Bitcoin Magazine

West Virginia Lawmakers Propose Bitcoin Investments With State Funds

West Virginia lawmakers introduced legislation this week that would authorize the state treasurer to invest a portion of public funds in bitcoin, precious metals, and regulated stablecoins, marking a significant step toward integrating digital assets into state-level finance.

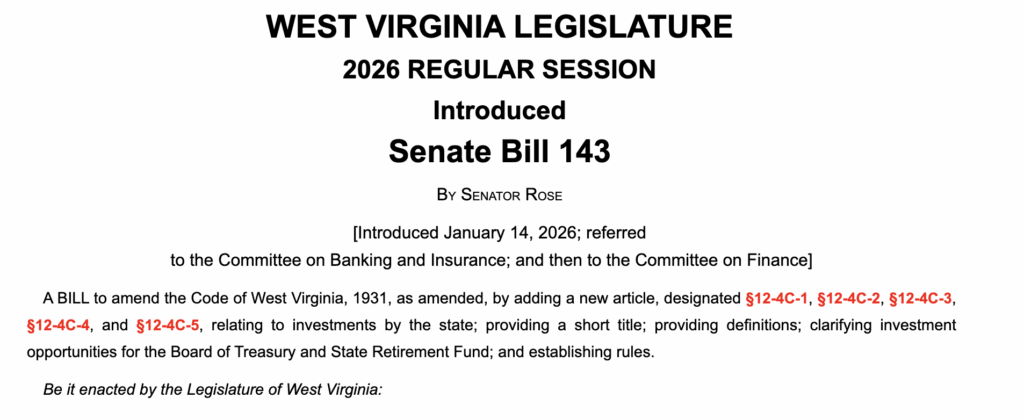

West Virginia Senate Bill 143, introduced by Sen. Chris Rose during the 2026 regular legislative session, would create a new section of state law titled the “Inflation Protection Act of 2026.” The measure permits the Board of Treasury Investments to allocate up to 10% of funds it oversees into gold, silver, platinum, and certain digital assets, subject to existing investment rules.

Under the bill, the West Virginia could invest in digital assets that maintained an average market capitalization above $750 billion over the prior calendar year. That threshold currently limits eligibility to only bitcoin, without naming the asset directly in statute.

At the end of the digital bill, there is text that says “The purpose of this bill is to empower the Treasurer to invest in gold, silver, and bitcoin.”

The bill also allows investments in stablecoins that have received regulatory approval at either the federal or state level.

The proposed 10% cap would apply at the time an investment is made. If asset prices rise and push the allocation above that threshold, the board would not be required to sell holdings, though it would be barred from making additional purchases until the allocation falls back below the limit.

The legislation includes detailed custody requirements for digital assets. Holdings would need to be secured either directly by the West Virginia treasurer through a defined secure custody system, by a qualified third-party custodian, or through a registered exchange-traded product.

The bill outlines standards for key control, geographic redundancy, access controls, audits, and disaster recovery.

In addition to holding digital assets, the bill would allow the treasurer to pursue yield-generating activities. Digital assets could be staked using third-party providers if legal ownership remains with West Virginia. The treasurer could also loan digital assets under rules designed to avoid added financial risk.

Precious metals investments could be held through exchange-traded products, by qualified custodians, or directly by West Virginia in physical form. The bill allows for cooperative custody arrangements with other states, subject to rules established by the treasurer.

West Virginia retirement funds would face tighter limits. Under the proposal, retirement systems could invest only in exchange-traded products registered with federal or state regulators, rather than holding digital assets directly.

The bill grants the treasurer authority to propose implementing rules, which would require legislative approval.

The proposal reflects a growing interest among U.S. states in using bitcoin and hard assets as long-term stores of value for public funds.

West Virginia and other states exploring bitcoin

Several states have explored or enacted similar measures allowing limited exposure to digital assets, though most have relied on exchange-traded products rather than direct custody.

Most recently, Rhode Island lawmakers reintroduced Senate Bill S2021, which would temporarily exempt small Bitcoin transactions from state income and capital gains taxes, allowing up to $5,000 per month and $20,000 annually to be tax-free.

Introduced January 9 by Senator Peter A. Appollonio, the bill was referred to the Senate Finance Committee and is framed as a pilot program to reduce tax friction for everyday Bitcoin use.

This marks the second consecutive year Rhode Island legislators have proposed a targeted Bitcoin tax exemption.

West Virginia Senate Bill 143 has been referred to the Senate Committee on Banking and Insurance, with a subsequent referral to the Committee on Finance.

At the time of writing, Bitcoin is trading at $95,494 with a 24-hour volume of $52 billion, down 1% on the day and roughly 1% below its seven-day high of $96,933. The asset’s market cap stands at $1.91 trillion, supported by a circulating supply of 19.98 million BTC out of a maximum 21 million.

This post West Virginia Lawmakers Propose Bitcoin Investments With State Funds first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

West Virginia introduces a bill to allow allocating 10% of state funds to

West Virginia introduces a bill to allow allocating 10% of state funds to