Bitcoin Magazine

Lightning Is Misunderstood

The Lightning Network is one of the most exciting and innovative technologies built on Bitcoin, but it’s also one of the most misunderstood. From its early days with grassroots efforts like “PLEBNET,” to ambitious visions of Lightning Applications (LApps), and the idea of earning passive yield as a routing node operator, enthusiasm around Lightning has often outpaced its practical realities.

Many Bitcoiners expected Lightning to be a seamless, plug-and-play extension of the Bitcoin network — just as sovereign, decentralized, and accessible as running a full Bitcoin node. But the reality is more complex. Setting up and maintaining a well-connected Lightning node involves technical skills and capital requirements that most users aren’t prepared to manage. This isn’t a failure: It’s simply a reflection of Lightning’s design.

As a result of these barriers, many users have turned to custodial solutions to access Lightning’s benefits. Custodial wallets and neobanks like Strike, Blink, Wallet of Satoshi, Cash App and others offer features such as Lightning URLs, instant low-fee transactions, and the kind of reliability and user experience people expect from full-featured, banking-style apps. To some, this reliance on custodians feels like a compromise, and in a way, it is. But more importantly, it reveals something often overlooked: Running Lightning infrastructure isn’t meant for everyone.

Here’s the controversial part: That’s perfectly okay.

Lightning’s critics, both within the Bitcoin community and among altcoin promoters, often frame these trade-offs as proof that Lightning has failed, suggesting it should be replaced with something else entirely. But that view misses the mark. Rather than seeing these limitations as fatal flaws, it’s far more accurate and productive to understand the Lightning Network for what it truly is: enterprise-grade infrastructure.

In this context, “enterprise-grade” means robust, scalable, and dependable enough to power real-time, low-fee payments for mission-critical services. It’s not something every casual user will host themselves. Lightning is built for professional operators — Bitcoin exchanges, payment processors, wallet developers, and technically capable community projects. For them, Lightning isn’t a compromise, it is a competitive advantage.

Moreover, the Lightning Network complements Bitcoin in many important ways and is becoming increasingly interoperable with adjacent technologies such as ecash mints and other layer-2 solutions. It functions as a global, open source, and permissionless financial infrastructure that any serious operator, anywhere in the world, can tap into. In essence, the Lightning Network is evolving into the interoperable glue connecting external systems to the Bitcoin blockchain.

Not everyone will run a Lightning node, and that’s okay. This reality doesn’t diminish Lightning’s significance in Bitcoin’s scaling roadmap. On the contrary, Lightning is a foundational layer that enables a wide range of tools and services. Far from being a centralizing force, it actually enhances decentralization by opening the door to permissionless payments anywhere in the world, creating new types of economic actors that weren’t previously possible.

A great example of this is the Kenyan Bitcoin payments app Tando. This app allows users to spend bitcoin at any merchant or service that accepts M-PESA using the Lightning Network.

M-PESA is a mobile money platform launched by Safaricom in Kenya that allows users to send, receive, and store money via mobile phones without needing a traditional bank account. As of 2024, it serves over 34 million users in Kenya, processes more than 30 billion transactions annually, and accounts for nearly 60% of the country’s GDP.

Thanks to Lightning, Tando’s creators can build a seamless, programmatic payment experience that interoperates directly with the M-PESA system, dramatically improving liquidity access for Bitcoin users in Kenya. Because everyone and their grandma in Kenya accepts M-PESA, now with Tando, anyone can spend bitcoin anywhere in Kenya — even in the Maasai Mara.

Without Lightning, on-chain Bitcoin payments would simply be too slow to offer a practical experience for everyday M-PESA transactions. Transaction confirmation times on-chain aren’t suited to real-time payments, especially in fast-paced retail settings. But by building a Lightning payment gateway that connects directly to M-PESA wallets, Tando has transformed the payment landscape for Bitcoin users in Kenya. Tando is proof that Lightning unlocks real-world use cases for builders without needing to ask for permission to build. The fact that Lightning enables this is amazing.

Another excellent example of the edge Lightning gives businesses can be seen by comparing two global neobanks: PayPal and Strike.

PayPal, the original internet payment company, launched in 1998 and took over 17 years to expand to more than 200 countries. In contrast, Strike, a far more niche application built on Lightning and launched in 2020, has already rolled out to over 100 countries in just five years, reaching markets across Africa, Latin America, Europe, and the Asia-Pacific. Strike’s global expansion not only rivals PayPal’s in scope but also dramatically outpaces it in speed and ease, highlighting the unique advantages of building on modern, borderless infrastructure like the Lightning Network.

Strike CEO Jack Mallers and his team largely bypassed working directly with banks, instead choosing to partner with Bitcoin exchanges around the world that already had established local banking relationships in the markets they serve. These partners use the Lightning Network to send value instantly across borders. When a user wants to convert their Strike app balance into local currency, the partner facilitates the exchange on the back end. This strategy allowed Strike to launch a global payments service powered by universally accepted, instant Lightning payments faster than ever before.

Strike leveraged Bitcoin and Lightning’s borderless capabilities to build a truly global network, combining this technical edge with strong business development to secure fiat conversion partnerships. While legacy players remain bottlenecked by traditional banking rails, Strike uses Lightning to instantly move value anywhere on the planet.

Not only does the Lightning Network open new doors for businesses, but it also enables permissionless payments both large and small within other open protocols. A premier example of this is Nostr, a decentralized protocol designed to support social media experiences and much more.

In a post on X, Jack Dorsey stated, “The greatest at-scale example of Bitcoin as everyday payments are Zaps on Nostr.” In a 2023 interview with Politico, he discusses his grounded optimism for both Nostr and Lightning-enabled zaps:

“He also argued that the user experience on NOSTR had already surpassed that of Twitter, citing ‘Zaps’ a feature that lets users tip each other in Bitcoin — part of a vision in which information and money flow together around the internet without obstruction.”

Zaps on Nostr evolved from a basic Lightning invoice system to a seamless micropayment feature largely thanks to the efforts of William Casarin, known as jb55. Initially, users had to attach Bitcoin payment requests to notes manually. But in early 2023, Casarin, the creator of the Damus client, authored NIP-57, introducing event types 9734 (zap request) and 9735 (zap receipt), which formalized zaps as instant, Lightning-powered bitcoin transfers.

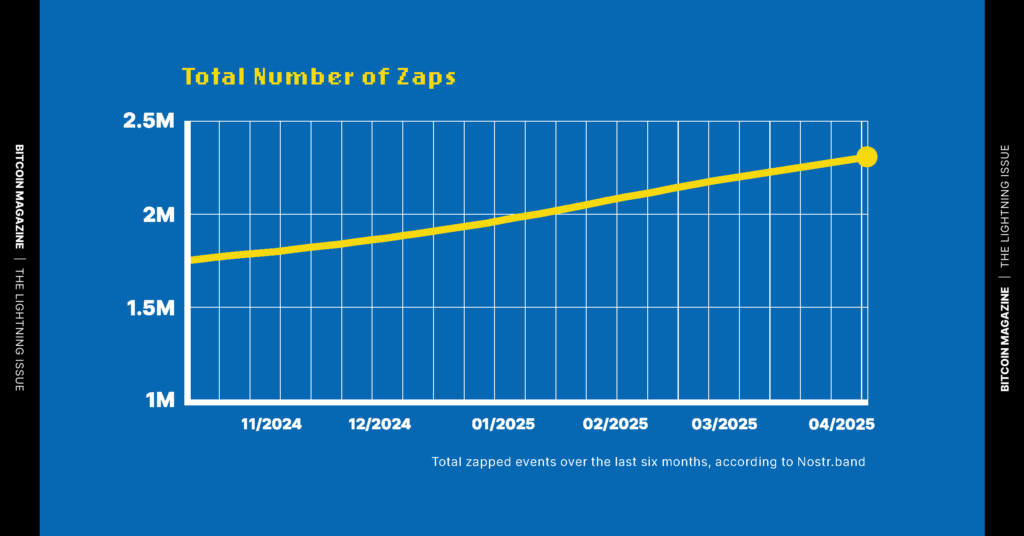

Building on Nostr’s early Lightning integration, Casarin’s vision helped transform zaps into a native, user-friendly feature across every prominent Nostr client. The introduction of zaps sparked a surge in Nostr adoption: By June 2023, Nostr users had sent over 1 million zaps across a network with roughly half a million users.

Requiring only a Lightning wallet and a Nostr client, zaps eliminated intermediaries and empowered creators to receive direct, low-fee payments for their posts, streams, or other content. This seamless integration of social interaction and Bitcoin’s Lightning economy has redefined the way value is exchanged online, one small or large transaction at a time.

Even though casual users typically won’t manage their own always-online Lightning infrastructure, the network empowers small teams and skilled individuals to offer financial services that once required a bank. This dynamic is rapidly evolving into a broader trend, one that’s driving Lightning toward greater decentralization through community-based infrastructure.

Imagine if every local Bitcoin meetup had someone running a Lightning node for their community. This could provide a neighborhood or region with an approachable, trusted operator, almost like modern-day credit unions. In such a model, Lightning infrastructure wouldn’t be dominated solely by large enterprise nodes. Instead, trust and routing would be distributed among smaller, localized actors with different incentives, builders who prioritize resilience, privacy, and accessibility over scale or profit.

This dynamic is also already happening today! I’ve personally seen this in action through initiatives like Praia Bitcoin in Brazil and La Crypta in Argentina. Both projects pair grassroots communities with locally managed payment systems built on Lightning. Together, Bitcoin and the Lightning Network are enabling a grassroots alternative to traditional banking — and it’s a beautiful thing.

Lastly, I would be remiss not to mention the many incredible projects like Zeus, Phoenix, Breez, Aqua, Muun, and other Lightning wallets that are innovating to create diverse user experiences. These teams are building feature-rich applications without sacrificing user custody while navigating the still-wild frontier of Bitcoin payments in 2025. In a world where Bitcoin and Lightning remain niche, and speculative behavior is as rampant as ever, delivering excellent noncustodial payment experiences is no small feat. While not perfect, many of these projects are doing exactly that. The fact that so many builders are offering such a wide range of ways to interact with Lightning gives consumers real choice and ultimately reinforces my core argument.

The Lightning Network was never meant to serve every user in every way and that’s precisely why it works. It’s not failing because casual users may prefer custodial wallets. It’s succeeding because developers, businesses, and organizers are using it to solve real-world problems without needing permission.

What Lightning offers isn’t universal simplicity, it’s focused, high-leverage software. It’s infrastructure that bridges Bitcoin to people, and delivers innovative solutions to the edges of the global economy. When we stop expecting Lightning to be something it can’t be, we begin to understand its true purpose: a dynamic, foundational layer for those building the future of financial freedom.

Don’t miss your chance to own The Lightning Issue — featuring an exclusive interview with Lightning co-creator Tadge Dryja. It dives deep into Bitcoin’s most powerful scaling layer. Limited run. Only available while supplies last.

This piece is an article featured in the latest Print edition of Bitcoin Magazine, The Lightning Issue. We’re sharing it here to show the ideas explored throughout the full issue.

This post Lightning Is Misunderstood first appeared on Bitcoin Magazine and is written by Christian Keroles.