Bitcoin Magazine

Bitcoin Bears Dominate: Failure to Break $71,800 Keeps Downside Risk Alive

Bitcoin Price Weekly Outlook

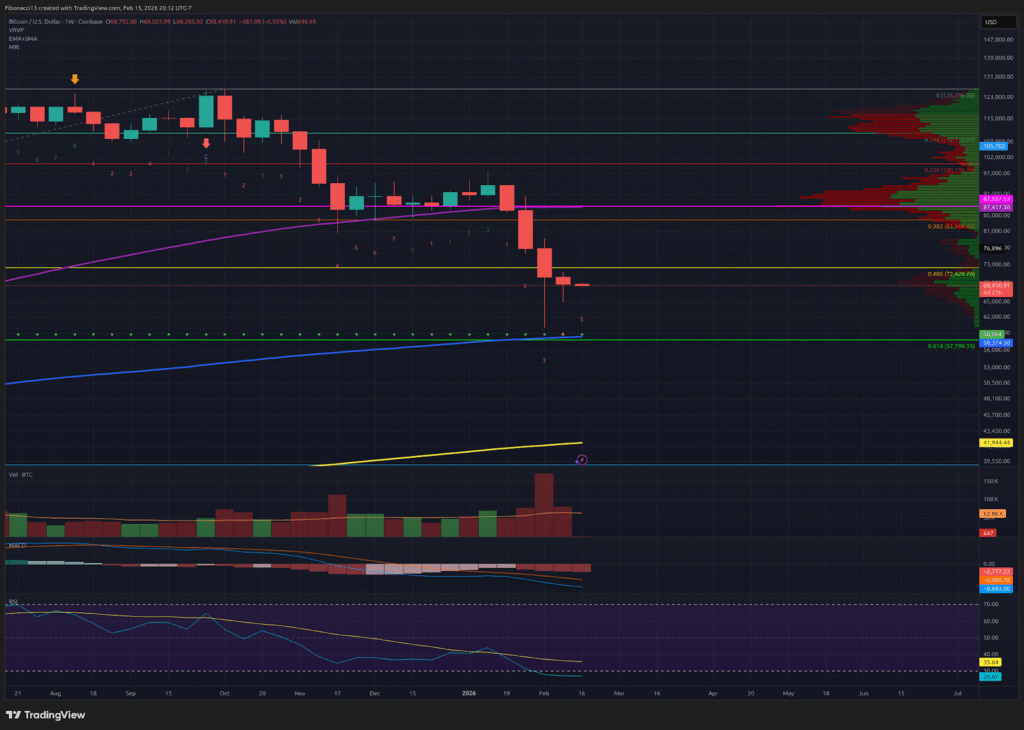

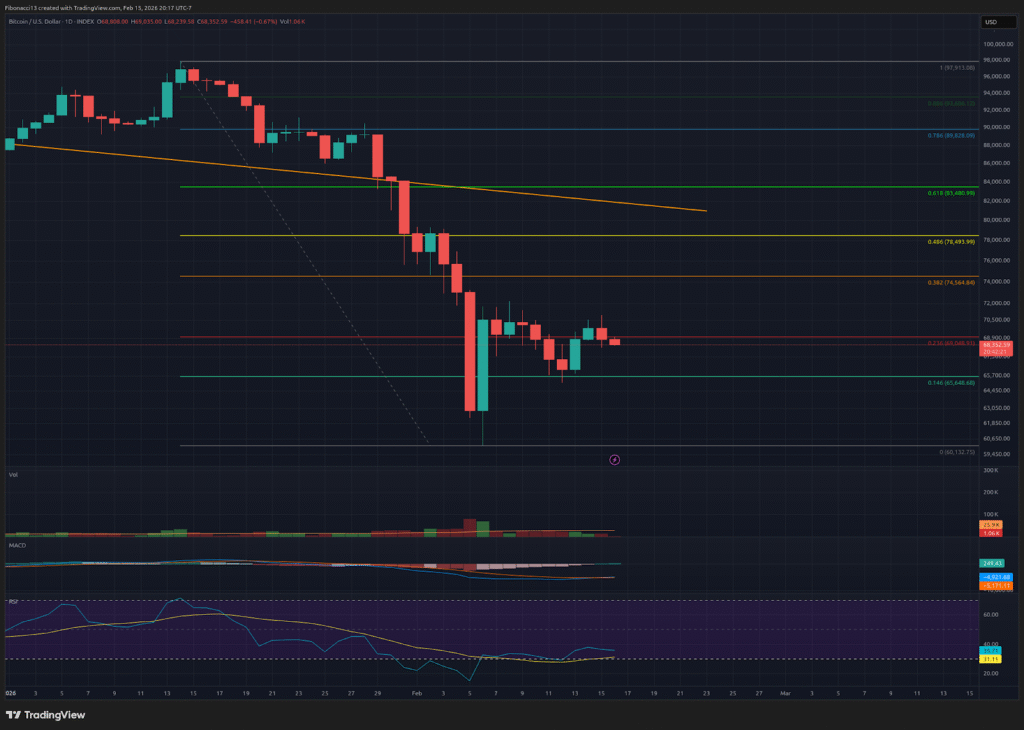

The past week’s price action has been rather lackluster for Bitcoin. After seeing a big bounce from $60,000, the price failed to get above short-term resistance at $71,800 last week. Instead, the price tested the short-term support at $65,650 before bouncing back up to close the week out at $68,811. While the weekly chart is showing some buying strength below $66,000, the lack of follow-through for buyers on the bounces so far is a sign of weakness. Look for the price to drift towards the $60,000 lows this week if the bulls can’t keep it above $71,000 on a daily close to challenge higher levels.

Key Support and Resistance Levels Now

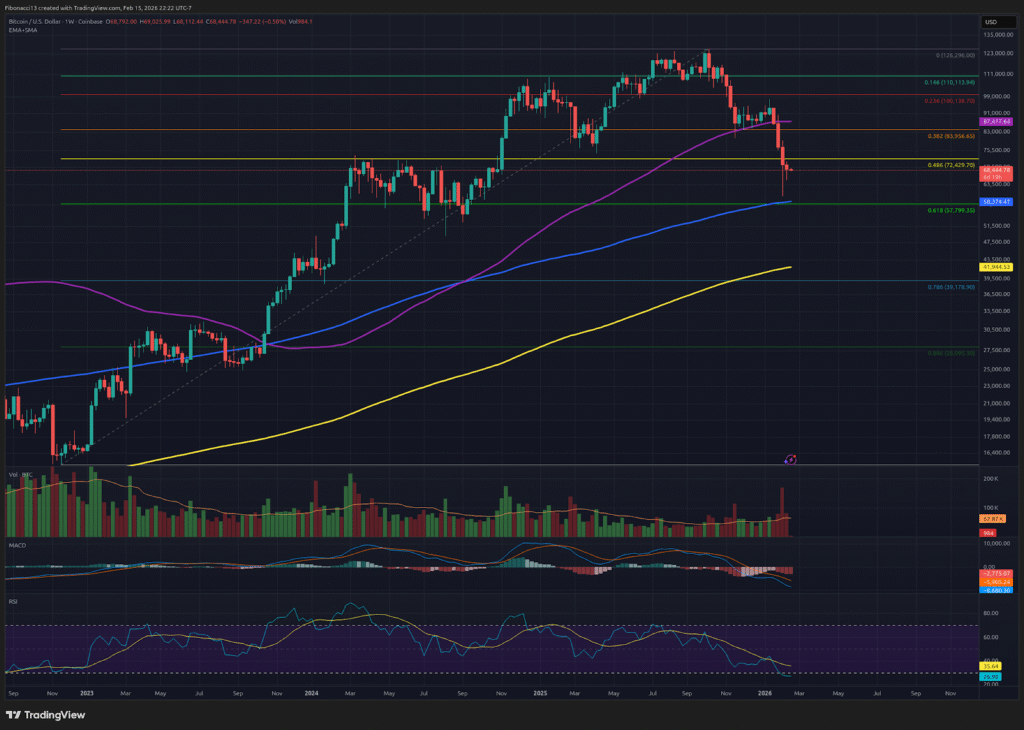

Last week, $65,650 proved to be valid short-term support as the price dipped just below it before rallying quickly back above it. If a day closes below $65,650, look for $63,000 to act as support. Below $63,000, we have the 0.618 Fibonacci retracement at $57,800. This is a key level to hold as there isn’t much support below until $44,000.

If the bulls can muster up some strength, resistance still sits overhead at $71,800. Closing above this level leads to $74,500, with $79,000 resistance above here. If the bulls can somehow manage to get above $79,000 (unlikely), $84,000 remains as a very strong barrier up above.

Outlook For This Week

The outlook for this week is a tough one to call. U.S. markets are closed on Monday, so don’t expect too much movement until Tuesday morning. We really could go either way from this $68,800 close. I would look for the $67,000 level to be tested early this week, and if we see support near there, we may be able to push past $71,000 later into the week. If $67,000 is lost, though, look for the low $60,000 to be challenged once again.

Market mood: Very bearish – The price could not manage to gain any upward momentum last week at all. The bears are in full control.

The next few weeks

As I mentioned last week, the price may range in the area from $60,000 to $80,000 for a while, with maybe a wick down to the 0.618 Fibonacci retracement at $57,800. At the moment, this ceiling can be lowered to $74.5k. There is no telling exactly when the impending “Crypto Bill” will be passed by Congress, or exactly what it will entail for the crypto space as a whole. It is not guaranteed to result in higher prices for bitcoin when it eventually passes, either, so for now, we must rely on the technicals to guide us. For the time being, the bias is still bearish, and if we lose $57,800, the bitcoin price will likely take the next leg down.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).

This post Bitcoin Bears Dominate: Failure to Break $71,800 Keeps Downside Risk Alive first appeared on Bitcoin Magazine and is written by Ethan Greene – Feral Analysis and Juan Galt.