Bitcoin Magazine

Bitcoin Price Fights For $90,000 Despite Fed Rate Cuts

The bitcoin price fell on Wednesday night into Thursday, even after the U.S. Federal Reserve lowered interest rates, as Fed Chair Jerome Powell signaled a cautious approach heading into 2026.

On Wednesday, the Fed cut its benchmark rate by 25 basis points to 3.50%–3.75%, a move widely expected by markets. However, the 9–3 split among Federal Open Market Committee (FOMC) members and Powell’s hawkish remarks during the press conference tempered investor enthusiasm for risk assets, including cryptocurrencies.

One official favored a deeper 50-basis-point cut, while two voted against any reduction.

The Bitcoin price briefly jumped over $94,000 but then dropped below $90,000 and stabilized around $89,730 at the time of writing.

Bitfinex analysts shared with Bitcoin Magazine that the Fed’s unexpectedly hawkish tone surprised markets, causing a price reversal and kept risk appetites in check.

The Fed’s updated “dot plot” shows little consensus for more than a single 25-basis-point cut in 2026, with stronger growth forecasts and shifting tax policy limiting near-term easing.

Timot Lamarre, director of market research at Unchained, wrote to Bitcoin Magazine that “

There is so much to be bullish about in the bitcoin space – from Square facilitating bitcoin payments to large institutions like Vanguard now allowing their clients access to bitcoin ETFs to quantitative tightening coming to an end.”

Lamarre said that bitcoin’s recent price movements show a gap between growing adoption and the price increase that usually comes with higher demand.

Bitcoin price decline and broader market pullback

Bitcoin price’s recent pullback also reflects broader market concerns. Technology stocks, including Oracle, suffered after disappointing earnings and warnings about slower-than-expected AI-related profits.

Oracle shares fell 11% in after-hours trading following revenue and profit forecasts below analysts’ expectations.

The Fed’s outlook for 2026 suggests only one additional rate cut, fewer than markets had anticipated. Asian stock markets declined, and U.S. equity futures pointed lower, while European trading remained subdued.

Standard Chartered recently revised its year-end Bitcoin forecast, lowering its target from $200,000 to $100,000, citing a slowdown in corporate treasury buying and reliance on ETF inflows to support future price gains.

Bernstein analysts recently said that they see a structural shift in Bitcoin’s market cycle, meaning that the traditional four-year pattern has broken. They forecast an elongated bull cycle driven by steady institutional buying, which offsets retail selling, and minimal ETF outflows.

The bank raised its 2026 price target to $150,000 and expects the cycle to peak near $200,000 in 2027, maintaining a long-term 2033 target of roughly $1 million per BTC.

Meanwhile, JPMorgan remains bullish over the next year, projecting a gold-linked, volatility-adjusted Bitcoin target of $170,000 within six to twelve months, factoring in market fluctuations and mining costs.

Analysts say Bitcoin’s decline after the Fed announcement reflects a “sell the fact” dynamic. “The market had fully priced in the cut ahead of time,” said Tim Sun, senior researcher at HashKey Group. “Concerns over political and economic developments in 2026, combined with potential inflation from AI-driven capital expenditure, are weighing on risk sentiment.”

Last week, Bitcoin price saw a volatile ride, dipping to $84,000 before bulls pushed it up to $94,000, then dropping slightly below $88,000, and closing the week at $90,429.

The market now faces key support at $87,200 and $84,000, with deeper support zones around $72,000–$68,000 and $57,700.

Resistance levels stand at $94,000, $101,000, $104,000, and a thick zone between $107,000–$110,000, with momentum likely slowing above $96,000.

Typically, rate cuts lead to bullish momentum, but the market may have already priced in this month’s rate cut. The bitcoin price has fallen roughly 28% since its October all-time high.

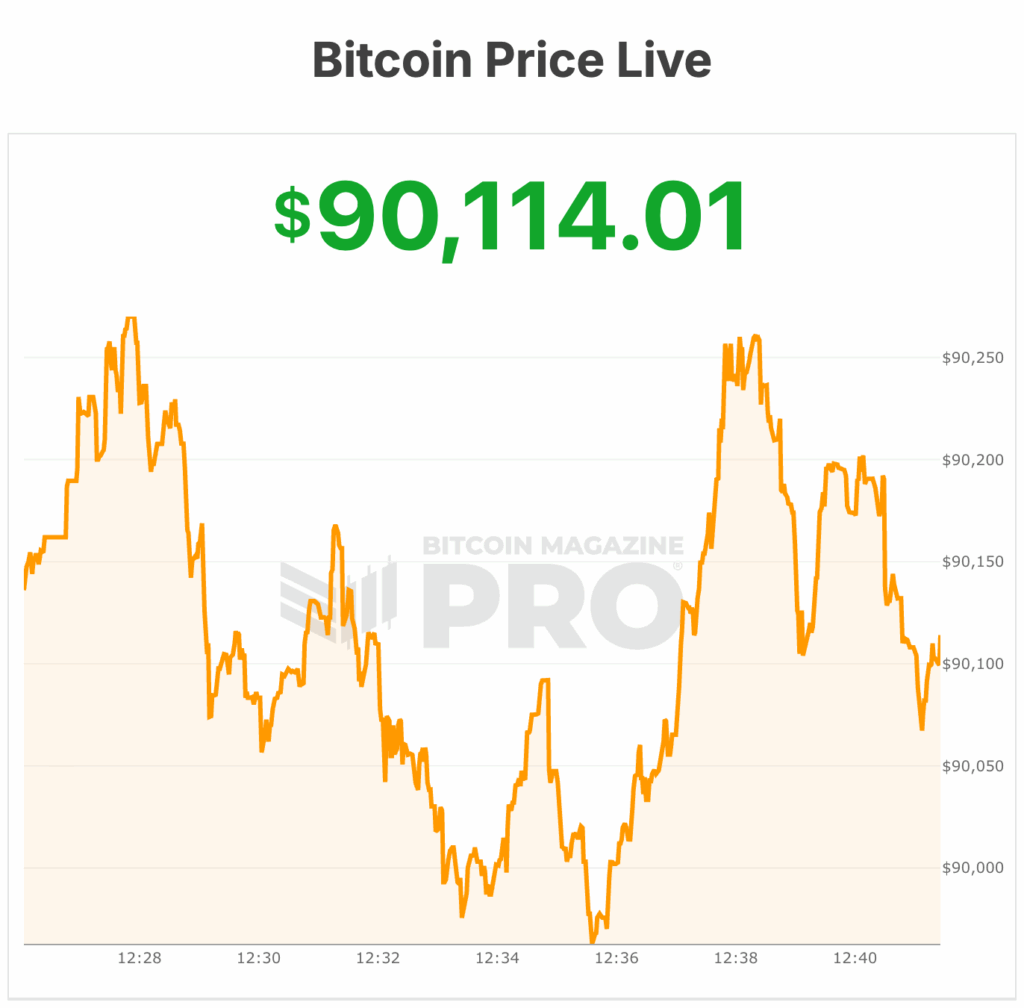

At the time of publishing, the bitcoin price is at $90,114.

This post Bitcoin Price Fights For $90,000 Despite Fed Rate Cuts first appeared on Bitcoin Magazine and is written by Micah Zimmerman.