Bitcoin Magazine

Michael Saylor’s Strategy Bought 1,286 BTC Last Week, Increases USD Reserve to $2.25B

Michael Saylor’s Strategy, the Tysons Corner, Virginia-based firm formerly known as MicroStrategy, kicked off the new year with another large Bitcoin acquisition, buying 1,286 BTC for approximately $116 million, according to a Monday filing with the U.S. Securities and Exchange Commission (SEC).

The purchase, made between December 29, 2025, and January 4, 2026, boosts the company’s Bitcoin holdings to 673,783 BTC, valued at around $62.7 billion at current prices.

The latest buy was funded entirely through the proceeds of MSTR Class A stock sales under the company’s at-the-market (ATM) program. The company sold nearly 2 million shares, generating $312.2 million in net proceeds.

The acquisition also coincides with the firm increasing its U.S. dollar reserve to $2.25 billion, up from $1.44 billion in December, intended to support dividend payments on preferred shares and interest obligations on outstanding debt.

The average price for the recent purchase was $90,391 per Bitcoin, with a small portion — 3 BTC — acquired in the final days of 2025 at $88,210 each.

Overall, Strategy’s Bitcoin portfolio was accumulated at an average cost basis of $75,026 per coin, reflecting total expenditures of $50.55 billion.

Despite the gains in 2026, the company reported a $17.44 billion unrealized loss on its digital assets in the fourth quarter of 2025, largely due to Bitcoin sliding from its October high of $126,000.

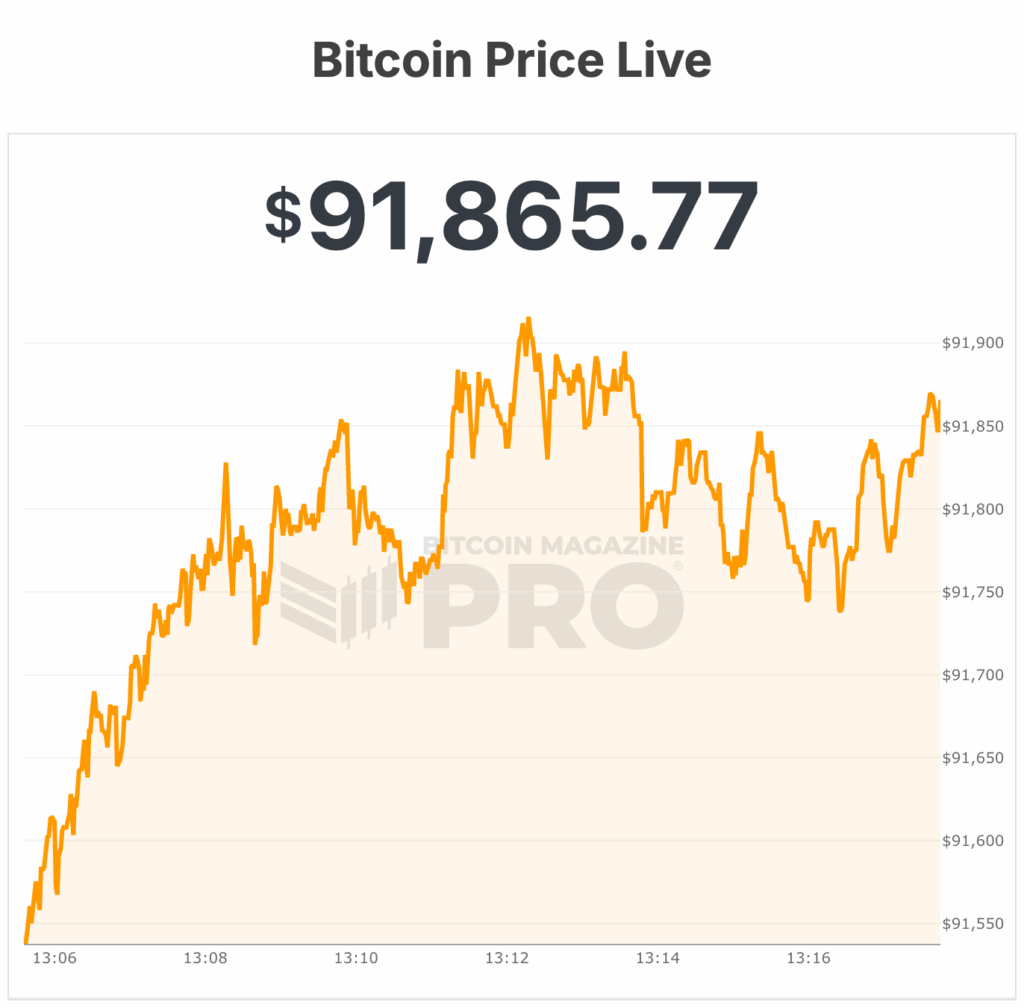

Bitcoin’s price surpassed $90,000 at the start of the year, partly buoyed by geopolitical tensions in the U.S.-Venezuela corridor and ongoing market optimism. As of Monday, BTC traded near $93,000, representing a roughly 6% gain year-to-date.

The move underscores the company’s continued commitment to its Bitcoin-first treasury model. Michael Saylor, co-founder and executive chairman, signaled the purchase on Sunday via X posting the firm’s Bitcoin portfolio with the caption, “Orange or Green?”

This weekly acquisition pattern has become a hallmark of Strategy’s approach to building its bitcoin holdings over time.

Strategy’s MSCI delisting possibility

However, the firm faces ongoing challenges beyond market volatility. Strategy could soon be removed from the Morgan Stanley Capital International (MSCI) global indices, which proposed last October that companies with 50% or more of assets in digital currencies resemble investment funds and may be excluded.

A potential MSCI delisting could trigger $2.8 billion in stock outflows, according to executives, with further impacts possible across other indexes, including the Nasdaq 100 and Russell benchmarks. Analysts from JPMorgan and TD Cowen estimate that exclusion from these indices could threaten billions in additional market value.

In December, Strategy submitted a formal response to MSCI’s consultation. The company called the threshold “misguided” and warned it could have “profoundly harmful consequences” for investors and the broader digital asset industry.

Earlier in November, Saylor pushed back on media reports warning that Strategy could face billions in passive outflows if MSCI did follow through with its decision.

In a statement on X, Saylor said that the company is “not a fund, not a trust, and not a holding company.” He described the firm as a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

Despite these pressures, Strategy’s aggressive accumulation of Bitcoin has influenced other publicly traded firms.

Tokyo-listed Metaplanet, for instance, has now become the fourth-largest corporate holder of Bitcoin, with 35,102 coins valued at roughly $3.27 billion.

Strategy’s USD reserve and stock sale-driven purchases illustrate a carefully managed, albeit high-risk, strategy of maintaining liquidity while expanding its digital asset holdings. The company has used the reserve to bolster its financial footing amid market swings, aiming to ensure operational continuity and investor confidence.

At the time of writing, bitcoin is dropping to below $92,000.

This post Michael Saylor’s Strategy Bought 1,286 BTC Last Week, Increases USD Reserve to $2.25B first appeared on Bitcoin Magazine and is written by Micah Zimmerman.