Bitcoin Magazine

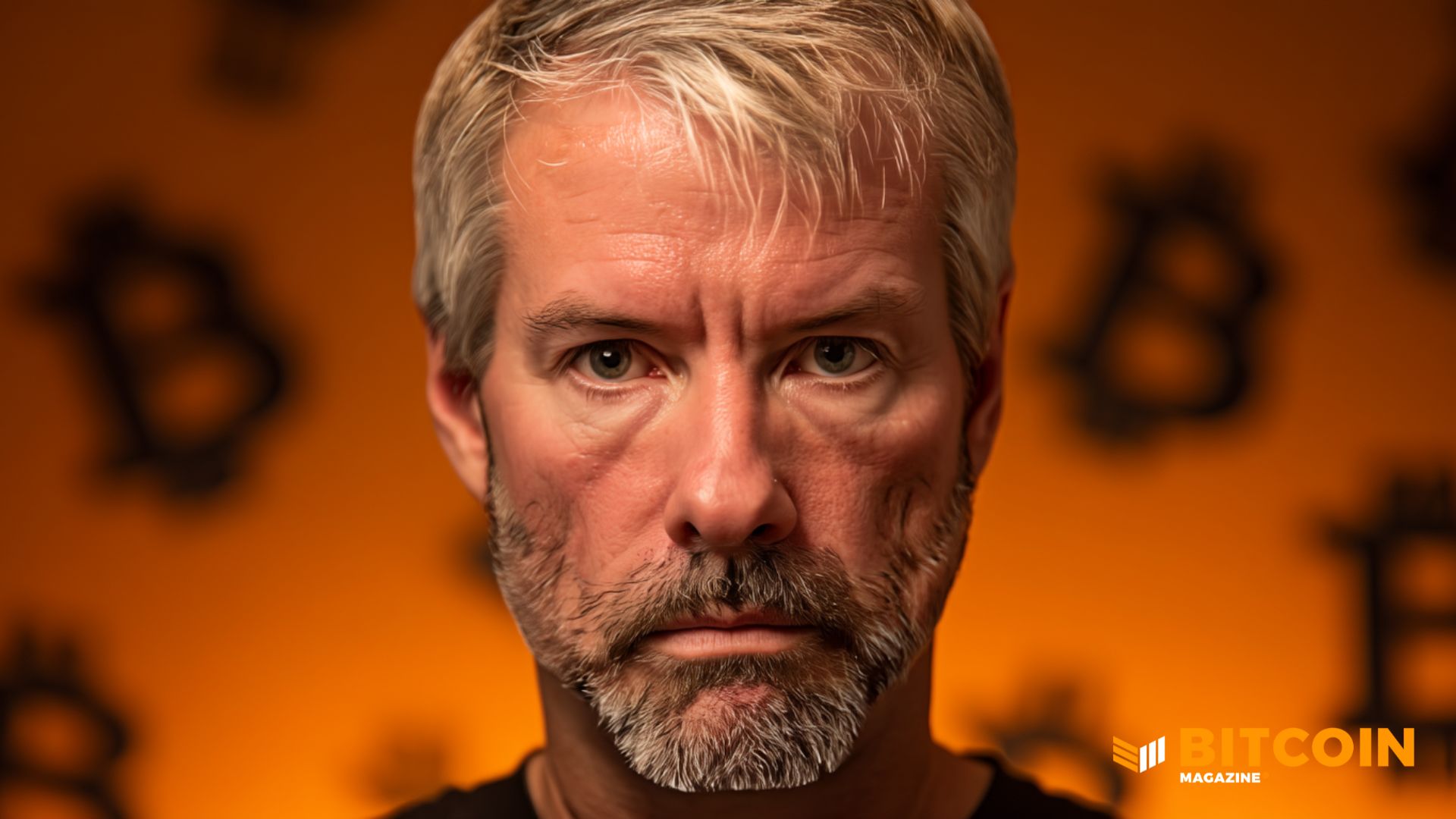

Strategy’s (MSTR) Michael Saylor Dismisses Index Concerns: ‘Our Conviction in Bitcoin is Unwavering’

Michael Saylor pushed back on recent reports warning that Strategy could face billions in passive outflows if MSCI excludes the company from major equity indices.

In a statement on X, Saylor said that Strategy is “not a fund, not a trust, and not a holding company.” He described the firm as a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

Saylor highlighted the company’s recent activity, including five public offerings of digital credit securities — $STRK, $STRF, $STRD, $STRC, and $STRE — representing over $7.7 billion in notional value.

He also pointed to Stretch ($STRC), a Bitcoin-backed credit instrument that offers variable monthly USD yields to institutional and retail investors.

“Funds and trusts passively hold assets. Holding companies sit on investments. We create, structure, issue, and operate,” Saylor wrote. “No passive vehicle or holding company could do what we’re doing.”

He described Strategy as a new kind of enterprise: a Bitcoin-backed structured finance company innovating in both capital markets and software.

Saylor added that index classification does not define the company. “Our strategy is long-term, our conviction in Bitcoin is unwavering, and our mission remains unchanged: to build the world’s first digital monetary institution on a foundation of sound money and financial innovation.”

Will Strategy get removed from Nasdaq 100?

The statement comes as JPMorgan analysts warned that MSCI’s potential exclusion of Strategy from major indices could trigger $2.8 billion in outflows, rising to $8.8 billion if other index providers follow.

Strategy’s market cap sits around $59 billion, with nearly $9 billion held in passive index-tracking vehicles. Analysts said any exclusion could increase selling pressure, widen funding spreads, and reduce trading liquidity.

Strategy’s inclusion in indices such as the Nasdaq 100, MSCI USA, and MSCI World has long helped channel the Bitcoin trade into mainstream portfolios. However, MSCI is reportedly evaluating whether companies with large digital-asset holdings should remain in traditional equity benchmarks.

Market participants increasingly see digital-asset-heavy companies as closer to investment funds, which are ineligible for index inclusion.

Despite all the recent bitcoin volatility and concerns about potential outflows, the company continues to pursue its long-term vision of a Bitcoin-backed financial enterprise, aiming to create new financial products and a digitally native monetary institution.

On October 10, bitcoin and the broader crypto market crashed. Some believe it was because Trump threatened tariffs on China, but some contend that the broader crash was triggered when MSCI announced it was reviewing whether companies that hold crypto as a core business, like MSTR, should be classified as “funds” rather than operating companies. Some contend that ‘smart money’ anticipated this risk immediately after MSCI’s announcement, leading to the sharp market drop, with the outcome now hinging on MSCI’s January 15, 2026 decision.

Trillions of dollars in Bitcoin

Earlier this year in an interview with Bitcoin Magazine, Saylor outlined an ambitious vision to build a trillion-dollar Bitcoin balance sheet, using it as a foundation to reshape global finance.

He envisions accumulating $1 trillion in Bitcoin and growing it 20–30% annually, leveraging long-term appreciation to create a massive store of digital collateral.

From this base, Saylor plans to issue Bitcoin-backed credit at yields significantly higher than traditional fiat systems, potentially 2–4% above corporate or sovereign debt, offering safer, over-collateralized alternatives.

He anticipates this could revitalize credit markets, equity indexes, and corporate balance sheets while creating new financial products, including higher-yield savings accounts, money market funds, and insurance services denominated in Bitcoin.

At the time of writing, Bitcoin is experiencing extreme levels of sell pressure and its price is dipping near the $80,000 range. Bitcoin’s all-time high came only six weeks ago when it hit prices above $126,000.

Strategy’s stock, $MSTR, is trading at $167.95 down over 5% on the day and over 15% over the last five trading days.

This post Strategy’s (MSTR) Michael Saylor Dismisses Index Concerns: ‘Our Conviction in Bitcoin is Unwavering’ first appeared on Bitcoin Magazine and is written by Micah Zimmerman.