Markets pulled $454 million from crypto exchange-traded products last week as investors stepped back amid rising bets that the US Federal Reserve may not cut rates soon.

According to CoinShares data and market reports, the move erased much of the early-week gains that had pushed roughly $1.5 billion into the sector during the first two trading days. The shift was sharp and broad, though a few assets saw money flow in.

Smart Money Flees Bitcoin While Some Altcoins Attract Cash

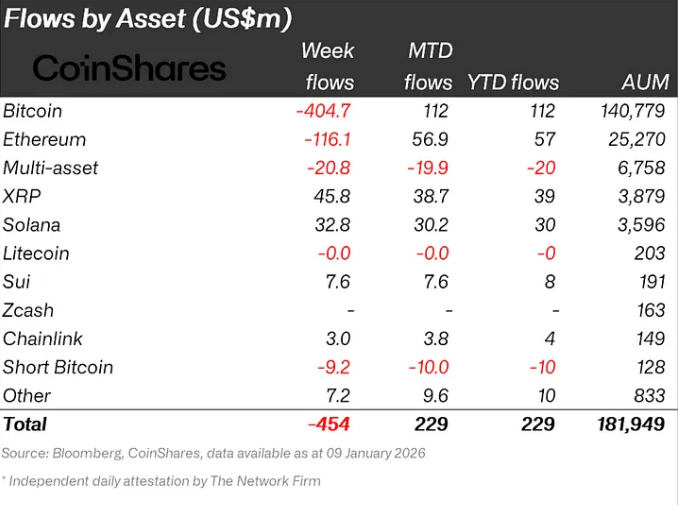

Bitcoin-linked products bore the brunt of withdrawals, with about $405 million leaving Bitcoin ETPs. Ethereum funds were also hit, posting roughly $116 million in outflows. Multi-asset crypto products reported net redemptions near $21 million.

Based on reports, these outflows came as recent inflation and jobs data made investors lower the odds of a March Fed rate cut, weakening appetite for risk assets that had been boosted by earlier optimism.

Selective Inflows Show Pockets Of Interest

But not all tokens were abandoned. XRP funds drew around $46 million in fresh money, while Solana products attracted about $33 million. Smaller tokens, including some newer layer-one projects, picked up modest flows as investors hunted for opportunities beyond the main leaders.

Total assets under management across global crypto ETPs remained near $182 billion, a figure that shows scale despite the weekly redemptions.

Regional Patterns Reveal US Outflows And Overseas Inflows

According to regional flow data, US-linked crypto investment products saw roughly $569 million exit last week. That outflow contrasted with inflows in some European and North American markets: Germany attracted about $59 million, Canada added $25 million, and Switzerland drew roughly $21 million.

The pattern suggests capital moved away from US vehicles and into other jurisdictions where investor appetite held up better.

What Traders And Analysts Are Saying

Based on reports from market analysts, the reversal came as traders reassessed the timing of monetary easing. With inflation readings remaining firmer than expected and the labor market showing resilience, market pricing shifted and risk assets were repriced. Some analysts warned that volatility could persist while others noted that pockets of demand for specific altcoins might support short-term rallies.

According to observers, the outflows highlight how sensitive crypto fund flows are to macroeconomic signals. While $454 million is a meaningful weekly move, the sector’s overall AUM near $182 billion means a single week does not rewrite the market picture.

Investors will likely watch upcoming economic releases and Fed communications closely; fund flows are expected to respond quickly to any sign that rate-cut hopes are returning or fading further.

Featured image from Gemini, chart from TradingView