Bitcoin Magazine

Strategy ($MSTR) Just Spent $1.25 Billion on 13,627 Bitcoin, Pushing BTC Holdings to 687,410

Strategy added to its bitcoin treasury for a third straight week, acquiring 13,627 BTC for roughly $1.25 billion at an average price of $91,519 per coin, according to an SEC filing dated January 12.

The purchases were made between January 5 and January 11 and funded through the company’s at-the-market offering program, which included sales of Class A common stock (MSTR) and its 10.00% Series A perpetual preferred stock, Stretch (STRC).

The sales generated about $1.2 billion in net proceeds, with $1.1 billion coming from common stock and $119 million from preferred equity.

The latest buy brings Strategy’s total bitcoin holdings to 687,410 BTC, acquired for an aggregate cost of $51.8 billion at an average purchase price of $75,353 per bitcoin.

At current prices, the stash is worth roughly $62 billion.

Last week, Strategy disclosed another sizable bitcoin purchase, acquiring 1,286 BTC for about $116 million in a filing with the U.S. Securities and Exchange Commission.

The buys, made between late December and early January, lifted the company’s total holdings to 673,783 BTC at the time, funded through Class A share sales under its at-the-market program.

Strategy also increased its U.S. dollar reserves last week to $2.25 billion to support preferred dividends and debt obligations, while reporting an average bitcoin cost basis of roughly $75,000 per coin.

Despite bitcoin rebounding above $90,000 to start 2026, the firm recorded a $17.44 billion unrealized loss in the fourth quarter of 2025 after prices fell sharply from October highs.

Strategy’s recent MSCI drama

Over the past several months, Strategy has been at the center of attention tied to its inclusion in MSCI’s global equity indexes due to its massive Bitcoin treasury strategy.

MSCI — one of the world’s most influential index providers — launched a review in late 2025 to consider whether companies with more than ~50 % of assets in digital assets (so-called Digital Asset Treasury Companies, or DATCOs) should remain in major benchmarks like the MSCI World and MSCI USA indexes.

If excluded, passive funds tracking these indexes could be forced to sell billions of dollars of MSTR shares, with estimates suggesting up to ~$2.8 billion in outflows from MSCI-linked funds alone and even more if other providers followed suit. Analysts from JPMorgan and TD Cowen estimated that exclusion from these indices could threaten billions in additional market value on top of that.

Strategy’s stock endured some declines and heightened risk-off sentiment as markets priced in the threat of index exclusion, with its share price dropping sharply in late 2025 amid these concerns.

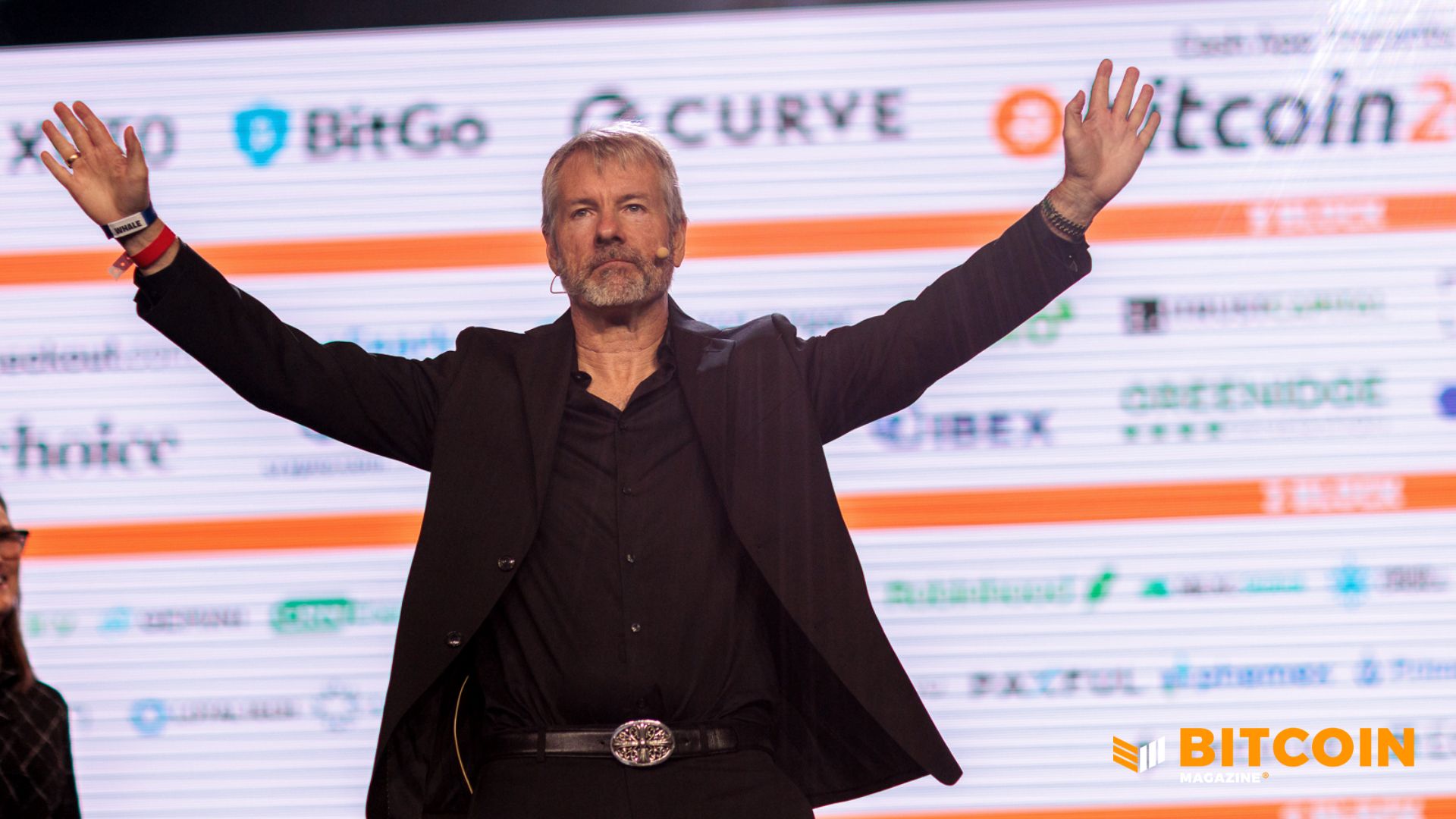

Company leadership, including Michael Saylor, publicly defended its positioning as a legitimate operating company rather than a passive fund, engaging with MSCI during the consultation and stressing its enterprise operations alongside Bitcoin holdings.

In a statement on X, Saylor said that the company is “not a fund, not a trust, and not a holding company.” He described the firm as a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

In early January 2026, MSCI announced it would not implement proposed exclusions of DATCOs from its indexes at this time, effectively postponing any removal for the upcoming February 2026 review. This decision was widely interpreted as short-term relief for Strategy — lifting some selling pressure and leading to a 4 %–6 % rise in MSTR stock as investors welcomed the reprieve.

However, MSCI also signaled a broader consultation on how to classify non-operating companies, indicating that similar debates could resurface later in 2026.

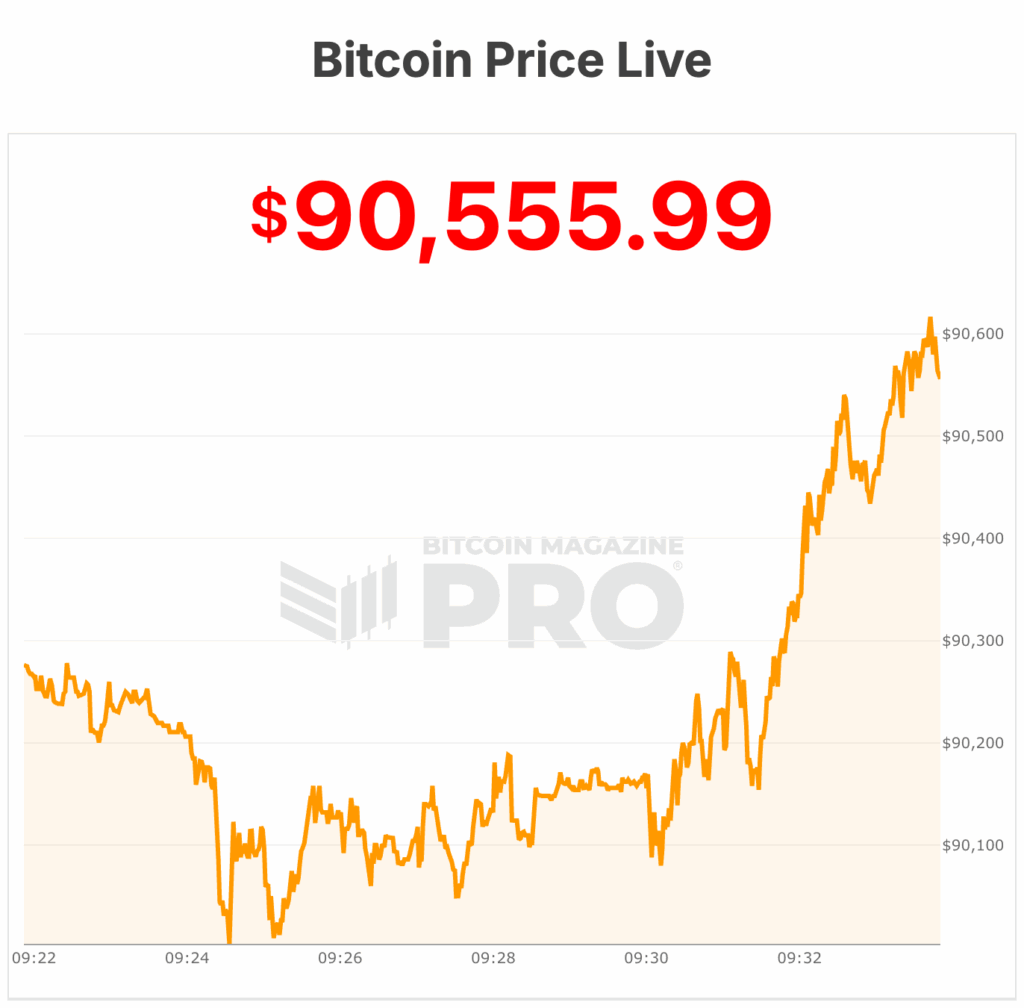

Despite all this buying, the price of bitcoin has been little-changed over the last couple of months. Bitcoin has bounced around the $90,000 range and is currently trading at $90,555.

This post Strategy ($MSTR) Just Spent $1.25 Billion on 13,627 Bitcoin, Pushing BTC Holdings to 687,410 first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

STRATEGY BUYS ANOTHER 13,627

STRATEGY BUYS ANOTHER 13,627