Bitcoin Magazine

Bitcoin Price Explodes Past $97,000 as Traders Set Sights on $100,000

The bitcoin price continued its strong run this week, breaking out of a multi‑week trading range and climbing well above key psychological levels as market participants digest macroeconomic data and new institutional interest.

The bitcoin price hit an eight-week high and triggered roughly $700 million in short liquidations, per Bitcoin Magazine Data. Polymarket now estimates a 73% chance that Bitcoin will reach $100K in January.

After trading relatively sideways near the low‑$90,000 or lower for the last two months, the bitcoin price began gaining traction over the weekend, ultimately surging above $97,000 at the time of writing. This is its best level in more than two months.

The rally, which has persisted through January 14, reflects a convergence of technical, macro, and sentiment drivers that have reignited bullish conviction across crypto markets.

This squeeze helped propel the Bitcoin price through resistance and toward fresh highs, triggering liquidations of speculative short bets and amplifying volatility.

Technically, Bitcoin’s reclaim of the $94,000–$96,000 zone has been widely interpreted as a breakout from its recent consolidation range.

Macro economic signals that are fueling bitcoin

The timing of Bitcoin’s rally coincides with some pivotal economic developments.

The U.S. Consumer Price Index (CPI) report released on January 13 showed inflation moderating — a result that eased fears of further aggressive monetary tightening and boosted “risk‑on” sentiment (think bitcoin) in global markets.

While stocks and traditional risk assets reacted modestly, Bitcoin’s sensitivity to macro cues was evident as investors sought alternative stores of value and growth exposure. Stable inflation numbers have also alleviated concerns about elevated real yields, which historically challenge non‑yielding assets like Bitcoin.

With inflation more contained than feared, traders and investors appear more willing to allocate capital to crypto, further underpinning the rally.

Another notable development in the world is the ongoing unrest in Iran that has intensified this week as nationwide protests against economic collapse and government repression raged amid a near‑total internet blackout, with authorities signaling fast‑track trials and possible executions of detainees.

The crisis has amplified geopolitical risk, driving traditional markets into safe‑haven assets and sparking heightened volatility.

In digital markets, Bitcoin has shown resilience and renewed investor interest, with BTC climbing despite broader risk‑off sentiment.

Also this week, the Department of Justice opened a criminal investigation into Federal Reserve Chair Jerome Powell, sending ripples through markets — including Bitcoin.

The investigation stems from Powell’s June 2025 testimony on a $2.5 billion Fed building renovation, which he says is politically motivated amid pressure from the Trump administration over interest rates.

The escalating feud between the White House and the Fed has shaken U.S. markets, boosting safe‑haven assets like gold and bitcoin.

New institutional demand is boosting the bitcoin price

Beyond technical factors and macroeconomic data, institutional demand has resurfaced as a credible driver of bullish momentum.

Spot Bitcoin ETFs recorded notable inflows over the past days — with figures suggesting the largest net inflows since late 2025 — signaling renewed interest from long‑term capital allocators and financial advisors.

Additionally, major corporate Bitcoin holders have contributed to the narrative. Strategy Inc., a widely followed holder of Bitcoin, announced a massive $1.3 billion acquisition of BTC in the days leading up to the price surge.

What comes next for bitcoin price

Despite the strong advance, there is strong resistance near the $97,000–$100,000 range that may pose a test for bulls, per Bitcoin Magazine Data.

The market’s ability to hold these gains and continue absorbing inflows will be critical in determining whether the Bitcoin price can extend this rally further into the weekend and further into 2026.

Market sentiment — often measured by metrics like the Fear & Greed Index — is climbing away from extreme fear and toward more optimistic territory, though it has not yet reached levels typically associated with blow‑off tops.

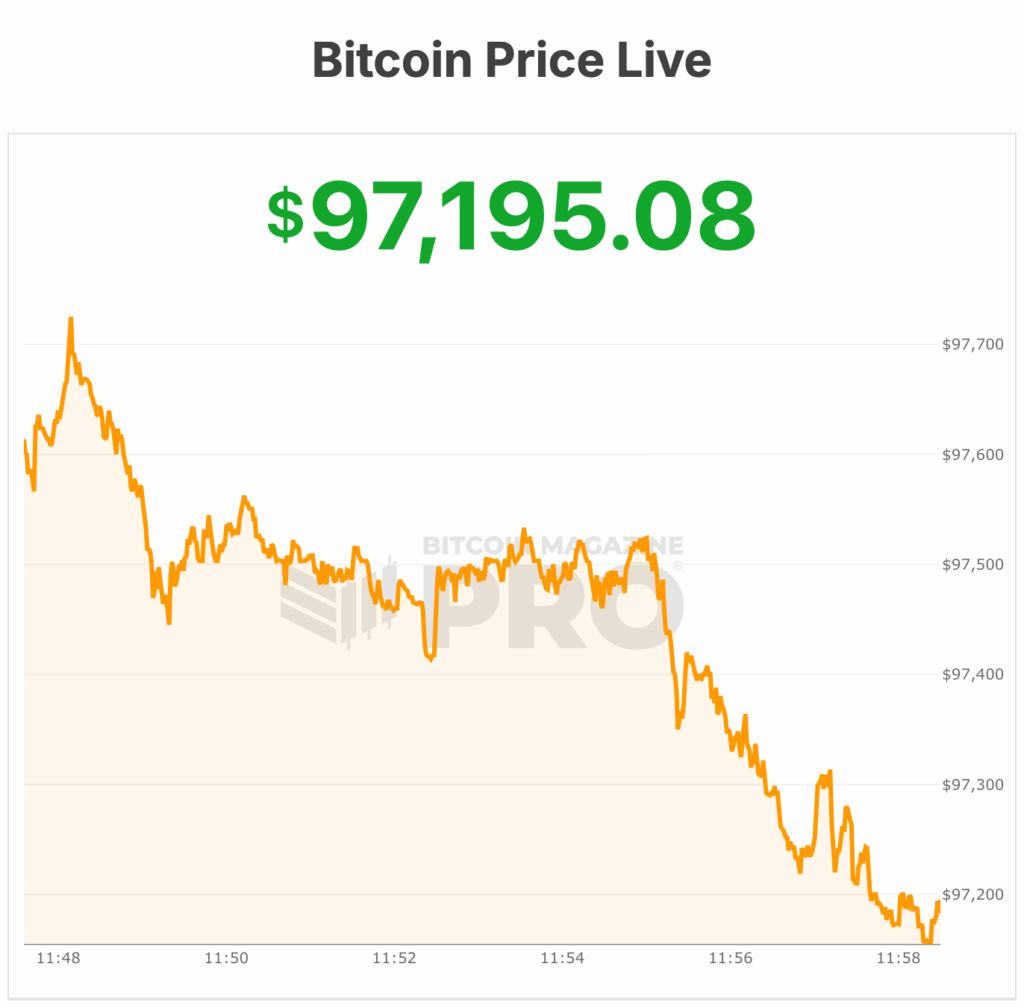

At the time of writing, the bitcoin price is near $97,200, up over 4% in the last 24 hrs.

This post Bitcoin Price Explodes Past $97,000 as Traders Set Sights on $100,000 first appeared on Bitcoin Magazine and is written by Micah Zimmerman.