What to Know:

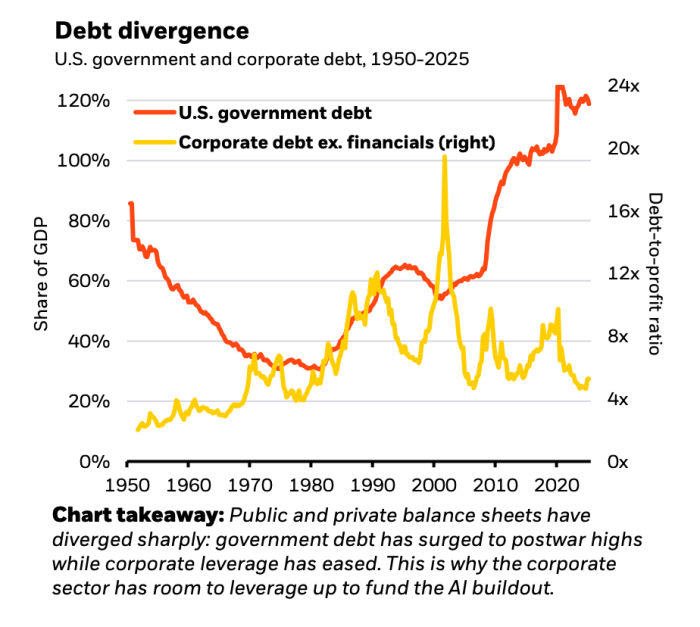

- Rising U.S. debt and heavy Treasury issuance are killing the charm of long-duration bonds, so institutions are looking toward Bitcoin and other digital assets as hedges.

- As Bitcoin adoption grows, demand is shifting away from simple price bets toward real infrastructure for fast payments, DeFi, NFTs, and gaming.

- Bitcoin Hyper ($HYPER) introduces a Bitcoin-anchored Layer 2 that uses the Solana Virtual Machine to fix Bitcoin’s slow transactions, high fees, and lack of smart contracts.

- Competition among Bitcoin Layer 2 networks will heat up as macro pressures and institutional inflows reward projects that mix Bitcoin’s trust with real performance.

Surging US debt and sticky deficits are no longer a quiet background issue. They are starting to feel like the entire plot.

BlackRock’s recent AI-driven research makes it clear: nonstop Treasury issuance and rising interest costs put pressure on long-term bonds.

When the concept of a risk-free asset starts wobbling, investors begin asking the classic question: where do we turn next?

Bitcoin keeps showing up in those conversations. After the spot ETF wave, $BTC turned into a boardroom-friendly hedge.

If US debt continues to climb, a supply-capped and rules-based asset starts looking pretty good. That is the broad idea BlackRock is pointing toward.

But once institutions agree Bitcoin belongs in the hedge bucket, the next question hits fast: how do you actually use $BTC inside today’s high-speed markets?

On-chain Bitcoin is slow, block space is tight, and fees can spike into tens of dollars when the network gets busy. Great for cold storage. Not great for anything that needs to move quickly.

This is the gap Bitcoin Hyper ($HYPER) aims to front-run.

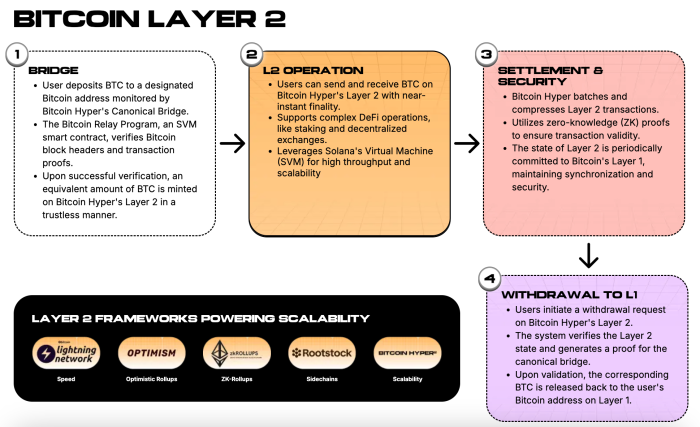

It markets itself as a high-performance Bitcoin Layer 2 built on the Solana Virtual Machine (SVM), offering sub-second settlement and smart contracts while anchoring its security to Bitcoin.

If BlackRock’s macro outlook drives more capital into $BTC, Bitcoin Hyper aims to be the platform where that capital actually generates results. Think payments, DeFi, gaming, NFTs, and more.

Why Debt Risks And Institutional Flows Favor High-Throughput Bitcoin Infrastructure

If the U.S. is heading toward chronic deficits, higher rates, and nonstop Treasury issuance, then long-duration bonds stop looking like a safe parking spot and start acting like a stress test.

That is why large asset managers talk about needing new hedges. Bitcoin fits that role, as do gold and tokenized assets backed by real collateral.

As institutions add Bitcoin exposure, the pressure builds to make $BTC usable, not just something you lock in a vault.

Lightning facilitates payments, but it does not support complex smart contracts or high-performance DeFi applications.

Ethereum rollups and Solana solve those problems, but they are not secured by Bitcoin, which matters to investors who want their hedge and their infrastructure to be based on the same monetary foundation.

That is why the race among Bitcoin-aligned Layer 2s and sidechains is speeding up. Stacks, Rootstock, and others are trying to push programmability closer to Bitcoin, each making different trade-offs.

Bitcoin Hyper is one of the new crypto projects taking a more ambitious approach: instead of building a new system, it uses the Solana VM and anchors it to Bitcoin. It is like taking a sports car engine and dropping it into a truck known for reliability.

Inside Bitcoin Hyper’s SVM Layer 2 And The Ongoing Presale

Bitcoin Hyper ($HYPER) focuses heavily on speed.

The design is modular: Bitcoin Layer 1 handles settlement and data availability, while an SVM-powered Layer 2 handles execution. Developers can use Rust and Solana-style tools, but the chain ultimately settles back to $BTC instead of $SOL.

The goal is simple: push beyond Solana speeds while inheriting Bitcoin’s trust and brand power.

Bitcoin Hyper currently relies on a single trusted sequencer. It batches transactions and anchors its state to the Bitcoin blockchain.

This setup allows extremely low-latency confirmations, which works well for order-book DEXs, gaming loops, and NFT mints.

Fees aim to stay at fractions of a cent, not the usual on-chain $BTC spikes. A decentralized canonical bridge moves $BTC into wrapped assets for fast swaps, payments, lending, and staking.

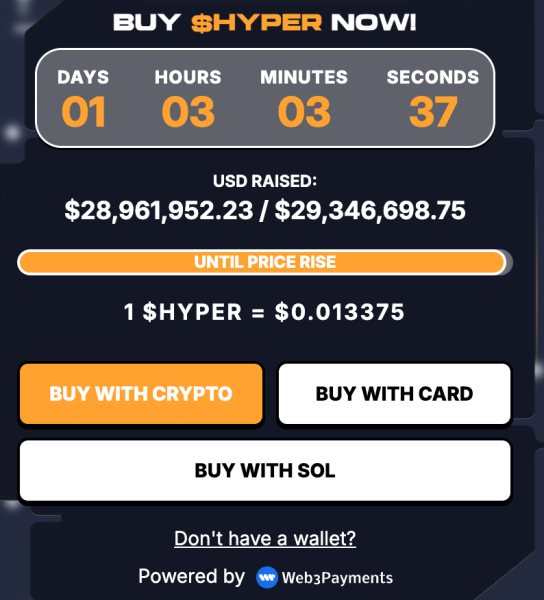

The presale is already large. Bitcoin Hyper has raised over $28.9M and you can buy $HYPER now for just $0.013375.

For Bitcoin holders and DeFi users, the pitch is straightforward. If institutional money continues to flow into $BTC due to macroeconomic risks, the next stage of the trade may manifest in the infrastructure that makes Bitcoin actually useful.

Bitcoin Hyper wants to be that high-throughput SVM Layer 2 built for payments, gaming, and composable DeFi.

This article is for informational purposes only and doesn’t offer financial, investment, or trading advice. Always do your own research (DYOR) before investing in crypto.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/news/blackrock-warns-on-us-debt-bitcoin-hyper-presale-accelerates