Bitcoin Magazine

Strategy ($MSTR) Stock Soars 10% Above $189 as Bitcoin Nears $100,000

Shares of Strategy ($MSTR) surged more than 10% Wednesday morning, briefly climbing above $189 per share, as investors piled back into the bitcoin treasury trade.

The move caps a volatile stretch for the stock following sharp drawdowns earlier this month.

Strategy, which holds the largest bitcoin position of any public company, has seen its equity trade as a high-beta proxy for bitcoin, with gains and losses often magnified relative to spot price movements.

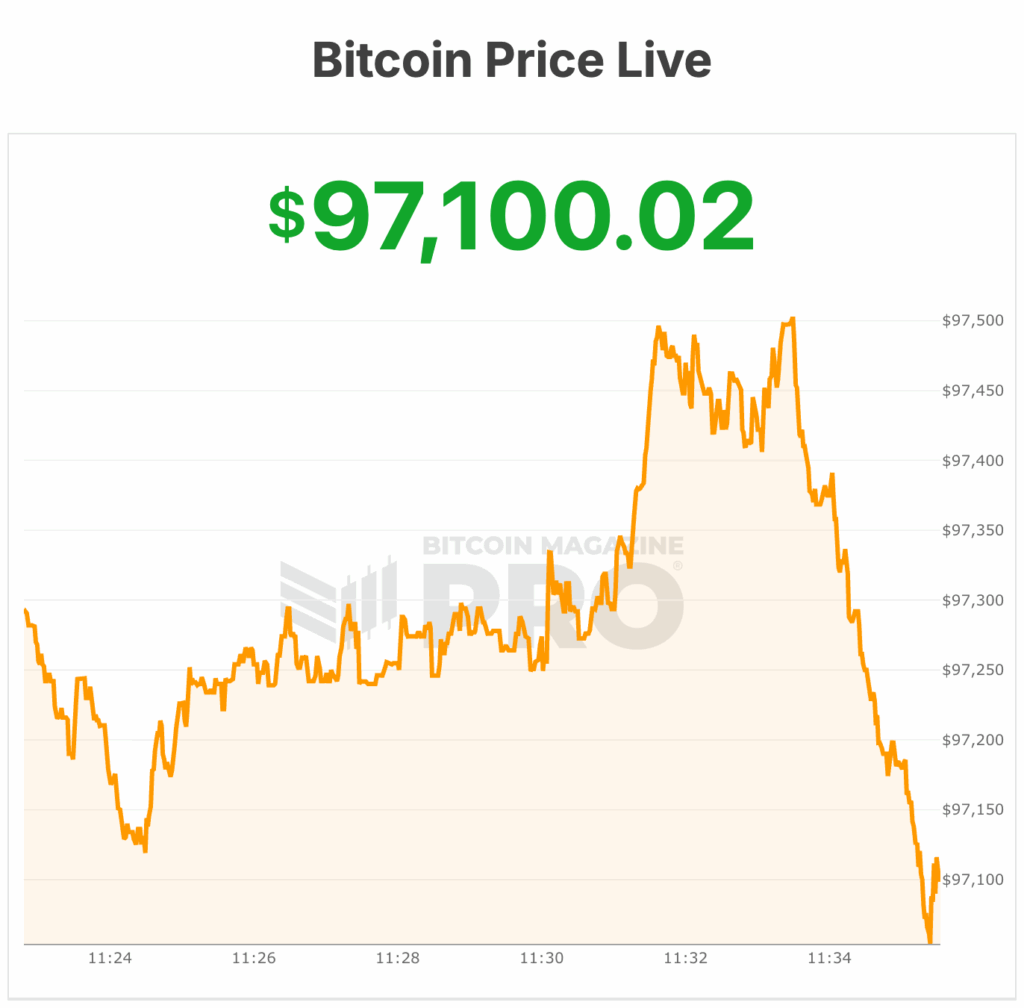

As bitcoin pushed toward the upper end of its recent range near $97,000, MSTR followed with a rapid upside move that outpaced the broader equity market.

The rally builds on momentum that began late last week after Strategy disclosed another large bitcoin purchase, adding more than 13,000 BTC to its balance sheet.

The acquisition lifted the company’s total holdings to roughly 687,000 bitcoin, reinforcing its long-stated approach of accumulating BTC through a mix of operating cash flow, equity issuance, and capital markets activity.

Executive Chairman Michael Saylor has framed the strategy as a long-term bet on bitcoin as a superior store of value and a treasury reserve asset.

Market participants say the size and consistency of Strategy’s purchases have helped re-anchor the bull case for the stock after weeks of pressure tied to bitcoin’s pullback and concerns around dilution.

While critics continue to point to leverage risk and accounting volatility, supporters argue that Strategy’s balance sheet has become one of the most direct institutional on-ramps to bitcoin exposure in public markets.

Sentiment also improved following signs of insider confidence. A recent open-market purchase by a company director marked the first such buy in several years, standing out in a period when insider activity had largely consisted of scheduled sales.

Strategy’s recent MSCI drama

Structural factors added to the rebound. Earlier this month, index provider MSCI opted not to remove bitcoin-focused treasury companies from certain benchmarks, easing fears of forced selling by passive funds.

That decision reduced near-term downside risk for Strategy, which has grown increasingly sensitive to index flows as its market capitalization expanded during bitcoin’s 2024 and 2025 rallies.

Still, Strategy’s model remains closely tied to bitcoin volatility. The company reported large unrealized losses in prior quarters as accounting rules required it to mark down bitcoin holdings during price declines.

Those losses reversed only when prices recovered, creating earnings swings that traditional equity investors often struggle to price.

Wednesday’s jump above $189 highlights the reflexive nature of the trade. As bitcoin strengthens, Strategy’s equity also strengthens and attracts momentum-driven capital seeking leveraged exposure.

This post Strategy ($MSTR) Stock Soars 10% Above $189 as Bitcoin Nears $100,000 first appeared on Bitcoin Magazine and is written by Micah Zimmerman.