The convergence of traditional finance (TradFi) and decentralized infrastructure just hit a new gear. ING, one of Europe’s banking heavyweights, is reportedly deepening its exposure to the crypto ecosystem through a strategic alignment with Bitwise.

This isn’t just a standard balance sheet adjustment. It signals a fundamental shift in how institutional capital views digital asset custody and yield generation.

For years, banks sat on their hands, paralyzed by regulatory fog. Now, with Bitwise providing the regulated rails, institutions like ING are effectively bypassing the technical friction of direct ownership while capturing the upside. That validates the ‘Bitcoin as collateral’ thesis in a big way. When a global systemically important bank (G-SIB) moves into the space, it forces competitors to re-evaluate their risk models.

The flow of capital is no longer just speculative retail volume, it’s sticky, long-term institutional allocation.

But here’s the catch: simply holding Bitcoin is becoming insufficient for sophisticated actors. The market is demanding utility. As trillions of dollars in potential liquidity seek entry, the limitations of the Bitcoin Layer 1 (L1), specifically its lack of native smart contract capability and slow transaction times, have become the ecosystem’s primary bottleneck.

That infrastructure gap has triggered a capital rotation into Layer 2 solutions capable of handling institutional throughput. Bitcoin Hyper ($HYPER) has emerged as a primary beneficiary of this trend, positioning itself to solve the scalability trilemma right as the institutional gates swing open.

Bitcoin Hyper Brings Solana Speeds to Bitcoin Liquidity

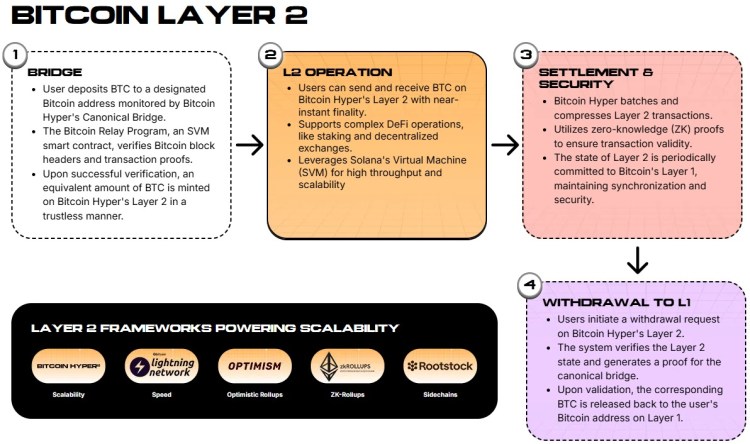

While the market obsesses over ETF inflows, developers are focused on the execution layer. The core innovation driving interest in Bitcoin Hyper ($HYPER) is its integration of the Solana Virtual Machine (SVM). Historically, Bitcoin Layer 2s have faced a brutal trade-off: inherit Bitcoin’s security but suffer from slow block times, or build a sidechain that sacrifices security for speed.

Bitcoin Hyper dismantles this dichotomy. By utilizing the SVM for execution while anchoring state to Bitcoin L1, it allows for transaction speeds that rival Solana, sub-second finality and negligible costs, while utilizing Bitcoin as the ultimate settlement layer.

For developers, this is a massive unlock. It enables the creation of high-frequency trading platforms, gaming dApps, and complex DeFi protocols using Rust (a language preferred for high-performance applications), all within the Bitcoin ecosystem.

The implications for DeFi are profound. Frankly, billions in BTC are currently sitting idle. By offering a high-performance execution environment, Bitcoin Hyper allows that capital to be mobilized in ways previously restricted to Ethereum or Solana. Plus, the protocol’s Decentralized Canonical Bridge facilitates trustless transfers, solving the fragmentation issue that has plagued previous bridging attempts.

Check out the technical breakdown in the Bitcoin Hyper whitepaper.

Whales Accumulate $HYPER as Presale Crosses $31 Million

It looks like smart money is front-running the public launch of this SVM-integrated Layer 2.

According to the official presale dashboard, Bitcoin Hyper has raised an impressive $31.2M to date. That level of capital commitment during a presale phase suggests high conviction from early backers regarding the project’s ability to capture L2 market share.

Currently priced at $0.013675, the token offers an entry point that stands in stark contrast to the valuations of established L2s.

Beyond the raw capital inflows, the project’s staking incentives are driving retention. Investors can stake immediately after the Token Generation Event (TGE), with a short 7-day vesting period for presale participants.

This structure incentivizes long-term alignment rather than mercenary capital rotation. With the roadmap including a mainnet launch that activates the SVM capabilities, the window for early accumulation is narrowing.

View the official Bitcoin Hyper presale.

The content provided in this article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are volatile; conduct your own due diligence before investing.