Bitcoin Magazine

Bitcoin Price Teeters at $85,000 as Analysts Eye a Crash to $75,000

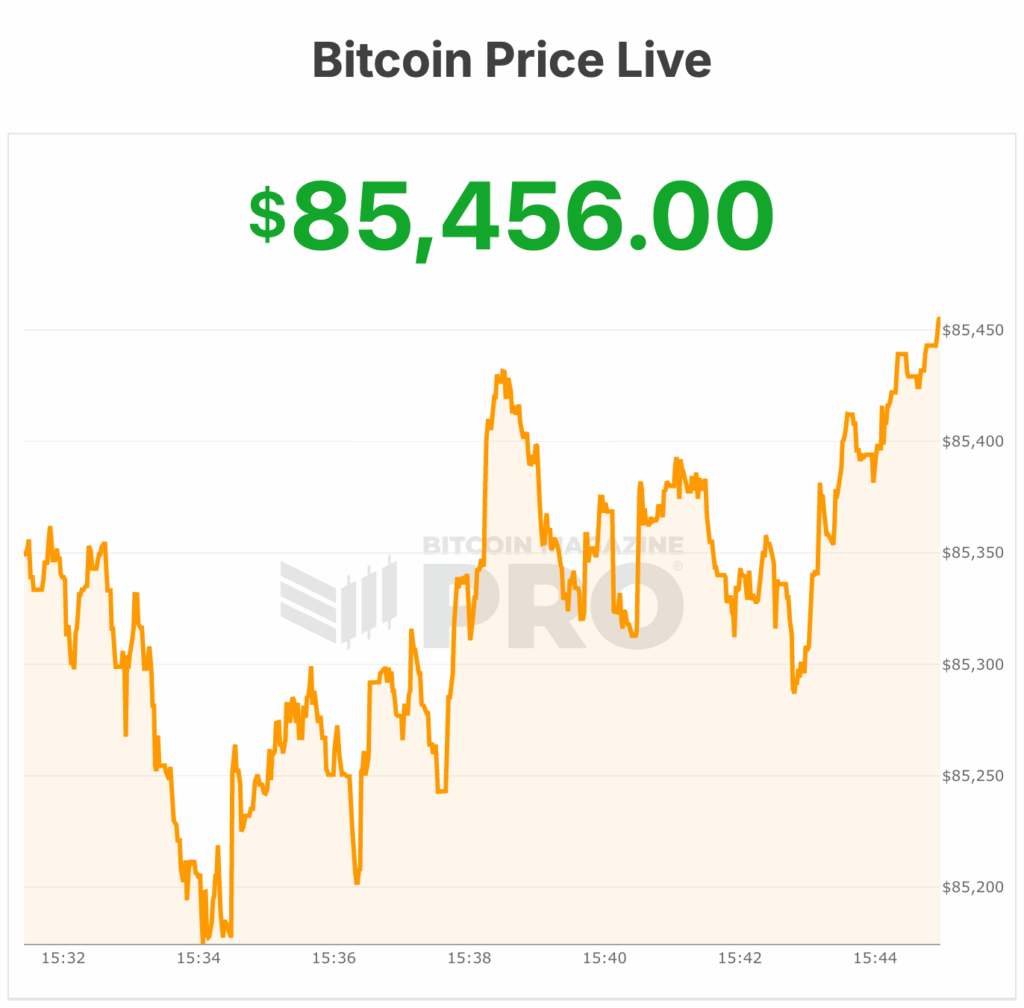

The bitcoin price stumbled into December with fresh volatility, plunging 8% early Monday to the mid-$84,000s before clawing back toward $85,456 at the time of writing.

The world’s largest digital asset is now teetering at a key $85,000 level — a price band analysts say could determine whether the bitcoin price stabilizes or slides toward a deeper test of $75,000 in the weeks ahead.

The pullback extends a two-month downtrend that has erased more than 30% from Bitcoin’s October record highs. Over the past 24 hours, BTC traded between $91,866 and $83,800, with thin liquidity and a surge in forced liquidations accelerating the move.

Bitcoin price key levels: $85,000, $84,000 — then $75,000?

Bitcoin price closed the week and month at $90,385, showing a brief green weekly candle, but bears quickly regained control, pushing the price down toward $87,000.

The close remains below key resistance at $91,400, leaving bulls with an uphill battle. Initial resistance tests at $91,400 and $93,000 failed, with stronger resistance expected between $98,000 and $103,000 if bulls regain momentum, according to Bitcoin Magazine analysts.

On the support side, $84,000 held this past week, though the bounce was weak. Bulls aim to defend the 0.146 Fibonacci level at $87,000, while failure to hold $84,000 could open a path down to $75,000. Further support lies between $72,000 and $69,000, with a deeper test of $57,700 if selling pressure intensifies.

November’s monthly candle closed strongly bearish, taking out prior green closes from April through June.

Although the bitcoin price remains above the 21-month EMA, the close confirmed a bearish MACD cross, signaling sustained subdued momentum over the next two to three months. This aligns with expectations of a potential top in the four-year cycle.

In the short term, the bitcoin price may trade in a range as bears consolidate, while bulls attempt to reclaim $91,400 and $94,000. Overall, the market faces downward pressure, and caution is warranted for bulls seeking a reversal.

Bitcoin’s November candle erased three months of prior gains and cemented a bearish monthly momentum shift. Analysts tracking the four-year cycle say the latest data adds weight to the argument that October likely marked the cycle top.

Federal Reserve, Bitcoin price and corporate bitcoin moves

The Federal Reserve’s upcoming December 9–10 meeting looms large. Markets currently assign an 80%–87% probability of a 25-basis-point rate cut — a move that typically supports risk assets and could potentially lift the bitcoin price.

But if the Fed stands pat, analysts warn the crypto market could see another wave of selling, especially with Bitcoin’s November close confirming a bearish MACD cross on the monthly chart — a historically powerful signal that often precedes multi-month side-ways trading and consolidation or decline.

Bitcoin-linked equities were also rattled Monday. Strategy Inc. (formerly MicroStrategy) announced it created a $1.4 billion reserve to cover at least 21 months of dividend and interest payments, aiming to quash investor fears it might be forced to sell part of its 650,000 BTC stash.

The company also disclosed a new purchase of 130 BTC for $11.7 million. The move stabilized the stock after an early market sell-off of over 12% at times. Currently, $MSTR’s stock is down 4% on the day.

BlackRock, meanwhile, recently increased internal exposure to its IBIT spot Bitcoin ETF, with its Strategic Income Opportunities Portfolio now holding 2.39 million shares worth $155.8 million — up 14% since June.

JPMorgan rolled out a structured note tied to IBIT, offering up to 1.5x upside by 2028.

Earlier this week, the price of gold nearly passed $2,300 an ounce.

At the time of writing, the bitcoin price is $85,456. On October 6, the bitcoin price hit all-time highs above $126,000.

This post Bitcoin Price Teeters at $85,000 as Analysts Eye a Crash to $75,000 first appeared on Bitcoin Magazine and is written by Micah Zimmerman.