Bitcoin Magazine

Bitcoin Price Struggled in 2025, but Long-Term Lows Show a Strong and Rising Floor

Bitcoin’s price action in 2025 pointed to a market shaped less by speculative and impulsive excess and more by macro forces.

The bitcoin price traded through a wide range last year. According to Bitcoin Magazine Pro data, bitcoin rallied above $126,000 during mid-to-late-year advances fueled by ETF inflows and optimism around U.S. regulatory clarity. Those highs did not hold.

By the fourth quarter, tighter financial conditions and elevated real yields weighed on risk assets. The bitcoin price slid sharply from its peak and ended the year near $87,000. It is on track for its first full-year decline since 2022.

While the drop from the highs was steep and can feel negative, longer-term charts tell a different, more bullish, story.

Bitcoin’s yearly lows continued to trend higher. Data shows the yearly low rose from $366 in 2016 to $76,329 in 2025. Each major cycle has set a higher floor despite deep drawdowns along the way.

The pattern held after major downturns in 2018 and 2022. In both cases, bitcoin later established higher yearly lows. The 2025 low stands well above prior cycle troughs, even after a volatile year.

The gap between yearly highs and lows widened in 2025. That spread reflects persistent volatility and rapid shifts in sentiment. It also highlights a market still adjusting to its growing size and popularity.

Analysts say the rising floor suggests deeper capital support than in past cycles. Long-term holders have shown greater willingness to accumulate during declines. Forced selling has remained concentrated during brief liquidation events rather than extended crashes.

Macro conditions played a central role throughout the year. Inflation remained sticky. Central banks kept policy restrictive longer than expected. That backdrop favored yield-bearing assets and pressured speculative positioning.

The bitcoin price’s correlation with broader risk markets increased. Price movements tracked equities more closely, especially during U.S. trading hours. Late in the year, crypto assets often sold off while American stocks were open.

That pattern showed signs of shifting as 2026 began. The bitcoin price climbed above $90,000 during early U.S. trading sessions.

October 10: Bitcoin price’s humbling ‘down to earth’ moment

Still, the defining moment of 2025 came earlier.

On Oct. 10, the bitcoin price suffered a massive and sharp intraday plunge of roughly $12,000. The move triggered billions of dollars in liquidations across derivatives markets. Total crypto market capitalization fell sharply in a single session.

The selloff set the stage for a prolonged pullback that is still being felt in the broader crypto market. Within weeks, bitcoin was trading more than 30% below its peak near $126,000. The decline erased much of the optimism that had dominated forecasts at the start of the year.

Entering 2025, price targets were aggressive. Many analysts and executives expected a sustained breakout well beyond prior highs. ETF inflows and institutional adoption formed the core of most bullish theses.

Those expectations failed to materialize. ETF demand absorbed supply but did not spark reflexive rallies. Liquidity conditions remained tight. Leverage repeatedly capped upside moves.

By year-end, the gap between forecasts and realized prices was clear. Bitcoin closed far below even the more conservative projections made earlier in the year.

Despite that, the yearly lows chart should attract attention and comforting thoughts.

The steady yearly lows reflect a maturing market. Bitcoin is larger, more regulated, and more integrated into global markets than during prior cycles. That structure may limit explosive rallies but also reduce the risk of total collapse.

The data suggests one clear trend. Even in a year marked by sharp corrections and unmet expectations, bitcoin price’s long-term floor will rise.

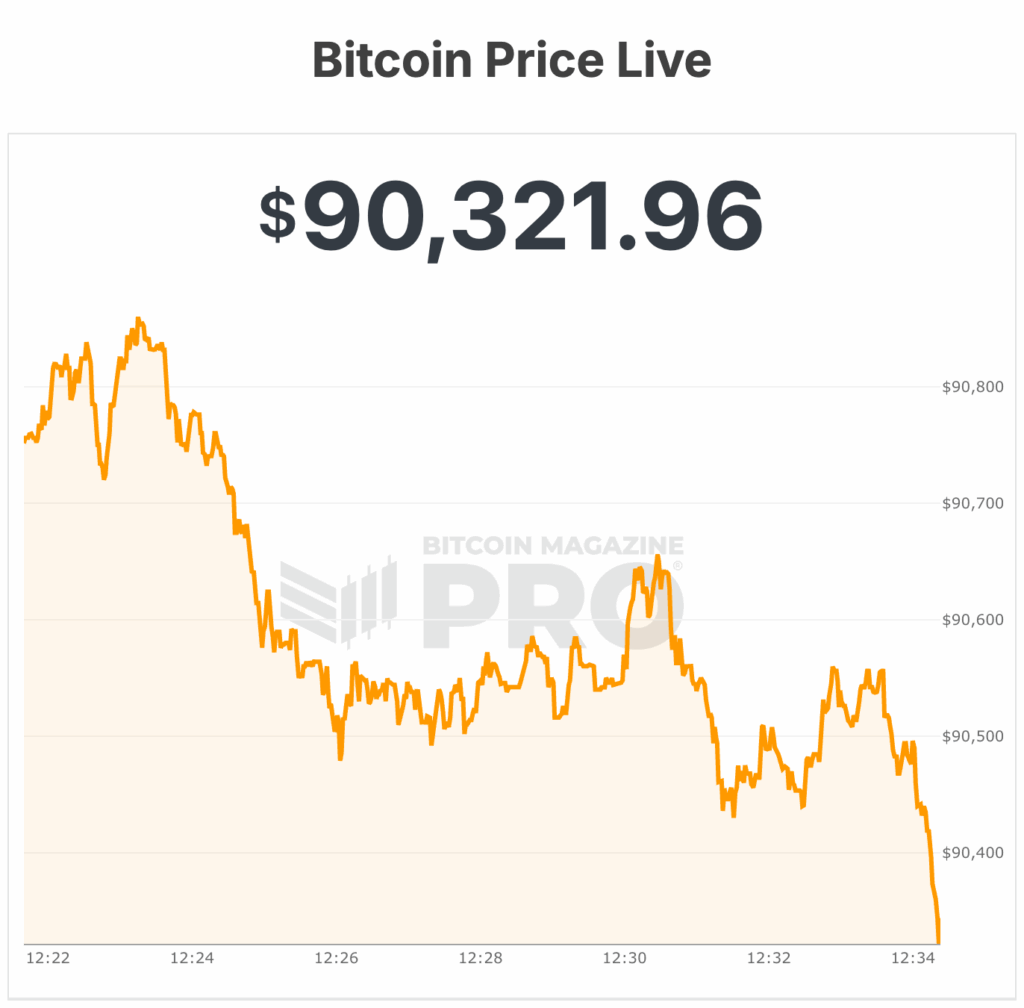

The bitcoin price is trading at $90,321, up 3% in the past 24 hours, with a market cap of $1.81 trillion and a 24-hour volume of $46 billion. Its price is near its 7-day high of $90,789 and 3% above its 7-day low of $87,967, with 19.97 million BTC in circulation out of a 21 million max supply.

This post Bitcoin Price Struggled in 2025, but Long-Term Lows Show a Strong and Rising Floor first appeared on Bitcoin Magazine and is written by Micah Zimmerman.