With Bitcoin still so early on its adoption curve, it seems that convicted Bitcoiners need an orange pill of their own.

This is an opinion editorial by Austin Herbert, a producer for “The Mark Moss Show.”

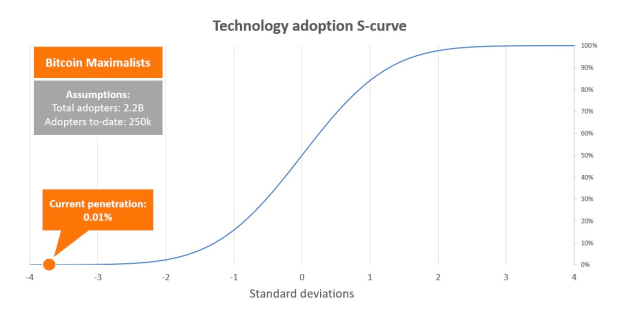

How do I know that Bitcoiners suck at orange pilling? Well… we are at .01% penetration. That’s just one out of 10,000 people who have been convinced to become Bitcoiners.

The specific number is arbitrary. It could be .01% or it could be a whopping .05% adoption rate. The point is, we are ridiculously early.

Here’s summary of what the .01% adoption rate means:

Croesus puts us at 250,000 Bitcoin Maximalists out there, defined by holding 50% of net worth in bitcoin. This is measured out of 2.2 billion total people. Why? Because he only accounts for people with $10,000-plus net worths. We are talking about storing our wealth in bitcoin, not measuring the medium-of-exchange network.

250,000 divided by 2.2 billion equals .01%.

“Everyone gets the price they deserve,” right?

As Bitcoiners, we believe the old system is fundamentally broken. We have an opportunity to build a new system. A fair system. A system that will remain long after we are gone. But in order for our new system to work, we need to fund that system. We need to defund fiat. How do we do that? We give people the opportunity to vote with their money, to opt out. But they won’t vote with bitcoin until they understand Bitcoin.

This is my story, and this is how I believe we get the masses onto Bitcoin.

Origin Story

It’s been so long that I can’t even remember how I viewed the world before I was a Bitcoiner, which is a problem. It makes it extremely hard to see the world through a non-Bitcoiner’s perspective.

To me and you, everything can be related back to Bitcoin. It’s obvious. And I mean everything, just ask my ex-girlfriend.

Climate crisis? Bitcoin fixes that. Inflation crisis? Bitcoin fixes that. Food crisis? Bitcoin fixes that. Authoritarian crisis? Bitcoin fixes that. Shitcoin crisis? Bitcoin fixes that.

Honestly, when I reflect back on it, I can’t exactly put my finger on the moment I reached escape velocity. It feels like I’ve always thought this way. So, if I can’t crawl back out of the rabbit hole, where do I go next?

I try to tell as many people about my epiphany as possible.I truly believe that Bitcoin can fix everything and I want the people closest to me to see what I see. I don’t want to be the only one sailing into this blue ocean of opportunity after this system collapses.

But, this is what happened…

Force Pilling

I started with those people I cared about the most. My mother, my sister, my best friends, etc. and to a certain extent, this worked. This is what I call a “forced pill.” They listened to me make my pitch on Bitcoin and then they invested. It was in hindsight that I realized they invested money because they trusted me to make them money.

Some of these forced pills actually converted people around me to reach escape velocity and become part of the .01%. But this was definitely an anomaly.

Why? Because they don’t care about the movement. They treat bitcoin just like anything else in their portfolios.

This is why shitcoiners can get so many people into their tokens, they force-pill them. Some really good, scum-bag marketer gains said person’s trust and then they sell them an “opportunity switch” (in layman’s terms, an opportunity switch is: “old doesn’t work, my new way does”).

To that said person, it sounds like an opportunity to make a lot of money. Bitcoin’s pitch doesn’t revolve around money. Well, Plan B’s stock-to-flow model did, but that actually worked, which is my point.

Just because my advice came from a place of morality and righteousness, that didn’t change the underlying dynamics. The only difference between me and that scum-bag marketer is that he had to gain that person’s trust before he could sell them the “opportunity switch.”

If you’re going to keep force-pilling people, use the concept that fiat doesn’t work, but that Bitcoin will. And keep it that simple.

But that is not what this article is about. I wanted to get people into the .01%, to see what I see, to be a part of this new system.

The sad part is, those forced-pilling experiences were the good ones. Now, let’s talk about some experiences as I moved out the trust spectrum (I’m defining the trust spectrum as: spouse/parent to complete stranger).

Moving Across The Trust Spectrum

Bitcoin is such a complex topic. It was tough to even begin the orange-pilling process. Maybe I started with logic: “It’s a decentralized, peer-to-peer network— that no one can stop!”

Be honest. Has that ever worked? I lost them at the third word… “decentralized.”

What about something more vague and meme-like? For example; “Rules, not rulers!” Closer… they paused because it’s catchy.

We have a ton of catchy hooks in Bitcoin. But we are still at .01% adoption.

For instance, the catch phrase above one recently caught my eye when Mark Moss and I were recording with Uncle Marty at his studio in Austin, Texas.

“Alright, so what if we put them both together, logical and catchy,” you might think. “That’ll work…”

Let’s try it:

“It’s digital gold! It’s faster, more scarce, instantly portable, And more divisible. It solves every failure point that gold has. And it’s one tenth of the price!”

(Actually, at the time of this writing, bitcoin represents 3.5% of gold’s market cap, according to Clark Moody.)

It doesn’t matter. Even that didn’t work… They did not join the .01% club just because I told them that.

But why not?!

It was extremely frustrating. No matter what I said, no matter how much sense I made, no matter how much supporting evidence I gave, it didn’t affect any change in behavior for the people around me, even in a world that is screaming my case at them.

They would listen to me talk about Bitcoin. Occasionally, Bitcoin would be in the mainstream news and they’d ask me about it. Some even ventured out and listened to a few recommended podcast episodes. But none of them could explain the Lightning Network. Or how to run a node. Or even describe what a node is. Self custody? Owning a hardware wallet? Hell, they didn’t even know that El Salvador made bitcoin legal tender… I got to the point where I didn’t want to talk to people about Bitcoin. I didn’t see the point anymore.

Here For The Movement

But, I keep coming to the same conclusion: We are here for this movement. We are here to build a parallel economy that will eventually take over the old fiat system.

I’m not a dev, I don’t have a large audience, I don’t have meetings with Jeff Bezos or presidents like Jack Ballers (no, that is not a typo).

One day, I came to this realization.., I’m not the only one struggling transporting people into the new world. Cough, cough… .01%. We are all struggling to unplug people from the matrix. Hence, my motivation behind “An Orange Pill For Bitcoiners.”

This is my first and probably will be the last article I ever write. But I had this “ah ha” moment a few months back. I was at the gym.

By the way, here’s a picture of the water bottle I bring to the gym… Naturally, I have random people come up to me and ask about Bitcoin.

Most conversations there are just some flavor of the examples above. But recently, I met a Bitcoiner, a real Bitcoiner, an “escape velocity” type. He reminded me a lot of the character from “The Big Lebowski,” The Dude. We were talking and talking and he’s telling me about all his friends who are pensioners and successful finance guys, yada yada, but none of them would listen to him either.

I remember the conversation was for a full hour. The reason that I remember that was because the treadmills at my gym have a “cool-down phase” after 60 minutes. As we were talking, it obviously tripped me up when the tread stopped treading in the middle of the multisig setup chat. I kid you not, this is word-for-word what he said at the end of our conversation:

“You know what, man?”

(Sighs, looks up.)

“Man, you are exactly right. I never thought about it like that before.”

Note: He’s retired and has a boat in St. Pete, purchased with bitcoin gains.

A few weeks later, he came up to me and said, “I was thinking about what you said to me, Austin. I realized why I was able to ‘get’ Bitcoin so quickly.”

(His escape velocity moment was back in 2015, to put it into context.)

For The Dude At The Gym, It came down to this: It doesn’t matter if you have the perfect solution to every problem on the planet if that person you are trying to sell the solution to doesn’t know there is a problem to be solved.

Now, I wish it was that easy. If it were, we wouldn’t be at .01%. Remember The Dude At The Gym was already orange pilled. He just didn’t know why he could accept Bitcoin right away. Hang with me to the end, I’m going to attempt to show you why you can’t simply tell a no-coiner the problem.

Think about the “digital gold argument.” Gold is flawed, we know this. We know why it is flawed. We know the problem. But does that make a difference? The market says that doesn’t matter. Bitcoin is a massively better product. Yet it remains at 3.5% of the valuation of gold. This is why even the most eloquent, rational argument still does not move the needle.

Inception

If explaining the problem isn’t the answer and explaining the solution isn’t the answer, then what is the answer?

Inception.

Just like in the movie, you have to plant an idea in their head. You have to make them think they came up with the idea on their own.

From the very beginning of this article, I could have just said “stop screaming the solution to people who don’t know there is a problem.” I could have tweeted that out. Honestly, I might have put a similar thought out before. But would it have mattered? No. Most likely, it would have gotten, at best, 20 likes. Who would have liked it? Why would they like it? They liked it because they were already orange pilled and they could relate to the tweet. Would a no-coiner like that tweet? No. Of those people who liked the tweet, do you think that any of them would have changed their approach because of my tweet? No. If Michael Saylor himself tweeted that out and got 20,000 likes, would it have solved anything? No.

How do you solve this with inception? You make them experience it. They came to the conclusion. Not you. It was their idea, they found the problem. Then, and only then, will they start their journey to escape velocity.

In one sentence: Make the horse thirsty before you lead him to the water.

That’s the punchline.

Now compare that to the idea that you can lead the horse to water, but you can’t make him drink. I’m arguing that you can. You just have to incept him before he sees the solution.

This wasn’t an inception for the masses, it was for the already orange pilled. I’m defining “orange pill” as an expansion of awareness.

Let me explain: I didn’t start off this article by saying “Bitcoiners need to ‘x’ instead of ‘y.’” I told you what I have experienced, my problem, knowing that, most likely, you have had very similar experiences. My story triggered your thoughts on your past attempts. No-coiners hear the problem, they understand the problem; it’s just not their problem.

The goal was to plant the seeds that caused a reaction. What seed did I plant?

First seed: the title, “How To Orange Pill An Orange Piller.”

Why did you click on the article? Because, for some reason, you were curious about orange pilling. Why were you curious about orange pilling? Because you already knew of the problem, but it wasn’t your problem.

This is essential.

Second seed: the story.

I told you my experiences so that you would think about your similar experiences and, therefore, the problem came from your perspective. I showed, rather than told, you.

Third seed: “The Wolf Of Wall Street” scene.

The scene broke down the barrier of internal disbelief. You can sell anything to anyone.

“But you just cherry picked that scenario.”

Fair enough, let’s change it.

Problem: Jordan Belfort challenged his friend, Brad, to, “sell me this pen.” What if Brad responded, “You will need this pen when the check comes.”

That should create urgency, no?

“Yeah, that would work. Right?”

If that was your thought, then it means you still think logic and reason will convince someone to react. The problem is, he told Belfort what his problem will be. You can’t tell someone they have a problem, they have to experience the problem.

In this example, it’s not Belfort’s problem. He doesn’t need to sign anything at that moment, so he actually doesn’t have a problem. So, he doesn’t want the pen. Yes, logically he’ll need to sign the check. But remember, all of the examples from above… logic doesn’t matter.

Inception is the moment they start to believe they have a problem. That’s when their journey to escape velocity begins.

“Alright, wise guy, how do you sell the pen in the check scenario, then?”

You have to wait until the waiter brings the check out. Then, pull the pen out of your pocket. Now they have a problem, now it is time to sell the solution. There was a catalyst.

So there it is, inception That’s how you orange pill a Bitcoiner.

This is a guest post by Austin Herbert. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.