Bitcoin’s “death cross” is back in the group chat. And yes, the emails too. Matthew Sigel, head of digital assets research at VanEck, said he’s been “getting questions from clients” about the latest death cross print — the 50-day moving average slipping under the 200-day — and answered with the kind of data dump that tends to calm people down.

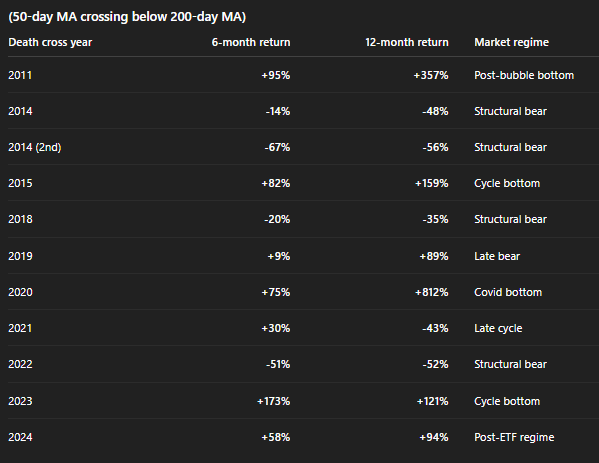

“Lagging indicator,” Sigel wrote on X, alongside a table of every Bitcoin death cross going back to 2011. The summary stats are clean: the 6-month median return after a death cross is +30%, the 12-month median is +89%, and the “positive hit rate” is 64%.

Another Bitcoin Death Cross, Another Missed Bottom?

But the interesting bit isn’t just the returns. It’s Sigel’s market regime column — basically a hint that the same technical signal can mean wildly different things depending on where you are in the cycle.

Take the ones tagged as some version of “bottom.” In 2011 (“post-bubble bottom”), the death cross showed up around the wreckage of an early-cycle blow-off, and the next 12 months were +357%. In 2015 (“cycle bottom”), it was +82% at six months and +159% at 12 months — classic post-capitulation behavior where trend indicators catch up late, after price has already stabilized and started to turn.

2020 (“Covid bottom”) is the extreme example: forced liquidation, policy response, then a monster rebound (+812% over 12 months). And 2023 is also tagged “cycle bottom,” with +173% at six months and +121% at 12 months — the kind of “this is awful until it isn’t” regime crypto does better than any asset class.

Now look at “structural bear.” That label shows up in 2014 (twice), 2018, and 2022 — and the forward returns are mostly ugly: 2014 prints -48% and -56% over 12 months, 2018 is -35%, and 2022 is -52%. Different environment. Less “washout and bounce,” more “trend is down because the system is deleveraging,” whether that’s miners, credit, exchanges, or macro liquidity tightening. In those regimes, a death cross isn’t a late alarm — it’s the moving averages confirming that the downtrend is real and persistent.

The in-between tags matter too. 2019 is marked “late bear,” with +9% at six months and +89% at 12 — choppy, uneven, but improving as the cycle turns. 2021 is “late cycle”: +30% at six months, then -43% at 12, which fits a regime where trend signals can whipsaw while distribution and macro tightening creep in.

And then there’s 2024: “post-ETF regime,” with +58% at six months and +94% at 12. That tag is doing a lot of work. It suggests the backdrop isn’t just “price vs. moving averages,” but structural demand (ETFs), different liquidity plumbing, and a market that may behave less like pure reflexive leverage and more like a hybrid of trad-fi flows plus crypto-native positioning.

So the takeaway isn’t “death crosses are bullish.” That’s not true. It’s that the signal is mostly a trailing mirror — and the regime you’re actually in (bottoming, late bear, structural deleveraging, late cycle, post-ETF flow market) is what decides whether it’s a fake-out, a confirmation, or just noise with a scary name.

At press time, Bitcoin traded at $86,631.