Ethereum is trading with renewed strength after breaking above the $3,300 level and briefly pushing toward $3,400, signaling a potential shift in short-term momentum. However, despite this recovery, bullish conviction remains fragile. Many analysts continue to warn that the broader trend still leans bearish, emphasizing that Ethereum has yet to reclaim the structural levels needed to confirm a macro reversal.

Yet one signal has captured significant attention: according to fresh data from Lookonchain, a major whale known as BitcoinOG has doubled down on his Ethereum long position. This trader is widely recognized for being the whale who successfully shorted Bitcoin during the October 10 market crash, a move that earned him substantial profits and elevated his reputation across the on-chain analysis community.

Rather than taking profits after ETH’s recent pump, he has expanded his long exposure—an unusually aggressive stance at a time when most traders remain cautious.

His renewed commitment raises questions about whether smart money is quietly positioning for a larger upside move, even as broader sentiment remains skeptical. If momentum holds, Ethereum may be preparing for a far more significant move than the market currently expects.

Whale Positioning and FOMC Impact

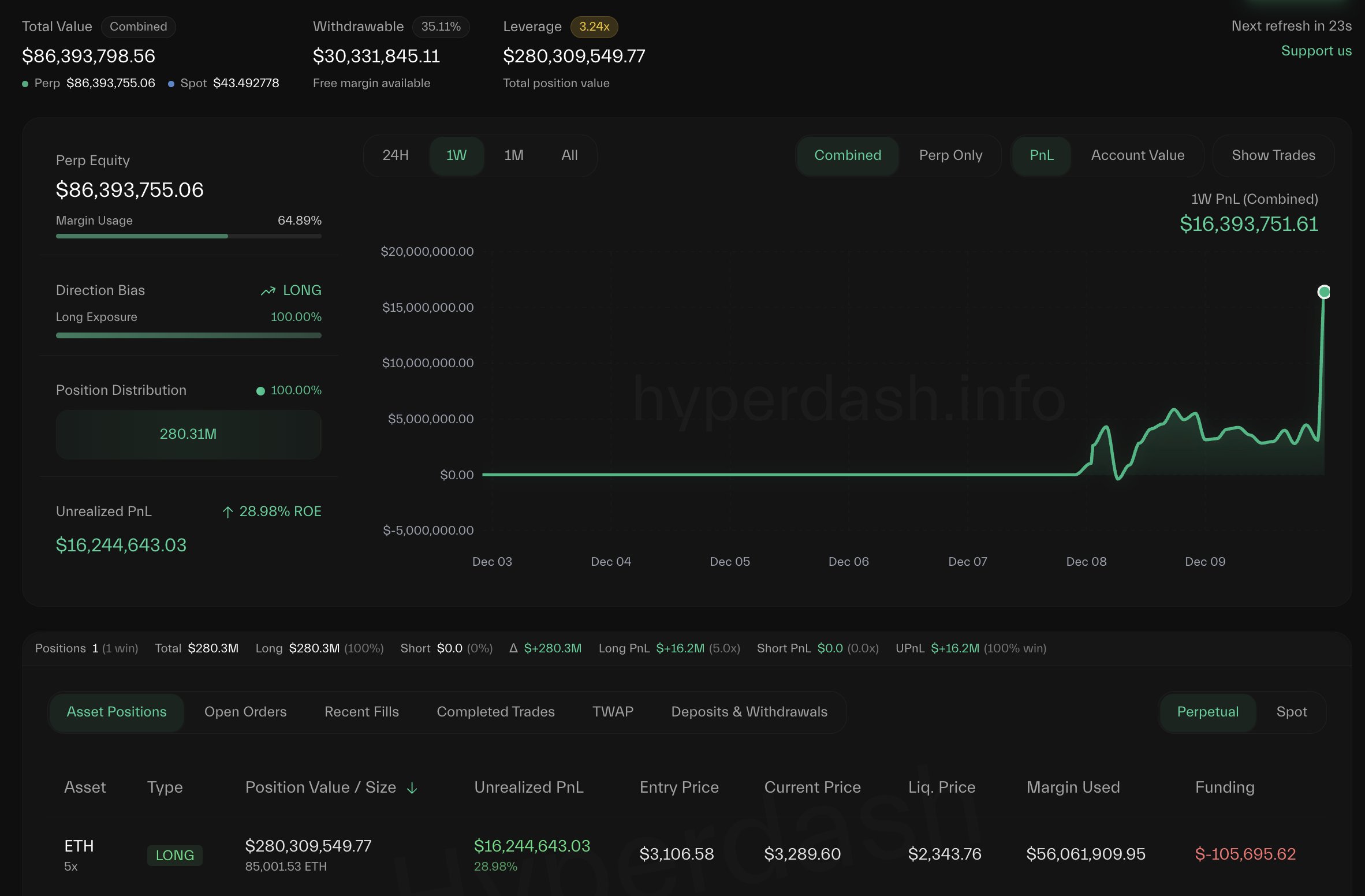

According to Lookonchain, the whale known as BitcoinOG has now expanded his position to 85,001 ETH, valued at roughly $280 million, and is currently sitting on more than $16 million in unrealized profit. Such an aggressive accumulation during a period of widespread caution signals a notable divergence between retail sentiment and whale behavior.

When a trader with a proven track record positions this heavily on the long side, it often reflects a strategic conviction that market conditions could soon shift in favor of higher prices.

However, this positioning unfolds just as the market approaches a pivotal macro event: the FOMC meeting. The Federal Reserve’s decision on interest rates can dramatically influence liquidity, risk appetite, and short-term volatility across all risk assets, including Ethereum.

A rate cut could inject optimism into the market by weakening the US dollar and improving overall liquidity conditions. Conversely, a hawkish tone or a smaller-than-expected policy adjustment could trigger a sell-the-news reaction, especially with ETH nearing resistance.

For Ethereum, whale accumulation combined with macro uncertainty creates a high-stakes environment. If liquidity expands post-FOMC, ETH could gain momentum. If not, even strong whale positions may face short-term pressure.

ETH Testing Breakout Strength Ahead of Key Resistance

Ethereum’s 4-hour chart shows a decisive shift in momentum, with ETH pushing firmly above the $3,300 level after a clean breakout from its multi-week downtrend. This move marks one of the strongest bullish impulses since early November, supported by rising volume and a clear reclaim of the 50 EMA and 100 EMA.

The 200 EMA (red), which previously acted as dynamic resistance throughout the decline, has now been tested and is beginning to flatten—often an early indication that bearish momentum is losing dominance.

However, ETH is now hovering directly below a critical resistance zone around $3,380–$3,420, a level where sellers previously stepped in aggressively. The current consolidation just beneath this zone reveals an undecided market: bulls attempt to establish acceptance above $3,300, while bears defend the next resistance layer.

If buyers manage to flip $3,320 into solid support, the path toward $3,500 becomes more achievable, especially if broader market sentiment improves. Conversely, a rejection from the $3,400 area could trigger a short-term pullback toward $3,200–$3,250, where moving averages are now stacked as layered support.

Featured image from ChatGPT, chart from TradingView.com