A massive crypto position opened by a high-net-worth holder has traders debating whether a short, sharp bounce is coming — or if the market is setting up for more pain. According to on-chain trackers, an $11 billion Bitcoin whale recently sold assets and placed nearly three quarters of a billion dollars on bets for higher prices in Bitcoin, Ether and Solana.

Whale Opens Massive Longs

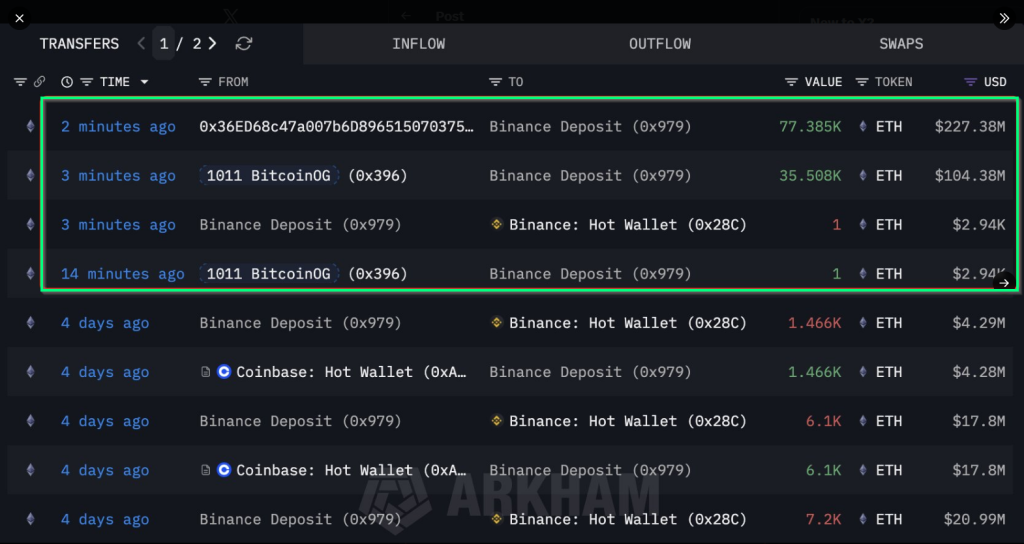

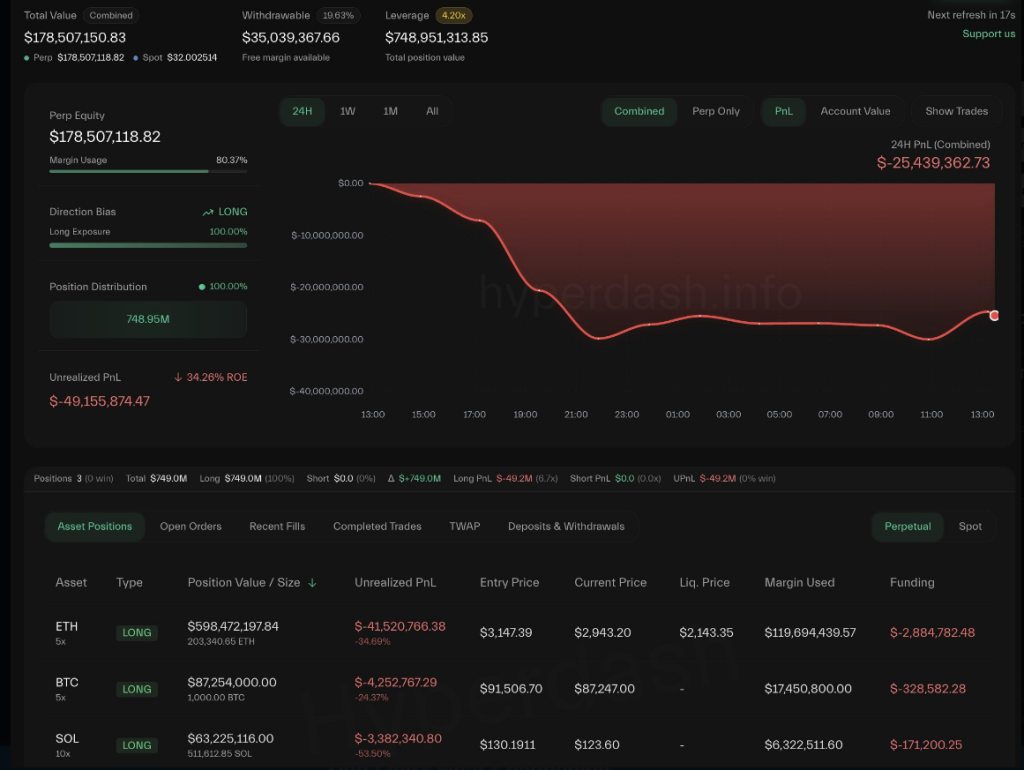

Based on reports by Lookonchain, the wallet sold about $330 million worth of Ether before opening three leveraged long positions totaling $748 million. The single biggest position is a $598 million long on Ether opened at $3,147 with a liquidation trigger under $2,143.

The same reports list entry prices near BTC $87,883 and SOL $124.43 for the other parts of the bet. At the time of the trades, Ether was trading around $2,975. The whale is carrying close to $50 million in unrealized losses on those leveraged bets, according to the on-chain data.

BREAKING!

The #BitcoinOG(1011short) with a massive $749M long position in $BTC, $ETH, and $SOL, just deposited 112,894 $ETH($332M) into #Binance again.https://t.co/rM9dXV3Ln4https://t.co/Fsi6okD47f pic.twitter.com/qVlZ4c6Htx

— Lookonchain (@lookonchain) December 30, 2025

Smart Money Still Cautious

Reports have disclosed that other whale addresses also piled into spot Ether around the same window. One thread of transactions shows about $5B of Bitcoin moved into Ether holdings since August, with an earlier swap that saw $2.59B of BTC exchanged for $2.2 billion in spot ETH and a $577M perpetual long.

In one burst of activity, nine large addresses added a combined $456 million in ETH within a day. Nansen data shows 19 wallets collecting a total of 7.43 million spot ETH in recent weeks.

Nansen’s data tells a very different story. Based on figures from the analytics firm, high-performing traders reduced their bullish Ether positions by $6.5 million in a single day and are now holding net short positions of $121 million on ETH.

The same group is also betting lower on Bitcoin, with $192 million in short exposure, and on Solana, totaling $74 million. While large holders buying on the spot market can push prices higher in the short run, experienced traders appear to be bracing for further weakness rather than a sustained move up.

Year-End Rally Failed As Liquidity Thinned

Bitcoin and Ether ended December without the expected year-end rally, highlighting the fragility of crypto markets when liquidity is low and risk appetite declines. Repeated attempts by Bitcoin to reclaim key levels were unsuccessful, and the quarter closed with negative performance while precious metals such as gold posted gains.

The market is now watching whether the alpha crypto can hold support into the new year; the failed rally may mean a deeper reset is needed before a sustained recovery.

Featured image from Unsplash, chart from TradingView