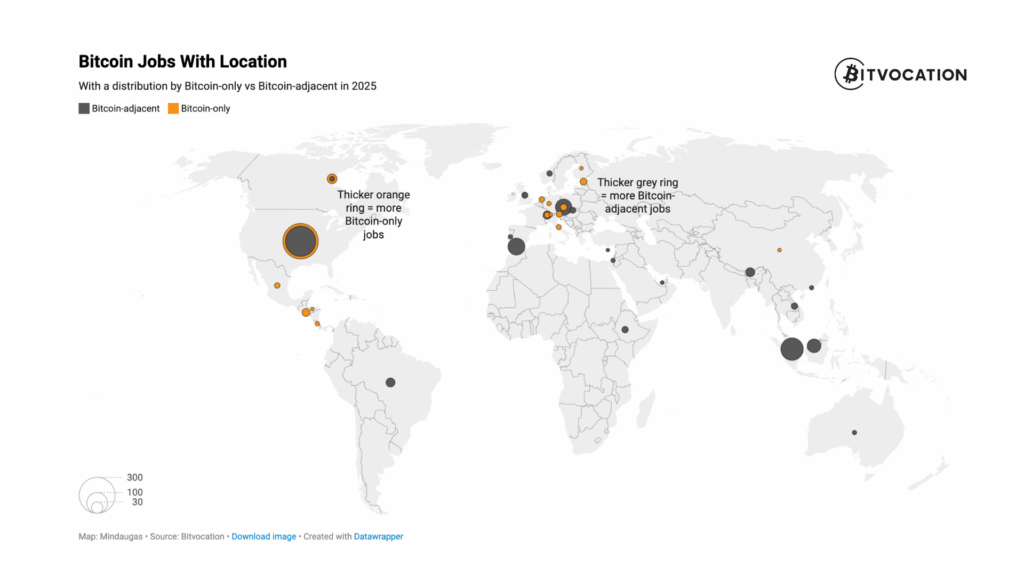

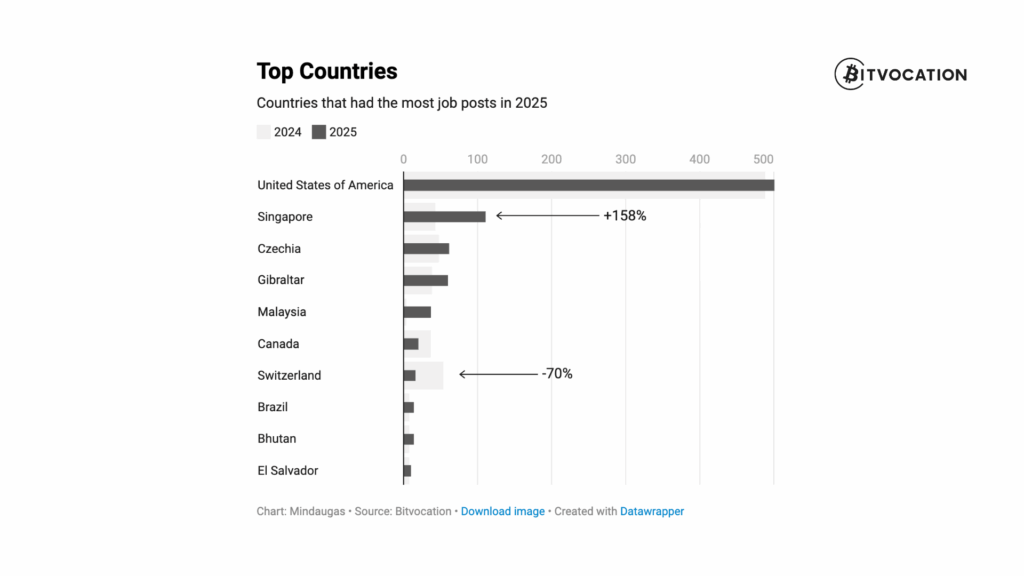

When it comes to location, the United States remains the undisputed center of the industry, though every continent offers opportunities, with Singapore seeing growth of 158% from the previous year, taking second place globally.

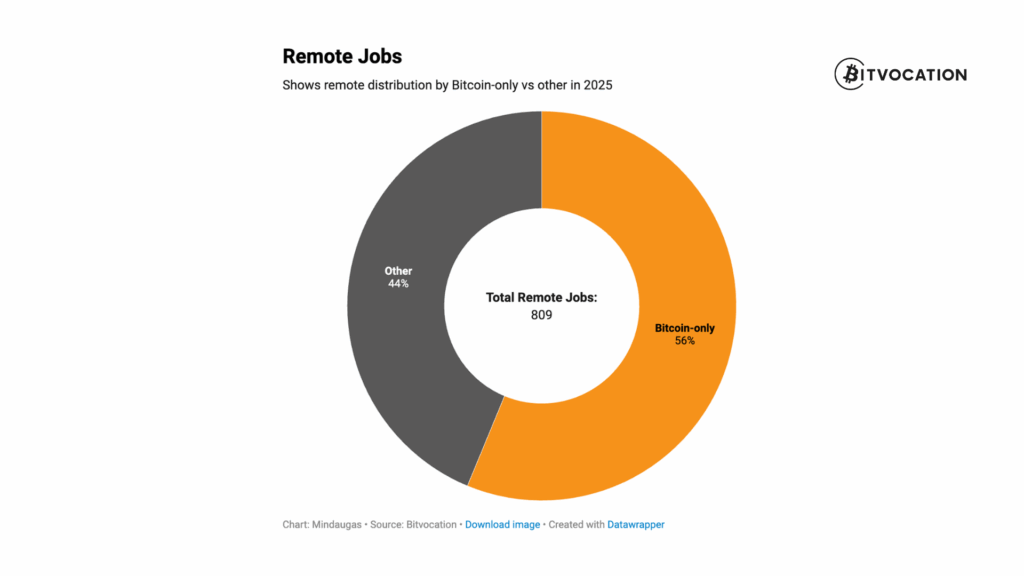

Remote jobs shrunk slightly, losing 10% to 2024 numbers. Nevertheless, almost half of all jobs in the report are remote jobs with Bitcoin-only companies offering 56% of all remote opportunities.

The hardest roles to fill, according to a survey conducted by Bitvocation, are two-fold. Highly specialized technical positions, such as Bitcoin Core, Lightning, and security-related engineers, are difficult to hire for. Non-technical roles that require translating Bitcoin’s values into product, growth, operations, or communication are also presenting a challenge to employers.

The survey also shows employers are looking for candidates with “Bitcoin conviction” as much as technical skills, and most of all “agency”. Strong communication, ownership mindset, and “the ability to operate in small, fast-moving teams” mattered as much as technical skill, according to the report. AI literacy is increasingly expected, but rarely sufficient on its own.

Across the board, employers emphasized culture fit, such as “Bitcoin alignment” and “proof-of-work”, which generally means portfolios of projects or general contributions to the industry are more important than traditional credentials alone.

Job seekers, on the other hand, reported often feeling ghosted – the solution, according to Bitvocation, is to “relentlessly build your network and create opportunities through relationships, rather than job boards”.

Interest in Bitcoin jobs nevertheless remains strong. Bitvocation registered “100% growth in subscribers,” looking for Bitcoin jobs, and over 800,000 views in the Telegram feed, according to the report.

This post US Dominates Bitcoin Hiring in 2025 as Singapore Jumps 158%, Bitvocation Data Shows first appeared on Bitcoin Magazine and is written by Juan Galt.