What to Know:

- Total crypto cap pulled back again as $BTC failed to reclaim $105K, keeping risk appetite muted.

- Bitcoin Hyper targets Solana-style throughput on Bitcoin via an SVM rollup, fitting into the ‘infra with strength’ narrative.

- Maxi Doge combines meme energy with staking and contests, giving holders something to do between presale and listing.

- XRP offers deep liquidity and fast settlement, making it a go-to large-cap for traders positioning ahead of market rebounds.

The market’s bleeding again, and it’s not just your watchlist.

Total crypto cap is slipping back toward $3.42T as $BTC struggles to rise above $105K and altcoins follow in lockstep. That’s a familiar pattern when macro jitters rise and liquidity thins into the weekend.

For traders watching risk rotations, that matters: bounces are being sold faster, and momentum names are chopping instead of trending.

That pullback isn’t a reason to switch off – it’s a reason to get selective. When the tape looks heavy, early-stage narratives with asymmetric upside often attract fresh attention.

Capital prefers roadmaps over vibes, and the best crypto presales with clear utility can soak up dip demand when listed coins move sideways.

Against that backdrop, three names stand out.

Bitcoin Hyper ($HYPER), a Bitcoin-flavored Layer-2 using Solana tech. Maxi Doge ($MAXI), a meme presale with staking and contests. And XRP ($XRP), a large-cap that still attracts big flows when risk returns.

Here’s why each aligns with today’s market structure, and how you could position if you’re buying the dip.

1. Bitcoin Hyper ($HYPER) – Bitcoin Layer-2 With SVM Speed

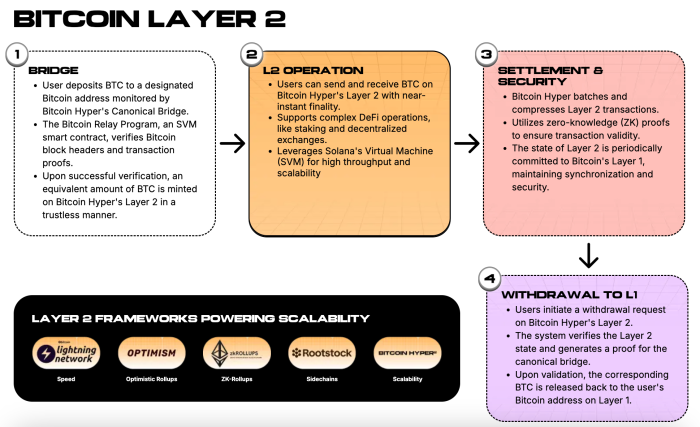

When fees spike and liquidity fragments, execution speed becomes the edge. Bitcoin Hyper ($HYPER) is pitching exactly that: a Bitcoin Layer-2 that ports Solana’s high-throughput Solana Virtual Machine (SVM) into a Bitcoin-secured rollup design.

In plain English, it aims to bring Solana-like parallel execution to $BTC rails, with a canonical bridge, zero-knowledge validity proofs, and periodic settlement to Bitcoin’s Layer-1.

The project’s updates also mention native support for Solana programs – a strong incentive for developers. During risk-off stretches, users still want fast, cheap transactions for trading, farming, and launches.

If Bitcoin Hyper can deliver sub-second confirmations on an SVM runtime while anchoring its state to Bitcoin, it fits neatly into the ‘quality infra’ basket – the kind of narrative that holds relative strength.

The $HYPER presale has already raised over $26.9M so far and you can buy $HYPER for $0.013255 per token, signaling solid traction rather than a passing pump. Plus, you can stake your tokens for 43% APY.

The $HYPER presale has already raised over $26.9M so far and you can buy $HYPER for $0.013255 per token, signaling solid traction rather than a passing pump. Plus, you can stake your tokens for 43% APY.

Check out our step-by-step guide to buying $HYPER to find out how.

Check out our step-by-step guide to buying $HYPER to find out how.

That momentum, combined with a cross-ecosystem pitch (Bitcoin security meets Solana speed), is what draws sticky capital in choppy markets.

If you’re looking for catalysts, Hyper’s presale-to-TGE roadmap includes audits, bridge testing, and ecosystem grants – all areas that will reward early entry if the team stays on track.

Now’s a good time to join the presale while token prices are still discounted. Buy your $HYPER today.

Now’s a good time to join the presale while token prices are still discounted. Buy your $HYPER today.

2. Maxi Doge ($MAXI) – Meme Energy With On-Chain Game Loops

Even the best meme coins tend to fade when the market turns red, unless they give holders a reason to stay.

Maxi Doge ($MAXI) leans into its ‘degens on 1000x’ vibe, but the mechanics have real structure: staking with daily contract distribution, ROI trading contests, and partner events with perps platforms.

That gives holders actual on-chain loops to play while waiting for listings, separating seasonal fads from sticky communities.

On the numbers side, the project has raised over $3.9M in the presale, and you can buy $MAXI for $0.0002675. Plus, there’s talk of the next tier activating soon.

Find out how to buy $MAXI and stake it for 77% APY.

Find out how to buy $MAXI and stake it for 77% APY.

In a market where rotation windows keep shrinking, those staged price steps add urgency without overhyping.

If staking APYs come out high early, remember what that really means: incentive bootstrapping, not a fixed yield curve – but it can still drive TVL and attention as a bridge to listing.

If staking APYs come out high early, remember what that really means: incentive bootstrapping, not a fixed yield curve – but it can still drive TVL and attention as a bridge to listing.

Maxi’s language is proudly degen, yet audits and Web3Toolkit infrastructure help build baseline trust in a meme cycle.

For traders watching rotations, a low unit price plus gamified engagement offers the right kind of optionality into a relief rally.

Join the $MAXI presale before the next tier kicks in.

Join the $MAXI presale before the next tier kicks in.

3. XRP ($XRP) – Liquid Large-Cap for Mean-Reversion Moves

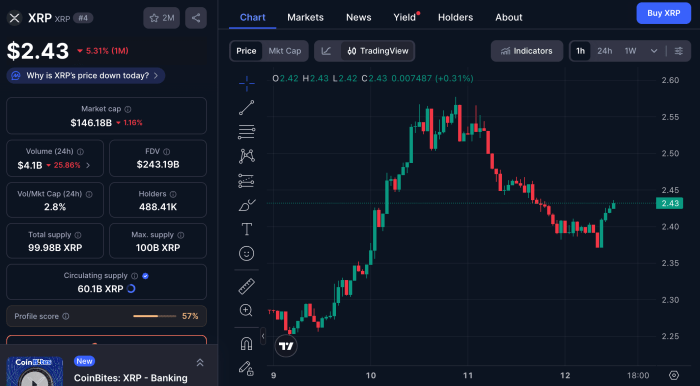

You don’t always need a presale to find a dip value. XRP ($XRP) currently trades at around $2.43 with a market cap of $146B, putting it firmly in the ‘flows matter’ category.

When dominance shifts and perps funding resets, high-liquidity large caps tend to catch bids first, and XRP’s deep books across major exchanges make it a natural mean-reversion candidate.

Under the hood, XRP’s low-latency consensus (a Byzantine agreement model) remains its key differentiator for payments and settlement.

Under the hood, XRP’s low-latency consensus (a Byzantine agreement model) remains its key differentiator for payments and settlement.

That’s why XRP often appears in cross-border and institutional narratives when macro sentiment improves.

For now, momentum looks sideways, but dips in liquid majors like XRP are often the first to bounce if total market cap stabilizes.

Trade $XRP on Binance or other top exchanges if you’re positioning for a rebound.

Trade $XRP on Binance or other top exchanges if you’re positioning for a rebound.

Recap: Market breadth is weak, with total cap slipping and $BTC stuck under nearby resistance. That setup pushes attention toward credible early-stage stories and liquid majors with clean mean-reversion setups.

Bitcoin Hyper, Maxi Doge, and XRP fit neatly into those lanes – a Bitcoin-secured L2 with SVM speed, a meme token that builds engagement, and a top-four asset with deep liquidity.

Disclaimer: This article is for informational purposes and doesn’t constitute financial advice. Always do your own research when investing in crypto.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/news/best-crypto-presales-buy-dip-while-market-stays-down