Bitcoin Magazine

Strategy ($MSTR) Jumps 7% After MSCI Decides Against Excluding Bitcoin Treasury Firms

Shares of Strategy ($MSTR) surged as much as 7% earlier today after global index provider MSCI concluded its long-running review of digital asset treasury companies and opted not to exclude them from its flagship equity indexes — at least for now.

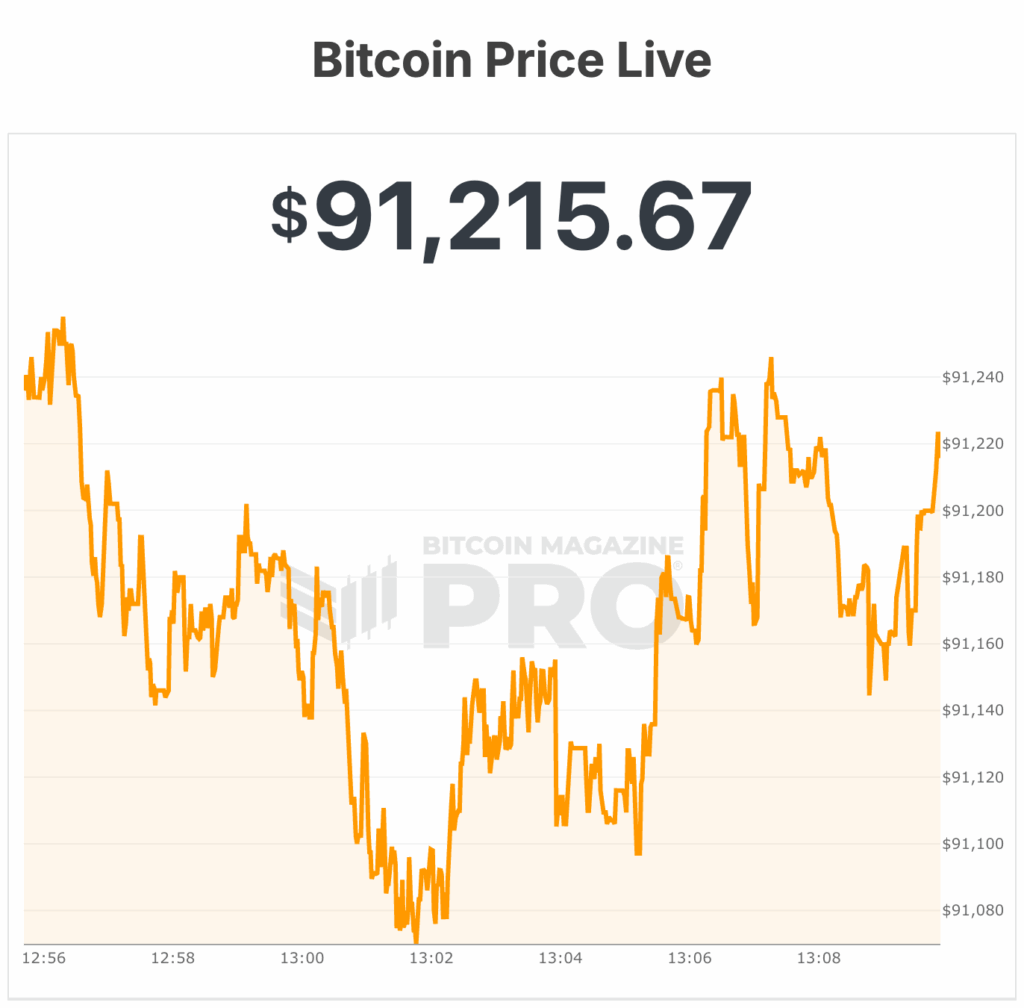

$MSTR was trading above $170 per share in early market trading, before paring gains as bitcoin pulled back into the low $91,000 range.

By midday, $MSTR shares had dipped to around $165, up only 4%, tracking weakness in the broader crypto market but still holding a solid advance on the day.

The rally followed confirmation from MSCI that it will maintain the current treatment of digital asset treasury companies (DATCOs), including Strategy, meaning firms already included in MSCI indexes will remain eligible so long as they continue to meet existing requirements.

The decision alleviated months of uncertainty that had weighed on Strategy’s stock and fueled concerns over forced selling tied to index rebalancing.

MSCI had been reviewing whether companies holding a majority of their assets in bitcoin or other digital assets should be classified as “investment-oriented” entities rather than operating companies — a shift that would have rendered them ineligible for inclusion in widely tracked benchmarks such as the MSCI All Country World Index and MSCI Emerging Markets Index.

That proposal sparked fierce pushback from Strategy and the broader bitcoin industry. Strategy argued that excluding companies based solely on balance sheet composition was arbitrary and undermined index neutrality.

Industry groups warned that removing DATCOs could trigger billions of dollars in passive outflows, destabilizing both equity and crypto markets.

Analysts had estimated that Strategy alone could have faced as much as $2.8 billion in forced selling if MSCI proceeded with exclusion, with broader selloffs across bitcoin treasury firms potentially far larger. MSCI’s decision effectively defuses that immediate risk.

$MSTR’s conditional regulatory relief

Still, the outcome was not an unqualified win. MSCI acknowledged concerns from institutional investors that some digital asset-heavy firms resemble investment funds and said further research is needed to distinguish between operating companies and investment-oriented entities.

As part of its interim approach, MSCI said it will not increase index weightings to reflect new share issuance by DATCOs — a move that could limit Strategy’s ability to expand its index footprint as it issues equity to buy more bitcoin.

MSCI also signaled that exclusion remains a possibility in the future, noting that its indices are designed to track operating companies and that a broader consultation on non-operating firms is forthcoming.

For now, markets focused on the relief. Strategy ($MSTR), which holds nearly $63 billion worth of bitcoin and remains the largest publicly traded corporate holder, saw immediate buying interest as the specter of index removal faded.

At the time of writing, bitcoin was trading in the low $91,000 range.

This post Strategy ($MSTR) Jumps 7% After MSCI Decides Against Excluding Bitcoin Treasury Firms first appeared on Bitcoin Magazine and is written by Micah Zimmerman.