Bitcoin Magazine

Botanix Labs Unveils stBTC: Bitcoin Yield from Network Fees Hits 34% APR

stBTC Launch: A New Bitcoin Yield Standard

Botanix Labs, a Bitcoin Layer Two with EVM capabilities, recently launched stBTC, a one-to-one backed bitcoin asset that redistributes transaction fees on the network to holders as yield. Users can stake bitcoin and earn additional bitcoin without inflationary token emissions, points programs or mandatory lockups.

Botanix, founded in 2023 at Harvard by Willem Schroé, operates as a Bitcoin Layer Two protocol or sidechain similar to the Liquid Network and Rootstock — but with some novel differences, including the use of more modern scripting tools in Bitcoin, the sharing of network fee revenue with stakeholders and a federation of 16 node operators as its custody foundation. The mainnet has been live for two months and has processed 10 million transactions with 100% uptime for peg-ins and peg-outs, according to Schroé.

Where Does the Yield Come From?

The most important question when it comes to any yield-bearing product is: where does the yield come from? If you can’t get an easy answer to that question, then you are the yield.

As the crypto industry matures from the Ponzi-like era of FTX, BlockFi and Celsius, which contributed to the 2022 crash, new, more stable forms of yield are emerging across the industry. Cash App, for example, reported that it’s earning over 9% APR on Lightning Network fees earlier this year, a yield that can only be earned by facilitating more efficient routing of payments throughout the Bitcoin network.

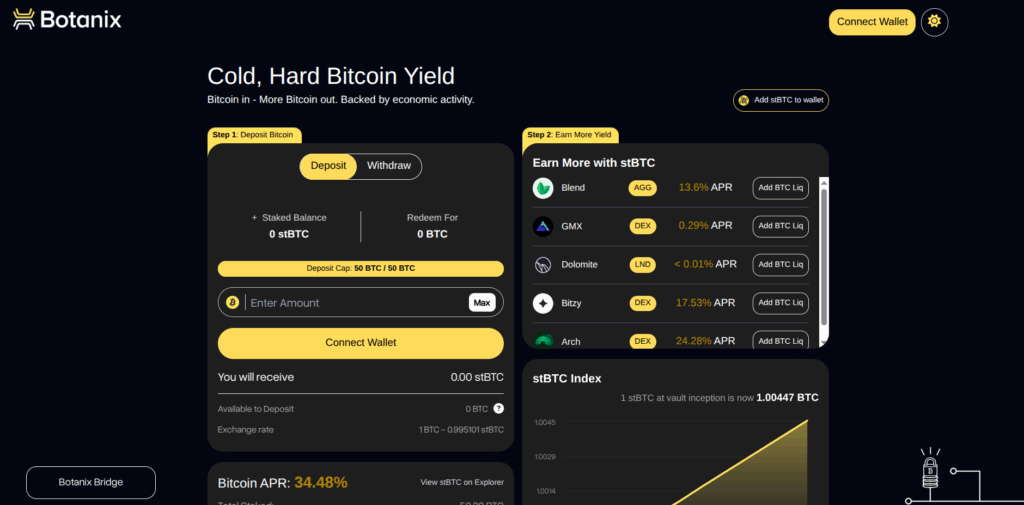

Taking a similar, conservative approach to yield, Botanix has set up its new stBTC token to earn 50% of all transaction fees paid on the Botanix network, paying its stakeholders from the economic success of its ecosystem and integrations across the industry. Today, stBTC boasts a 34% yearly APR, though Schroé explained that this is because of an accumulation of undistributed rewards from its prelaunch; he expects the APR on stBTC to stabilize around 5-6% in the future.

According to Schroé, the stBTC token contract, which is open source and has been audited by Spearbit and Sigma Prime, follows the EIP-4626 standard. The stBTC tokens should be backed one-to-one and visible on-chain. Botanix has a step-by-step guide on how you can verify their proof of reserves.

Users can deposit BTC into the Botanix federation via the Botanix bridge and claim the equivalent amount of Botanix Layer Two bitcoin via an EVM-compatible wallet like Metamask. The terminology gets a bit confusing as the Botanix token has the ticker “BTC,” unlike other somewhat similar products (e.g., WBTC) that wrap bitcoin and bridge it to other blockchains. Nevertheless, the Botanix BTC can move across the crypto EVM-compatible ecosystem as any other similar asset. Once you have Botanix BTC, you can stake it at the Botanix yield page, which converts it into stBTC and starts earning that sweet yield. You can also buy stBTC with BTC at bitzy.app/swap.

Staking adds proof-of-stake style security to the Botanix network and is likely to unlock other benefits in the future, as well as provide users with the power to vote on important network events.

Get Paid to Take out a Loan??

The invention of a yield-bearing BTC-denominated asset should not be understated. Most of tradfi is chasing after Saylor’s stock (NASDAQ: MSTR) because it effectively produces yield. Having assets “work” for you is a cornerstone of traditional finance and the investment models there derived. A great example of what such a financial product unlocks is the ability to take out a loan against your bitcoin and have your bitcoin help you pay off the loan — similar to how you might take out a mortgage on a rental home.

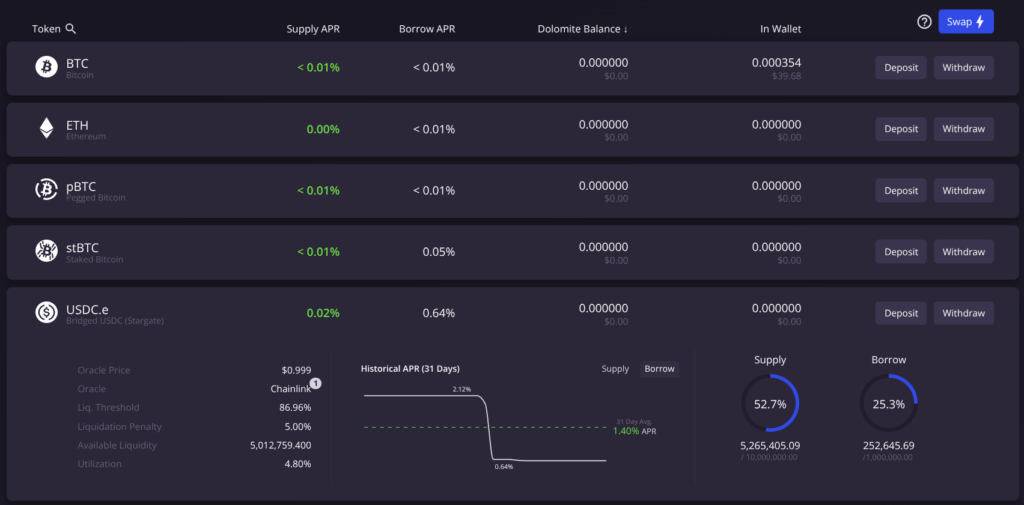

For example, users can currently take out USDC loans against their stBTC for as low as 0.6% APR via the Stargate defi protocol. You can test this out by logging into Dolomite with your Botanix-connected Metamask wallet, for example, and see USDC.e with a free-floating average APR of under 1%. Meaning your stBTC could make the USDC.e interest payments and still grow your total stBTC balance. Keep in mind this appears to be a free-floating rather than fixed interest rate, so make sure to understand the dynamics of the loan before making a financial decision.

According to a recent Botanix press release, there are no lock times, and users can swap out and withdraw their funds at any time, settling their trades.

The User Experience

The user experience and design of the Botanix network is very similar to that of other EVM chains and defi protocols, with crypto-to-crypto swap boxes, using the same terminology many crypto users are familiar with — such as bridges and yield. The fact that the protocol allows users to put bitcoin to work without putting the underlying asset at great risk is a major achievement, although the product is still in its early stages.

The Yield and Bridge website designs feel clunky compared to the sleek design of other defi portals, such as Uniswap, which most users are likely familiar with. And it may be confusing for users at first as they wrap their heads around the tickers. The Botanix BTC should probably follow convention and not copy the base asset ticker, opting for something like bBTC instead, as Liquid did with L-BTC and Rootstock with rBTC.

Ultimately, Botanix is quickly bringing Bitcoin into the world of programmable, decentralized finance and might just succeed at bridging it with the creator crypto ecosystem. Its product design will likely improve just as fast, perhaps taking us a step closer to having a Bitcoin bank in cyberspace, with all the financial services the public expects.

This post Botanix Labs Unveils stBTC: Bitcoin Yield from Network Fees Hits 34% APR first appeared on Bitcoin Magazine and is written by Juan Galt.