Bitcoin Magazine

Eric Adams’ NYC Token Crashes 80% in Hours, Offering a Stark Lesson in Why Bitcoin Is Different

Former New York City Mayor Eric Adams is facing a lot of heat today after his high-profile launch of a new cryptocurrency, dubbed the NYC Token, crashed within hours of launching. Adams launched the token on Monday, but the coin lost 80% of its value within a couple hours.

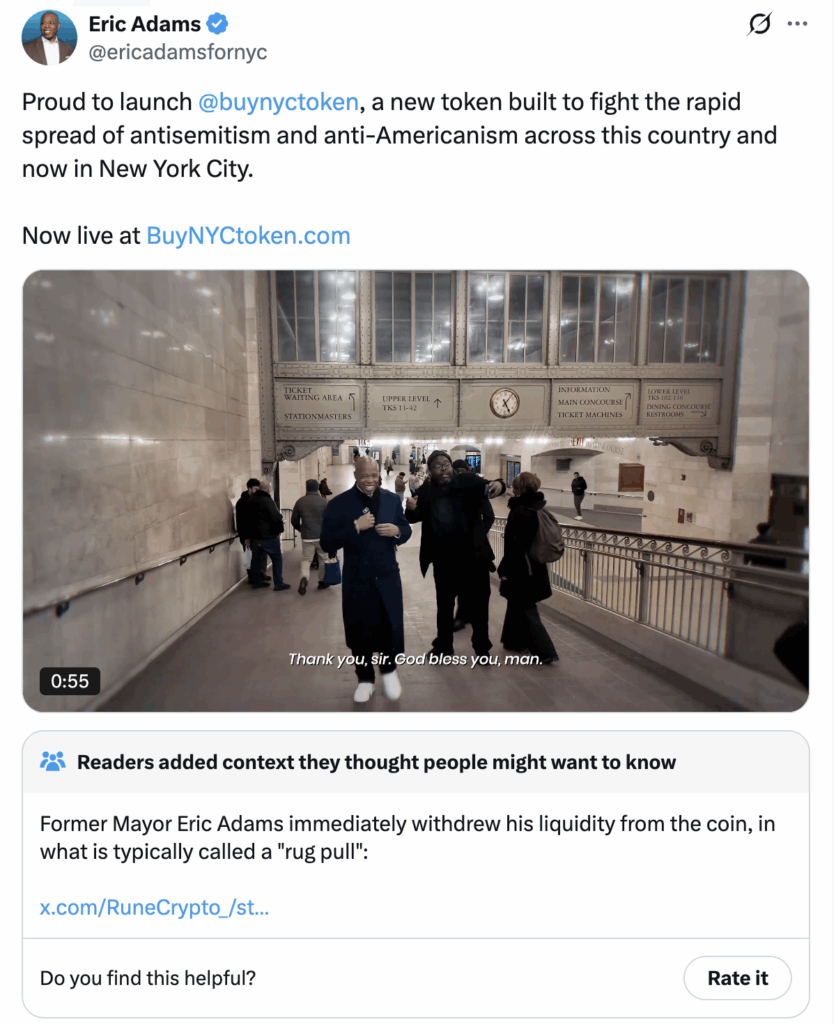

Adams unveiled the Solana-based token at a Times Square event on Monday, promoting it as a tool to generate funding for social causes including the fight against antisemitism and “anti-Americanism,” as well as blockchain education and student scholarships.

Eric Adams told Fox Business that proceeds would support nonprofits like Combat Antisemitism and historically Black colleges and universities without raising taxes.

The announcement came less than two weeks after Eric Adams left office as mayor, where he had long championed crypto adoption — including converting his first mayoral paychecks into Bitcoin and other crypto and signing an executive order to promote digital assets.

A mayoral ‘pump and dump’ from Eric Adams

Investor interest was strong for the first couple of hours following the coin’s launch, briefly driving the NYC Token’s market capitalization into the hundreds of millions of dollars. But within hours of its debut, the token’s price collapsed — dropping more than 80% from its peak, according to market data.

On-chain analysts and traders quickly accused the project of a rug pull, a scenario in which insiders withdraw liquidity from a token to the detriment of ordinary investors.

The coin hit $580 million in market cap before crashing -80% in a matter of minutes. Nearly $500 million in market cap was lost, as of earlier January 13.

Social media and trading forums erupted with criticism. Many in the crypto space saw this dump coming.

Some retail traders accused the coin’s pattern as a classic pump-and-dump scheme, while others questioned the token’s sparse disclosures, limited technical details, and the absence of named partners or a working project roadmap.

The case for Bitcoin

Here we go again. This classic moment and rug pull shows the risks inherent in the broader memecoin and altcoin market and makes a strong argument for Bitcoin’s relative stability.

Projects like this are prone to large liquidity withdrawals, either immediately after a token’s launch or as it reaches new highs. Popularity alone can make it easy to attract buyers, giving insiders an opportunity to sell. When they do, it often triggers sharp price drops and significant investor losses — practices that are manipulative and, frankly, resemble a scam.

Bitcoin, in contrast, offers a longer track record, transparent issuance, and decentralized governance. Its fixed supply and consensus mechanisms are its key to resilience, setting it apart from short-lived tokens with concentrated control or opaque structures.

Eric Adam’s token exemplifies recurring pitfalls we see in speculative, celebrity- or politically branded coins: opaque tokenomics, centralized supply, and sudden collapses that leave retail investors exposed.

Bitcoin’s architecture is designed to mitigate these risks through decentralized proof-of-work security and a predictable issuance schedule. Bitcoin’s decades‑long resilience has stood the test of any speculative churn coming from memecoins.

Crypto pump-and-dump schemes like this one from Eric Adams really highlight why Bitcoin stands apart from the broader crypto market.

This post Eric Adams’ NYC Token Crashes 80% in Hours, Offering a Stark Lesson in Why Bitcoin Is Different first appeared on Bitcoin Magazine and is written by Micah Zimmerman.