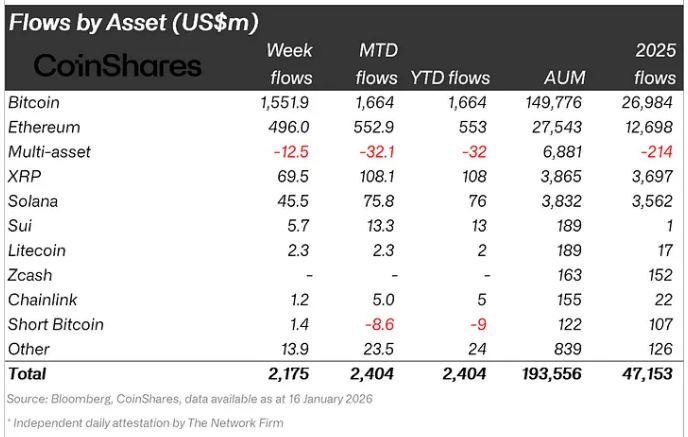

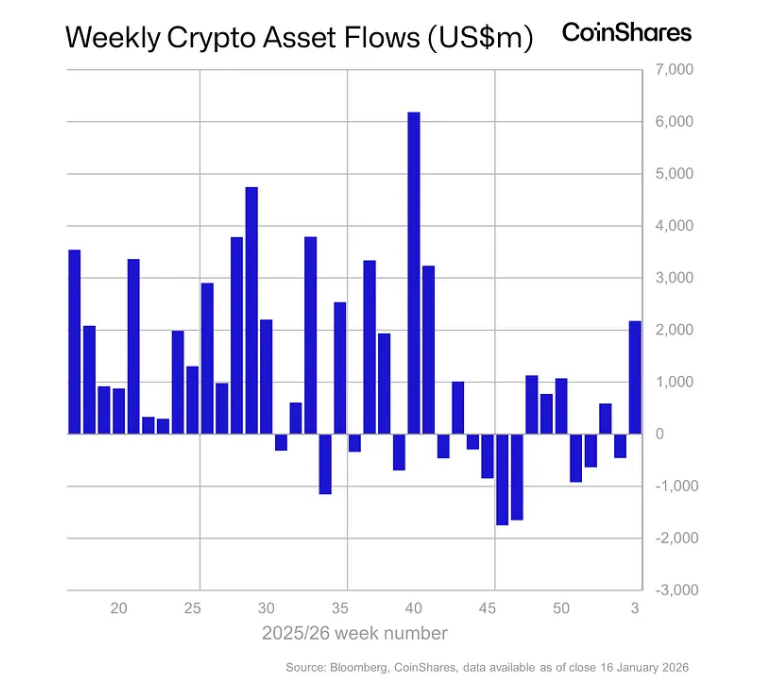

Reports say global exchange-traded products tied to crypto pulled in about $2.2 billion in net inflows during the latest week, a jump that marked the strongest weekly move since October last year.

Bitcoin-focused funds took the lion’s share, while Ether and a handful of altcoin products also saw fresh money enter.

Rising Appetite For Bitcoin And Ether

According to CoinShares, Bitcoin-led products accounted for most of the inflows, while Ether-linked ETPs grabbed a meaningful slice of new capital as well.

Many investors treated these products as an easier way to get exposure to crypto without owning coins directly. The pattern points to growing comfort among big traders and funds with exchange-traded wrappers.

Some Flows Came As Prices Moved

The uptick in cash into ETPs coincided with a fresh push higher in prices for core tokens. Traders who had been on the sidelines made buys after recent rallies, and funds that track these assets reported higher trading volumes.

That increase in trade activity helped push the headline inflow number into view. A few market watchers said the move looked like accumulation by longer-term holders, while others warned that part of the money could be short-term positioning around events and news.

Ease Of Access Draws Institutional Money

For many institutions, these products are more familiar than direct custody of crypto. Brokers and wealth managers can put them on client platforms with the same tools they use for stocks and bonds.

Some banks and advisers have started to offer these ETPs as part of broader portfolios, which has helped open a new tap of capital. That said, differences in rules across countries still shape where the biggest flows land.

Where The Money Went And What It Means

Bitcoin ETPs were the main beneficiaries, taking most of the $2.2 billion. Ether funds also saw healthy inflows, and a small number of altcoin products attracted fresh cash.

The data shows demand is not limited to a single corner of crypto anymore. Instead, investors are spreading bets across the biggest names while a few niche tokens get tested.

This could mean more stable demand for core products, even when smaller tokens wobble.

Featured image from Unsplash, chart from TradingView