Bitcoin Magazine

Will Bitcoin Price Defy Diminishing Returns This Cycle?

Every bitcoin price bull market to date has followed a familiar pattern of explosive upside followed by sharp drawdowns, with each cycle delivering lower percentage gains than the last. This phenomenon, known as diminishing returns, has become one of the most persistent narratives in Bitcoin. The question now is whether this cycle will follow the same trajectory or if the maturation of Bitcoin as an asset class could bend the pattern.

Bitcoin Price and Diminishing Returns

So far this cycle, we have witnessed approximately 630% BTC Growth Since Cycle Low to the most recent all-time high. That compares to more than 2,000% in the previous bull market. To match the last cycle’s magnitude, Bitcoin would need to reach around $327,000, a stretch that looks increasingly unlikely.

Evolving Bitcoin Price Dynamics

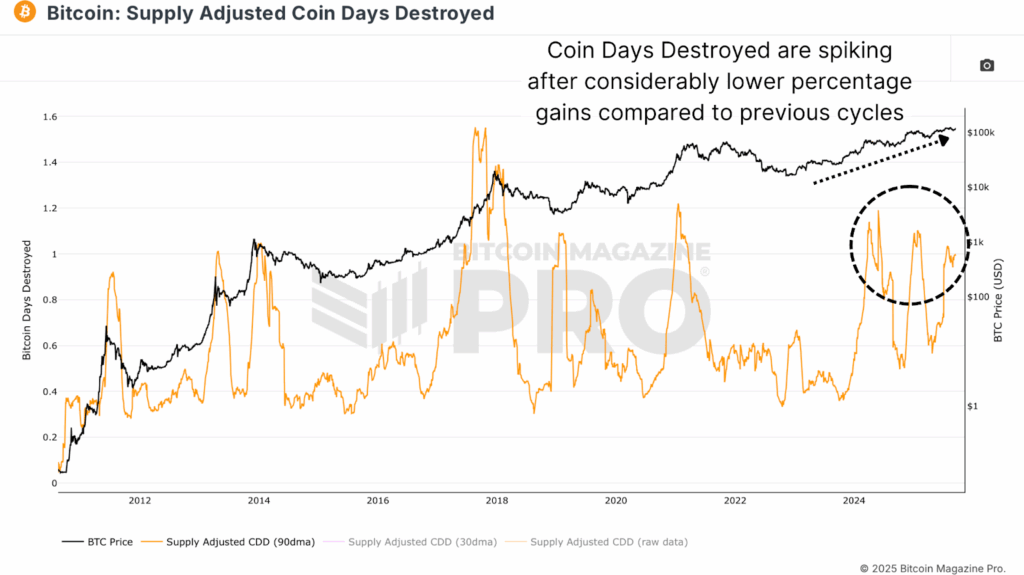

One reason for the less explosive upside gains can be seen in the Supply Adjusted Coin Days Destroyed (CDD) metric, which tracks the velocity of older coins moving on-chain. In past cycles, such as the 2021 bull market, long-term holders tended to sell after Bitcoin had already appreciated ~4x from its local lows. However, in this cycle, similar levels of profit-taking have occurred after just 2x moves. More recently, spikes in CDD have been triggered by even smaller price increases of 30–50%. This reflects a maturing investor base: long-term holders are more willing to realize gains earlier, which dampens parabolic advances and smooths out the market structure.

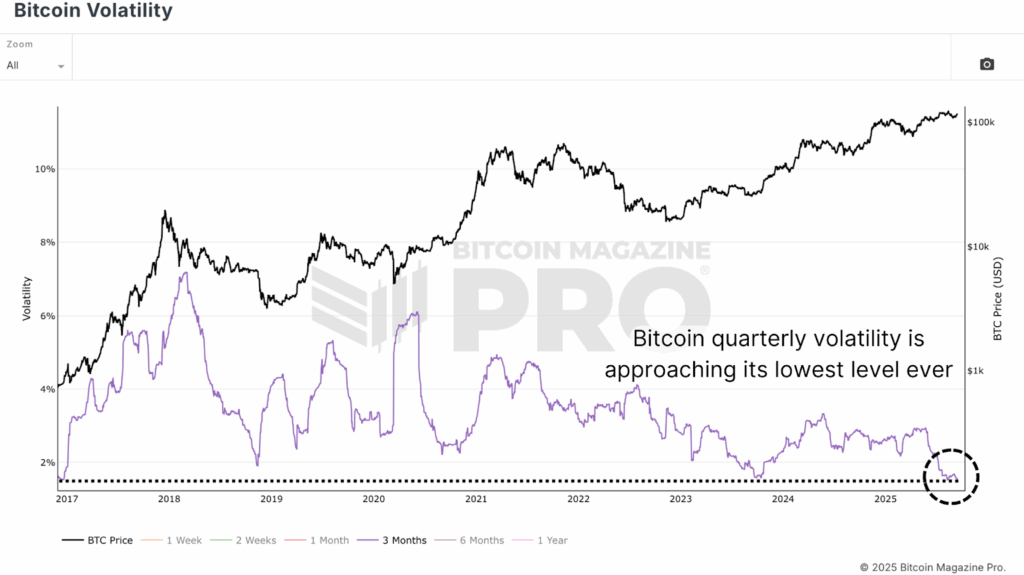

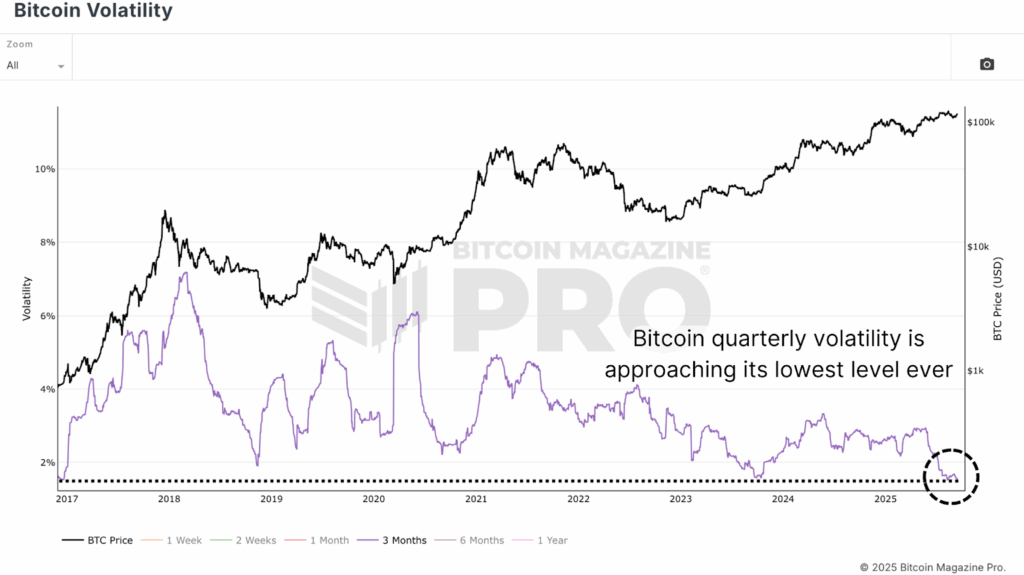

Another factor is Bitcoin Volatility. Bitcoin’s quarterly volatility has trended steadily lower. While this reduces the odds of extreme blow-off tops, it also supports a healthier long-term investment profile. Lower volatility means the capital inflows required to move price grow larger, but it also makes Bitcoin more attractive to institutions seeking risk-adjusted exposure.

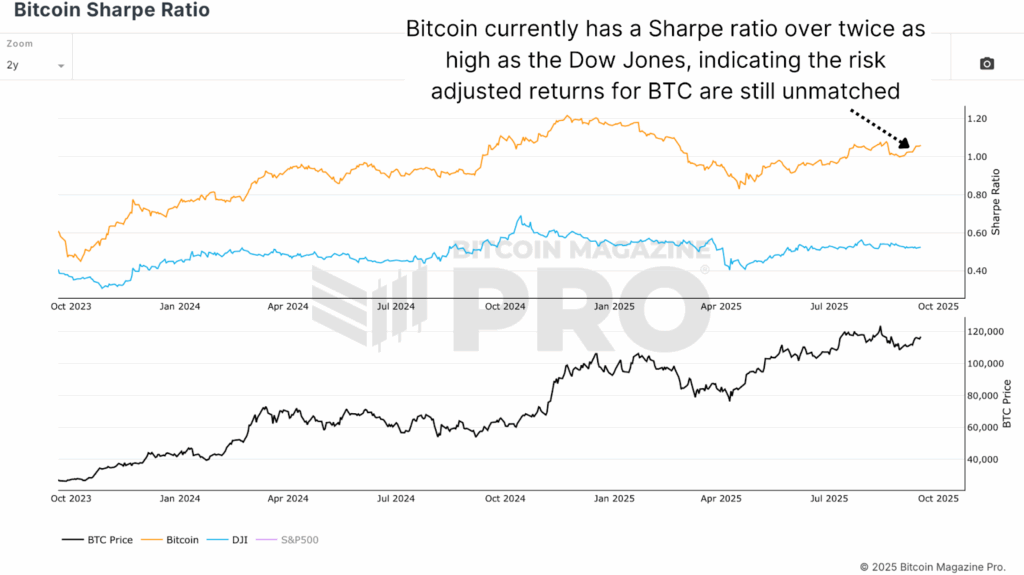

This shows up in the Bitcoin Sharpe Ratio, where Bitcoin currently scores more than double that of the Dow Jones Industrial Average. In other words, Bitcoin still offers superior returns relative to its risk, even as the market stabilizes.

Bitcoin Price and the Golden Ratio

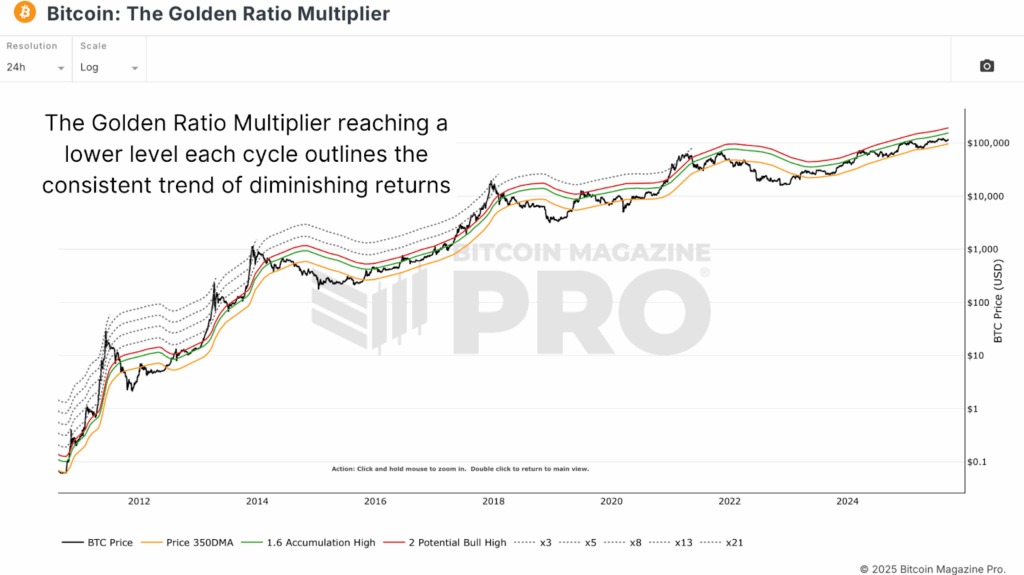

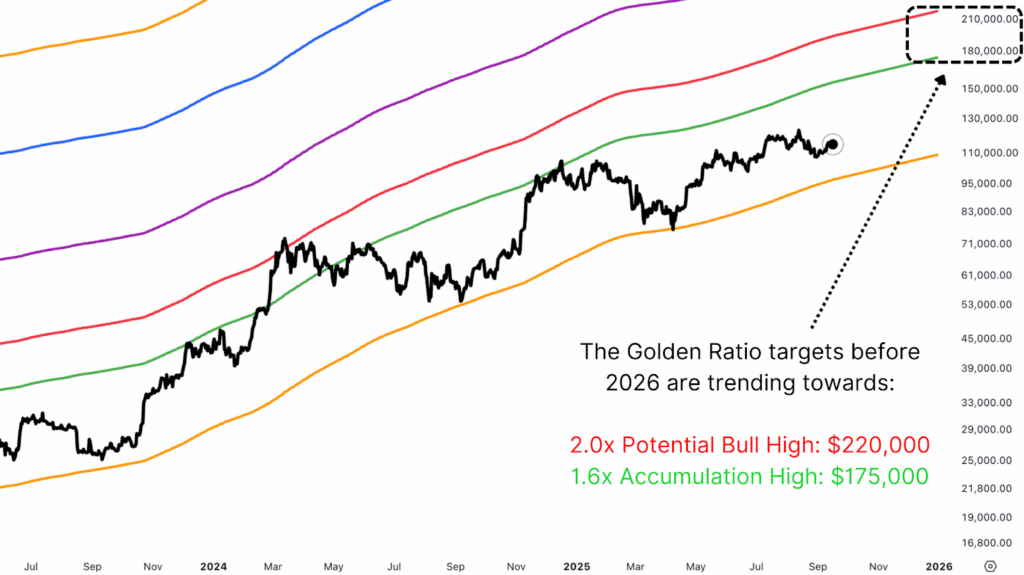

From a technical perspective, The Golden Ratio Multiplier provides a framework for projecting diminishing returns. Each cycle top has aligned with progressively lower Fibonacci multiples of the 350-day moving average. In 2013, price reached the 21x band. For the 2017 top, it reached the 5x band, and in 2021, the 3x band. This cycle, Bitcoin has so far tagged the 2x and 1.6x bands, but a push back toward the 2x levels remains possible.

Projecting these 1.6x and 2x levels forward, based on their current trajectory, suggests a target between $175,000 and $220,000 before the end of the year. Of course, the data won’t play out exactly like this, as we would see the 350DMA move more exponentially to the upside as we closed in on these upper targets. The point is these levels are ever-changing and constantly pointing towards higher targets as the bull cycle progresses.

Bitcoin Price in a New Era

Diminishing returns don’t reduce Bitcoin’s attractiveness; if anything, they enhance it for institutions. Less violent drawdowns, potentially lengthening cycles, and stronger risk-adjusted performance all contribute to making Bitcoin a more investable asset. However, even as Bitcoin matures, its upside remains extraordinary compared to traditional markets. The days of 2,000%+ cycles may be behind us, but the era of Bitcoin as a mainstream, institutionally held asset is only just beginning, and will likely still provide unmatched returns in the coming years.

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Will Bitcoin Price Defy Diminishing Returns This Cycle? first appeared on Bitcoin Magazine and is written by Matt Crosby.