Bitcoin Magazine

Saylor’s Bitcoin Treasury Strategy Inspires Global Corporations, But Not All See Premiums

Bitcoin treasury strategies are being adopted by corporations worldwide. Following the example of Michael Saylor, the founder of Strategy (formerly MicroStrategy), the company with the largest known stack of Bitcoin in the world, others have copied his playbook and are attempting to follow suit; some are even trying to catch up.

Recently, Bitcoin Treasuries announced that over 1 million bitcoin are now held by publicly traded companies, representing more than 5% of the total Bitcoin supply, marking a historic shift for a novel asset that, until recently, was primarily owned by enthusiasts.

The Bitcoin Treasury playbook that inspired many of these corporations was pioneered by Saylor and developed as a response to the “melting icecube” problem in traditional finance. Strategy, a lucrative cashflow-rich ‘business logic’ software company, was struggling to grow or keep up with inflation at the time, while competing with giants like Microsoft, which fought for every inch of the market with massive resources. The company’s cash reserves were thus ‘melting’ under inflation, a situation exacerbated at the time by the COVID-19 pandemic and the resulting monetary policy.

In an interview with Bitcoin Magazine, George Mekhail, Managing Director of Bitcoin for Corporations, explained the playbook, noting it “goes back to Saylor’s origin story: he looked at his balance sheet, saw that his cash balance was eroding, and couldn’t keep up with inflation just by putting his money in bonds.”

After reviewing his options, including gold, Saylor decided that a bitcoin treasury strategy was the only way out that did not involve selling the company and retiring. On August 11, 2020, Strategy announced that the company would transition to a bitcoin standard.

Strategy “generously announced the company would buy out any shareholders at a premium if they did not like the [bitcoin] strategy. Shortly after, on December 7th, the company announced a proposed private offering of $400 million of convertible senior notes. This offering was oversubscribed and completed for a total of $650 million of senior notes due in 2025, with a 0.750% coupon. With this move, MicroStrategy borrowed over half a billion dollars at a negative real interest rate to buy the hardest money the world has ever known.” Dylan Leclair wrote in 2021. Leclair today leads a similar strategy for Metaplanet, Japan’s equivalent of Strategy in the U.S.

Fast forward to 2025, and “Non-endemic companies are coming to the same realization.” Mekhail said that of the many corporations not otherwise involved with the Bitcoin industry, many are now adopting Bitcoin into their treasuries in various ways.

The Problem

While the Bitcoin Treasury strategy has so far borne undeniable benefits to some, not all corporations have seen the same results. Some are even trading at a discount to their bitcoin holdings. Alex Wals -Membership Experience Lead at Bitcoin For Corporations told Bitcoin Magazine that “It seems like many of the companies in the Bitcoin-sphere, seeing rapid market cap growth, are holding companies riding bull market hype. In contrast, companies like Fold and Murano, which focus on building active business operations and generating real revenue, are not receiving nearly as much attention. This is despite potentially being better positioned long term, especially in a bear market.”

Take, for example, a company like Fold Holdings Inc. (NASDAQ: FLD), which recently surprised the market with a massive bitcoin treasury of 1492 BTC, placing it as the 35th biggest company when measured by total BTC holdings. Fold is a U.S. Bitcoin-centric financial services company with high-tech capabilities, offering rewards, payments, and savings options to American users through an innovative Fold app and Fold prepaid debit card. The company had been quietly accumulating bitcoin and developing its business since 2014, until its recent IPO earlier this year through a merger with FTAC Emerald Acquisition Corp. Despite its prominence as a unique and successful Bitcoin company, its Market Net Asset Value (MNAV) is currently under 1, at 0.916. In other words, the company’s public stock is trading at a lower value than its total bitcoin holdings.

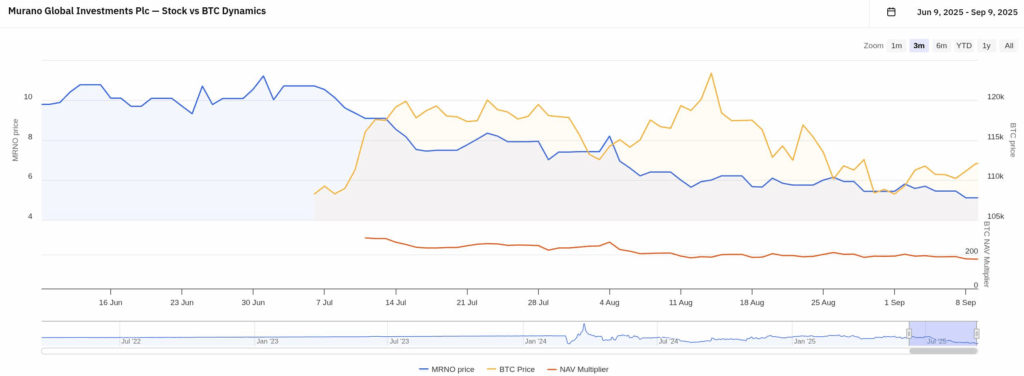

Another interesting example is Murano Global Investments PLC (NASDAQ: MRNO), founded in 1996 and headquartered in London with operations centered in Mexico, is a real estate company specializing in the development, ownership, and investment in luxury hotel, resort, and commercial properties across the country, including high-profile assets like the Hyatt-operated Andaz and Vivid Grand Island Cancun resorts, the Accor-managed Mondrian Hotel in Mexico City, and projects in Baja California that emphasize tourism-driven hospitality and urban developments to capitalize on Mexico’s robust travel sector.

Over its nearly three decades, Murano has achieved notable success, reporting annual revenue of approximately 730 million MXN (around $36.5 million USD) in its latest fiscal year, with a 155% year-over-year growth. However, it faced challenges, including a net loss of 3.57 billion MXN, amid expanding operations.

In July 2025, the company announced a strategic pivot to build a Bitcoin treasury, starting with the purchase of 21 BTC valued at over $2.1 million, funded through operating cash flows and a $500 million Standby Equity Purchase Agreement (SEPA) with Yorkville Advisors, while joining the Bitcoin for Corporations initiative as a Chairman’s Circle Member to accelerate corporate adoption. Looking ahead, Murano plans to allocate a significant portion of SEPA proceeds and real estate divestitures—like sale-leaseback transactions on assets such as Grand Island Cancun condominiums—toward accumulating a robust bitcoin stack, targeting a $10 billion treasury within five years through ongoing purchases from operating profits, integration of BTC payments and rewards in its hotels, and installation of crypto ATMs to enhance guest experiences and hedge against inflation.

Today, the company has an enterprise value of nearly one billion dollars, while its stock’s market capitalization is less than half of that at 432 million, according to Yahoo Finance. The company’s stock has also suffered a significant correction since the bitcoin strategy announcement, dropping from $10.41 to $5.45 per share, suggesting investors disagree with or perhaps misunderstand the company’s pivot to Bitcoin.

Two Types Of Bitcoin Treasury Companies

The variation in results seen across the many Bitcoin treasury companies emerging so far has lead analysts to develop a framework that categorizes these companies into two essential types, ‘pure play’ accretive companies that follow the Strategy model of maximum bitcoin accumulation, and non-accretive sometimes non-endemic companies that add bitcoin to their balance sheet as a store of value, but optimize for other business metrics outside of the Bitcoin industry.

On the two broad categories of Bitcoin treasury companies, Mekhail explained that “Accretive companies like MicroStrategy and MetaPlanet get the most attention because they have the most volatility in their stock and therefore they have the most speculation in the retail markets, especially.” Adding that “If you’re not accretive, these companies are still very interesting. Companies like Fold, which quietly IPOed… they’re just not announcing a new Bitcoin buy every week because it’s not a core part of their strategy.”

Mekhail dug deeper into market sentiment and how investors appear to be analysing these companies saying that “The market really isn’t as interested in how much Bitcoin you have on your balance sheet. They are more interested in things like these new metrics that we’re seeing” referring to MNAV which compares total value of bitcoin holdings versus stock market capitalization, bitcoin per share which measures how much bitcoin each share purchase should represent, or bitcoin related yield.

Chaitayan Jain, Bitcoin Strategy Manager at Strategy, reinforced this idea in an interview with Bitcoin Magazine, saying that “If the company is not valued at a significant premium or even a reasonable premium to its MNAV, it is broadly down to the belief from most of the shareholders that they may not be able to outperform spot bitcoin. Be it because the underlying operating business is not generating cash flows that are being swept into Bitcoin, or the company doesn’t have the ability to access the capital markets at high velocity to raise equity or debt and buy more bitcoin to increase bitcoin per share.”

Investor Education and Market Opportunities

Companies seeking a more robust response from the market after integrating bitcoin into their treasury strategies will likely need to engage in targeted and ongoing investor education. They will have to clearly articulate their Bitcoin thesis and outline their plan to acquire more of it, particularly how they will leverage the benefits of being a cash flow-generating corporation, which can afford cheap access to credit. Jain made this very clear, noting that “It comes down to two simple ideas: access to credit in public markets, cheap credit, intelligent credit, and long-dated credit. And the second is the robustness of the operating business and the robustness of the cash flows and bitcoin not being a drag, not becoming a distraction for the company.”

Investors, on the other hand, may benefit from taking a closer look at some of these companies, which often have very long-term views on Bitcoin, presenting investors with a significant opportunity. Mekhail, speaking from his experience talking to corporations about their Bitcoin strategy, noted that “Once you understand Bitcoin, I think your expectations really are fairly long term. And you have this low time preference where you understand that this is a race. This is the digital gold rush, and it is all about speed. So expectations from companies adopting Bitcoin treasury strategies are fairly muted in that they’re here for the long haul.”

Bitcoin Magazine is wholly owned by BTC Inc., which operates Bitcoin For Corporations, a platform focused on corporate adoption of Bitcoin. BFChas a variety of relationships with Bitcoin businesses, including some of those mentioned in this article.

This post Saylor’s Bitcoin Treasury Strategy Inspires Global Corporations, But Not All See Premiums first appeared on Bitcoin Magazine and is written by Juan Galt.