Bitcoin Magazine

Bitcoin Price Will Jump to $143,000 Next Year, Says Citi Bank

The bitcoin price could climb to $143,000 next year as continued adoption through exchange-traded funds and a more accommodating U.S. regulatory backdrop draw new capital into the market, according to a new forecast from Citi.

Analysts at the Wall Street bank set $143,000 as their base-case target for the bitcoin price over the next 12 months. They outlined a bullish scenario that places the price above $189,000, while their bearish case sees the bitcoin price falling to around $78,500 if macroeconomic conditions deteriorate, according to MarketWatch reporting.

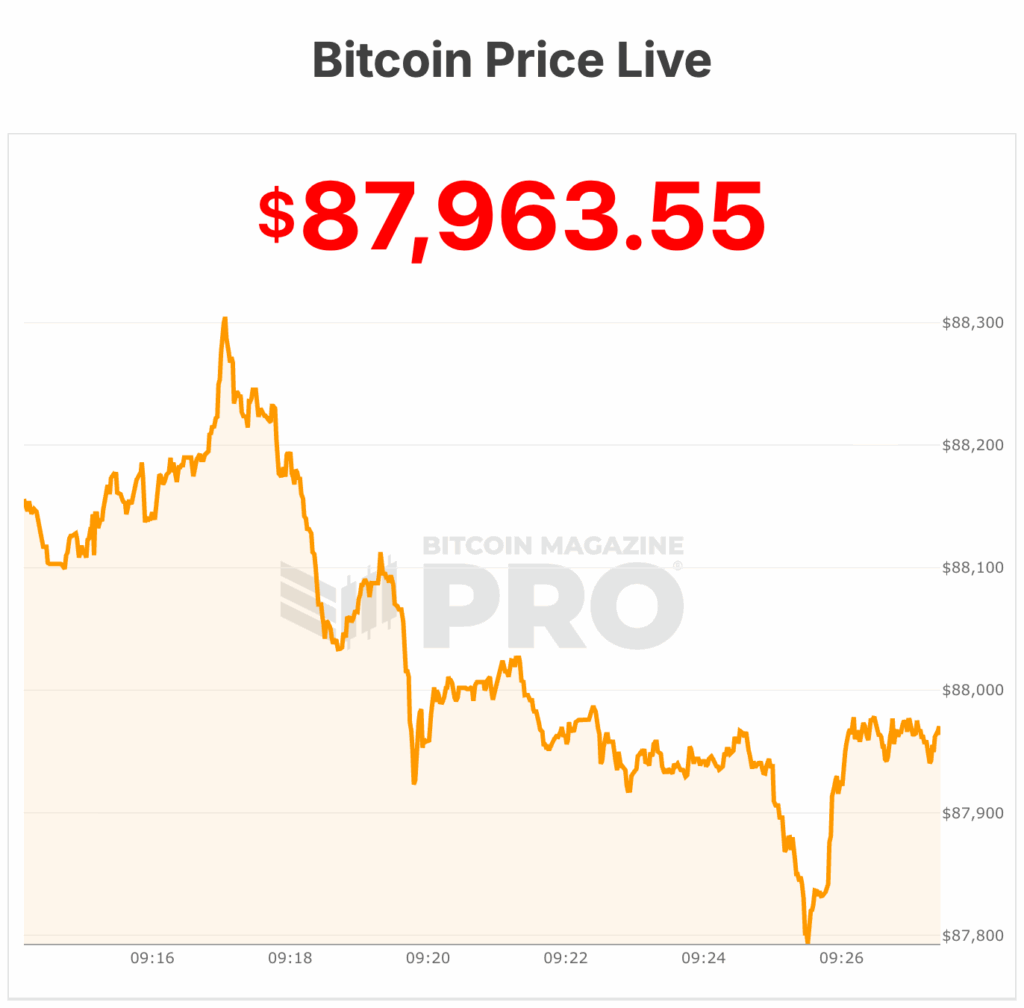

The bitcoin price was trading near $88,000 on Friday, down roughly 30% from its late-October peak. The pullback followed a sharp wave of selling after the rally earlier this year, though Citi noted that outflows from spot bitcoin exchange-traded funds have moderated in recent weeks.

“Our forecasts, in particular for bitcoin, rest on an assumption that investor adoption continues with flows into ETFs of $15 billion boosting token prices,” the analysts wrote. The note was led by Alex Saunders, Citi’s head of global quantitative macro strategy.

Citi also pointed to potential regulatory clarity in the United States as a key driver of future demand. The U.S. Senate is negotiating its own version of the House-passed Clarity Act, legislation that would place bitcoin under the oversight of the Commodity Futures Trading Commission. The analysts said clearer rules could encourage broader institutional participation.

The bank’s bearish scenario assumes recessionary pressures and weaker appetite for risk assets. The bitcoin price fell to multi-month lows in November as concerns over high technology valuations and broader macro risks weighed on markets.

The cryptocurrency shed more than $18,000 that month, marking its largest dollar decline since May 2021 amid heavy investor withdrawals.

Banks are embracing bicoin

Two weeks ago, the Bank of America told its wealth management clients to allocate 1% to 4% of their portfolios to digital assets, signaling a major shift in its approach to Bitcoin exposure.

The move allowed over 15,000 advisers across Merrill, Bank of America Private Bank, and Merrill Edge to proactively recommend crypto to clients.

Last week, PNC Bank launched direct spot bitcoin trading for eligible Private Bank clients, allowing them to buy, hold, and sell bitcoin natively through its own digital banking platform without using an external exchange. The move was powered by Coinbase’s Crypto-as-a-Service infrastructure.

Bitcoin price analysis

Bitcoin’s latest sell-off underscores a market stuck in consolidation, where positive macro catalysts fail to translate into sustained upside.

After briefly testing $89,000 on cooler-than-expected U.S. inflation data, bitcoin slid back toward the $84,000 range, extending a correction now entering its second month. The pattern has become familiar: sharp, data-driven rallies followed by quick retracements as sellers defend resistance below $90,000.

Macro signals offer mixed support. November CPI eased to 2.7% year over year, with core inflation at 2.6%, strengthening the case for eventual Federal Reserve rate cuts in 2026. That backdrop helped spark the intraday rally. Yet rising U.S. unemployment and uneven job growth complicate the outlook, reinforcing expectations that the Fed will move cautiously. Markets appear reluctant to price in aggressive easing.

A key drag remains U.S.-listed spot Bitcoin ETFs, which have shifted from consistent inflows to net redemptions. The outflows remove a stabilizing bid that previously absorbed sell pressure, making breakouts harder to sustain even on positive news.

Technically, the bitcoin price is range-bound. Resistance sits just below $90,000, while support near $84,000 is weakening. A decisive break lower could open a move toward the $72,000–$68,000 zone, where analysts expect stronger demand.

Extreme fear readings suggest potential undervaluation, but near-term momentum still favors sellers.

At the time of writing, the bitcoin price is dancing around the $88,000 level.

This post Bitcoin Price Will Jump to $143,000 Next Year, Says Citi Bank first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

$2.6 trillion Citi says Bitcoin could hit $189,000 in the next 12 months

$2.6 trillion Citi says Bitcoin could hit $189,000 in the next 12 months