Bitcoin’s April 2025 swing low around $73,000 has become the make-or-break line for 2026, according to veteran professional trader and commentator Nik Patel, who argues that a higher-timeframe break below that level would likely open the door to a prolonged grind in the mid-$50,000s.

In Part Three of his “2026 Outlook” published Jan. 21, Patel laid out a high-conviction call that Bitcoin prints fresh all-time highs in the first half of 2026, framing it as further evidence the market has shifted away from the clean, narrative-driven four-year cycle. “Bitcoin trades new all-time highs in H1 — the 4-year cycle is dead,” he wrote, summarizing his regime view as “higher for longer,” potentially stretching into 2027.

Why Bitcoin Must Hold $73,000 Or Risk A Slide

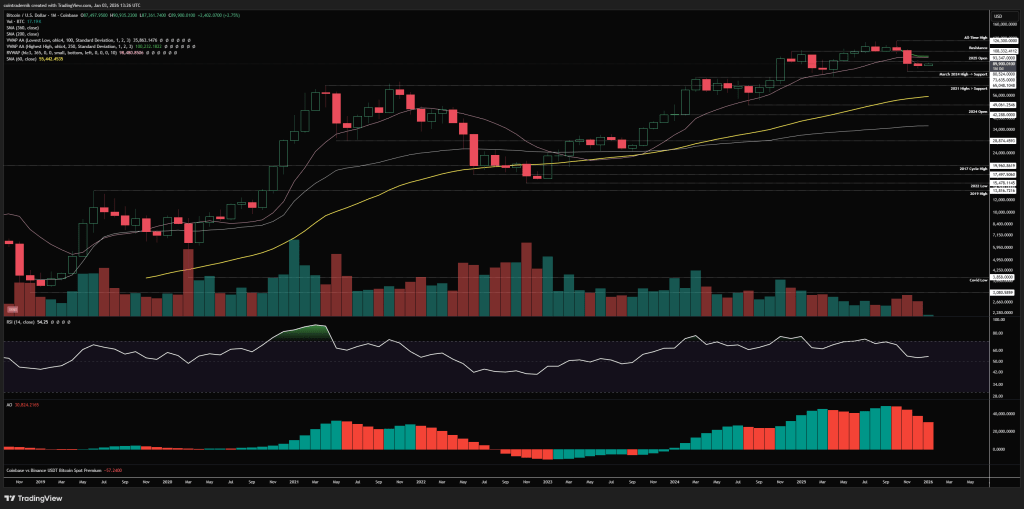

Patel’s core technical claim is simple: as long as Bitcoin does not close key higher timeframes below the April 2025 low, the broader structure remains intact and the base case is continuation higher. He acknowledged that he expected a sharper reversal earlier: “Timing-wise, I was wrong on my expectations for a more immediate reversal,” but stressed that price has continued to hold above the April lows “despite having every reason to break and close below.”

That resilience, in his view, matters more than moving averages or anchored references. “Since 2022, we have not made fresh lows on a weekly timeframe below the bottoms that preceded the next highs (or, more plainly, weekly structure in the most technical sense has remained bullish with higher-highs and higher-lows),” Patel wrote.

“This has not changed and I place less weight on MAs, VWAPs etc. than I do on price itself, and whilst the $73k April lows that preceded the $126k all-time highs are protected, weekly structure is still bullish.”

His forecast leans heavily on a macro and positioning backdrop he describes as inconsistent with a deep-cycle crypto bear market. Patel cited “Goldilocks into reflation,” rising inflation breakevens, falling real rates, midterm dynamics, and bearish sentiment and positioning as part of the setup that makes a 2018- or 2022-style unwind less likely in his framework.

Patel’s downside map is unusually explicit for a discretionary macro-technical thesis. “If I’m wrong — and we close the higher timeframes below $73k — we likely trade mid-$50ks this year, consolidate there for many months and produce no new highs in 2026,” he wrote, outlining a scenario where a structural failure forces a wholesale reassessment.

He reiterated that the trigger is not an intraday wick but timeframe closes. In his year-ahead playbook, he described being “invalidated on a weekly close below $73k but with a view to re-entering on an immediate reclaim,” while “fully” cutting exposure if Bitcoin prints a monthly close below $73,000, in which case he would “prepare for mid-$50ks.”

Patel also pushed back on the idea that the drawdown from the highs represents a new, uniquely bearish regime. “Where many view the most recent move off the highs into $80k as a ‘structural shift unlike prior corrections’, I disagree and continue to view this as a ‘higher for longer’ regime within which we have these 30-40% corrections, range-bound price-action chewing through supply and subsequently continue higher,” he wrote.

He added that the correction “felt different” in part because it coincided with what he called “the largest liquidation event in crypto history,” alongside forced selling dynamics and long-term holder supply, yet it has still only produced a drawdown modestly larger than prior pullbacks in the broader uptrend.

Even so, Patel allowed for near-term turbulence. He said there is “a decent chance we sweep the November low in early Q1,” but maintained he “categorically” does not expect a higher-timeframe close below the April lows in the first half of the year. His base case remains new highs in H1 2026—“perhaps in late Q1 but likely in early Q2.”

At press time, BTC traded at $90,060.