The recent slide of Bitcoin has punched a hole in short-term holders’ wallets and left loud questions about where prices might settle next. Markets are jittery; people who bought high are taking losses. Some sellers reacted fast, and that rush shows up in on-chain numbers.

Realized Losses Hit Historical Levels

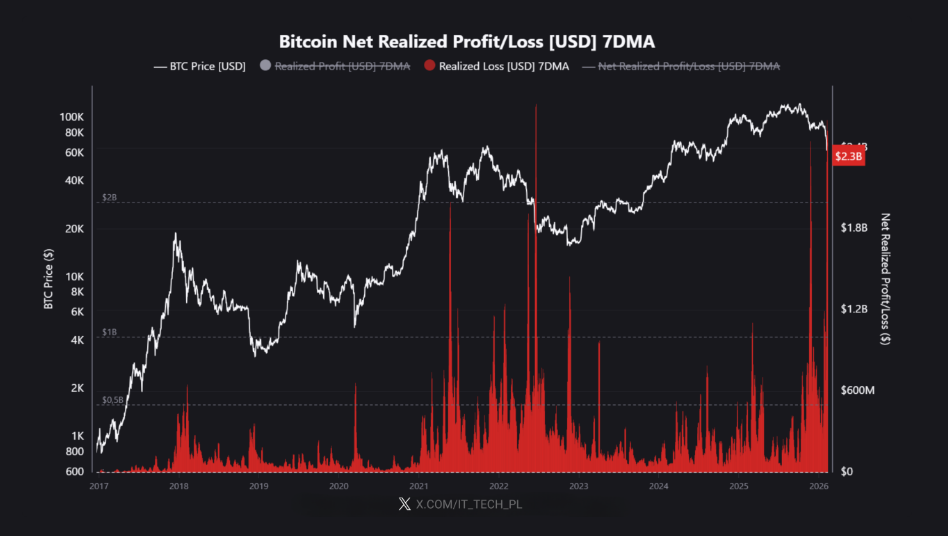

According to CryptoQuant and an analyst writing under the name IT Tech, Bitcoin’s seven-day average of realized net losses climbed to about $2.3 billion — a figure that puts this sell-off among the largest loss events on record.

“This is one of the largest capitulation events in BTC history, rivaling the 2021 crash, 2022 Luna/FTX collapse, and mid-2024 correction,” IT Tech said.

This spike in losses means many traders sold at a loss over the span of a week, not just a day.

Price Action And Market Context

Reports say Bitcoin fell sharply from its recent peak and has been bouncing between support lines that traders watch closely. After topping near $126,000, the token traded as low as about $60,000 earlier in the month and has been seen around $66,600 on recent checks. That gap is large, and it explains why panic selling pushed realized losses so high.

Signs Pointing To Capitulation

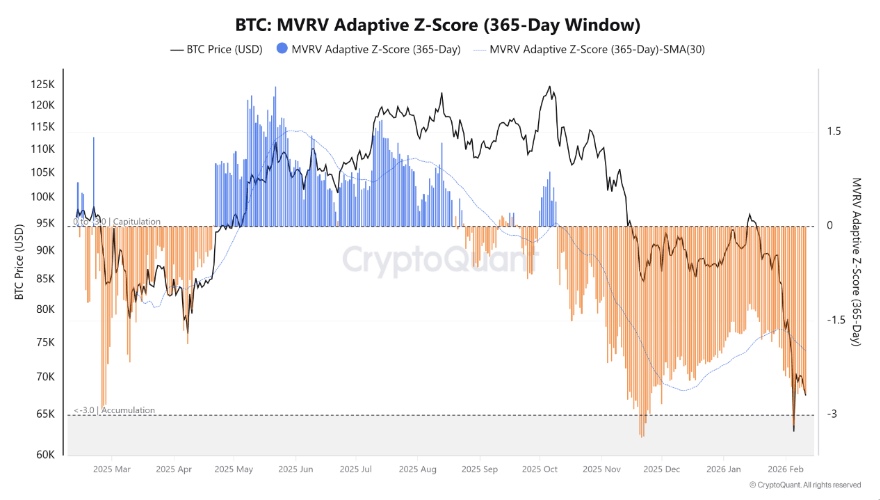

Reports note that on-chain indicators tied to profit and loss show losses are rising faster than gains. One contributor at CryptoQuant, GugaOnChain, flagged a Z-Score reading that he describes as consistent with deep capitulation — a phase where more holders give up than buy. When that happens, markets often become chaotic first and steady later.

What Analysts Are Saying Now

Reports say some market commentators expect pressure to continue for a while. Nic Puckrin, an investment analyst, described the market as being in “full capitulation mode,” and warned selling could persist for months before clearer footing appears. Others point out that heavy losses can also clear the way for patient buyers later.

Where Bottoms Have Lived Before

Reports have disclosed that CryptoQuant’s measure of the “realized price” sits near $55,000 — a level that has been linked in past cycles to the end of big sell-offs and the start of sideways consolidation.

That does not mean a floor has formed this time; it only marks a region where past buyers, on average, stopped losing money on their holdings. Markets have traded well below similar marks before they steadied, so history offers patterns, not guarantees.

What This Means For Traders And Investors

Short term, expect wild swings. Some days will bring sharp rallies that reverse quickly. Other days will drag, and realized losses may keep rising as more investors pull out.

Longer term, if institutional demand returns or big holders stop forcing sales, price stability could follow. Right now the market is clearing out positions and testing whether support levels hold.

Featured image from Gemini, chart from TradingView