CryptoQuant CEO Ki Young Ju revived the “Bitcoin equals energy” thesis on Wednesday, arguing that proof-of-work is becoming the settlement layer for an AI-driven economy where power, not narratives, is the binding constraint. In a post on X, Ju framed Bitcoin as a digital instrument that can price energy with precision in a way commodities can’t.

“Energy is money. Bitcoin precisely measures the value of energy,” Ju wrote. “Gold also embeds energy, but it cannot be measured accurately because it is not digital. Bitcoin is the money of an AI-accelerated energy economy.”

The Link Between AI, Energy And Bitcoin

Ju’s comments were posted alongside a long-form X post by Hashed CEO Simon Kim titled Monetizing Energy: Redefining Bitcoin’s Role in the AI Era, which argues that the old “energy waste” critique is being overtaken by an AI data center buildout that is rewriting the value of mining infrastructure.

Kim’s core claim is that the debate has shifted from morality to grid economics and industrial pragmatism. “The oldest criticism of Bitcoin has always been about energy,” he wrote. “Claims that it ‘wastes electricity,’ ‘destroys the environment,’ and ‘competes with data centers for power’ have been repeated for over a decade, solidifying into conventional wisdom. But in 2026, this debate no longer resides in the realm of moral condemnation.”

The thread points to capital flows as a tell. Kim highlighted Abu Dhabi sovereign wealth fund Mubadala’s $437 million allocation to BlackRock’s Bitcoin ETF in Q4 2024, followed by a partnership with Oman’s sovereign wealth fund to back Crusoe Energy and launch the Middle East’s first flare-gas mining operation. In October 2025, Mubadala co-led Crusoe’s Series E with a $1.375 billion check, pushing the company’s valuation above $10 billion—at which point Crusoe said it would divest its Bitcoin mining division and focus fully on AI infrastructure.

Kim’s thesis is that miners have already done the hard, unglamorous work AI now needs: securing power, mastering high-density thermal management, and building operational muscle around flexible load. He also leaned on an Elon Musk quote from a November 2025 podcast: “Energy is the true currency. This is why I say Bitcoin is based on energy. You can’t just pass a law and suddenly have a lot of energy.”

A recurring theme in Kim’s post is that electricity’s constraints (locality, immediacy, and transmission losses) make flexibility economically valuable. He cited early examples like Sichuan hydropower curtailment exceeding 20 billion kWh by 2020, and argued that miners became a buyer of last resort for energy that couldn’t be stored or sold.

Globally, he claimed curtailed renewable energy exceeds 200TWh annually, representing more than $20 billion in economic losses, positioning Bitcoin mining as an instant monetization path for surplus generation.

In Texas, Kim pointed to ERCOT’s classification of mining as a controllable load resource, citing Riot Blockchain cutting power usage by 98–99% during the 2022 winter storm and receiving $31.7 million in power credits during an August 2023 heatwave, more than it would have earned mining that month. The framing is less “miners versus data centers” and more “premium uptime workloads versus interruptible demand that stabilizes the grid.”

Kim also argued the environmental critique is changing on the margin as the industry’s energy mix shifts. He claimed more than half of mining now comes from sustainable sources, exceeding 52%, while coal dependence fell from 36% to under 9%.

On methane, he described flare-gas mining as an emissions arbitrage: methane has “80 times” the greenhouse effect of CO2, flaring combusts 93% with 7% escaping, while using gas for mining combusts over 99%, cutting CO2-equivalent emissions by over 60% versus flaring.

The forward implication of Ju’s framing is that if AI accelerates the premium on reliable power and buildout speed, Bitcoin’s value proposition may increasingly be argued in the language of energy markets: measuring, monetizing, and transporting scarcity.

Kim’s closing challenge was explicit: shift the question from consumption totals to system outcomes, suggesting the next phase of the debate will center on where miners sit in the stack of AI-era infrastructure, not whether they exist:

“AI operates where continuous uptime is essential; Bitcoin operates where flexibility has value. Governments can print money, but they cannot print energy. Bitcoin’s proof-of-work is the mechanism that brings this physical reality into the digital economy. It’s a technology that takes energy from one place and transports it anywhere.”

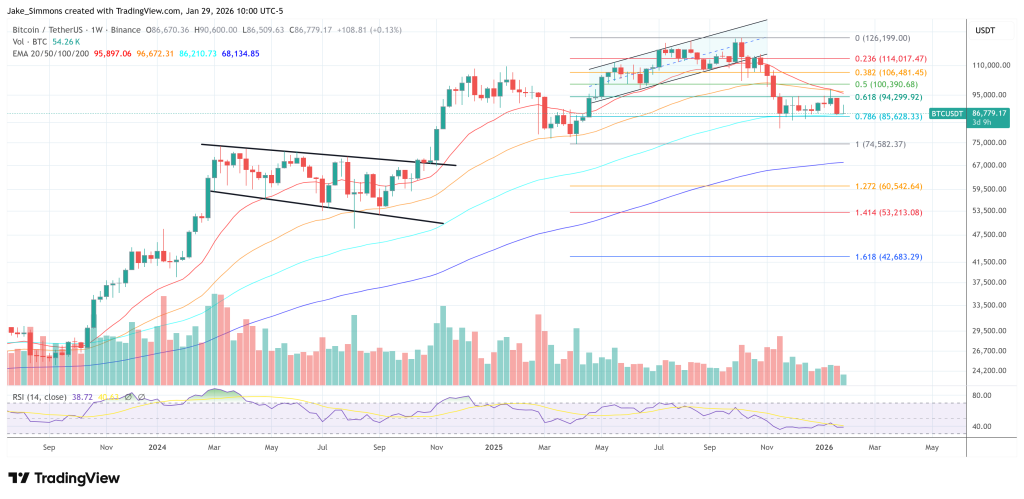

At press time, Bitcoin traded at $86,779.