Bitcoin Magazine

Bitcoin Price Teeters at $93,000 as Bears Press Their Advantage

Bitcoin price hovered near $93,000 on Tuesday as the market continued to reel from thin liquidity, cascading leverage, and growing bearish conviction across key technical levels.

The Bitcoin price traded near $94,000 at midday, up 1% in the past 24 hours, with a hefty $111 billion in trading volume. The asset now sits 1% below its weekly high of $93,669 and 4% above its weekly low of $89,368.

Bitcoin’s circulating supply stands at 19,950,440 BTC, inching closer to its 21 million hard cap, while its global market cap ticked 1% higher to $1.85 trillion, according to Bitcoin Magazine Pro data.

But sentiment is anything but buoyant. With volatility rising and liquidity thinning, even modest flows are pushing the market around.

“Markets are still feeling the impact of the October 10 liquidation event,” Nicolai Søndergaard, Research Analyst at Nansen, wrote to Bitcoin Magazine. “Market depth has fallen by roughly 30% since then, which means even modest selling pressure can move prices sharply. That’s essentially why Bitcoin slipped below $90,000 today. When liquidity is this thin, it takes far less capital to push the market in either direction, and when you layer leverage on top, volatility becomes inevitable.”

What Søndergaard is pointing to is the wave of liquidations triggered after a fresh bout of trade jitters set off a historic rush to unwind bitcoin long positions. Investors shed roughly $19 billion in leveraged bets across major exchanges in less than a day — with some estimates putting the total closer to $30 billion.

On that day, the bitcoin price dropped over 10%. It marked the largest bitcoin liquidation event on record.

Søndergaard added that options data shows a “non-negligible” probability of a dip toward the mid-$80,000 range, though a bounce or stabilization near current levels appears more likely.

Some long-term investors see opportunity in the chaos: “If your objective is to save in the hardest money humanity has ever known, you can stack 25% more bitcoin than you were able to just a month ago,” wrote Timot Lamarre, Director of Market Research at Unchained, to Bitcoin Magazine.

Bitcoin price: Bearish structure dominates

The broader market mood turned sharply negative after Bitcoin price’s decisive break below $96,000, a level analysts at Feral Analysis and Juan Galt had flagged for weeks as critical weekly support. Analysts warn that “with the price closing so low, we should not expect much of a bounce at this level, if any.” Resistance above $94,000 is “thick now,” they said, with sellers waiting at every major price shelf.

A heavy-volume support zone sits at $83,000–$84,000. Another key area sits at $69,000–$72,000, marking the top of the 2024 consolidation range. A slide into the mid-$80Ks is also becoming more plausible if volatility spikes again.

Upside scenarios remain challenging. Even a surprise short squeeze, they wrote, would face “the equivalent of a brick wall” between the bitcoin price of $106,000 and $109,000. Only a weekly close above $116,000 would force a reconsideration of the bear trend — an outcome they call unlikely.

The bitcoin price has now fallen more than 25% from its October peak. That decline has triggered fresh debate over whether the 2025 cycle top is already behind us. Historically, the September–December window hosts major cycle highs. This year’s structure fits the pattern — but with a twist: the top may have arrived early and with less force than expected.

A late-cycle peak in Q1 2026 remains possible. With equities showing early signs of fatigue and liquidity draining from risk markets more broadly, they argue that “little hope remains for any meaningful rally or new highs” in the near term.

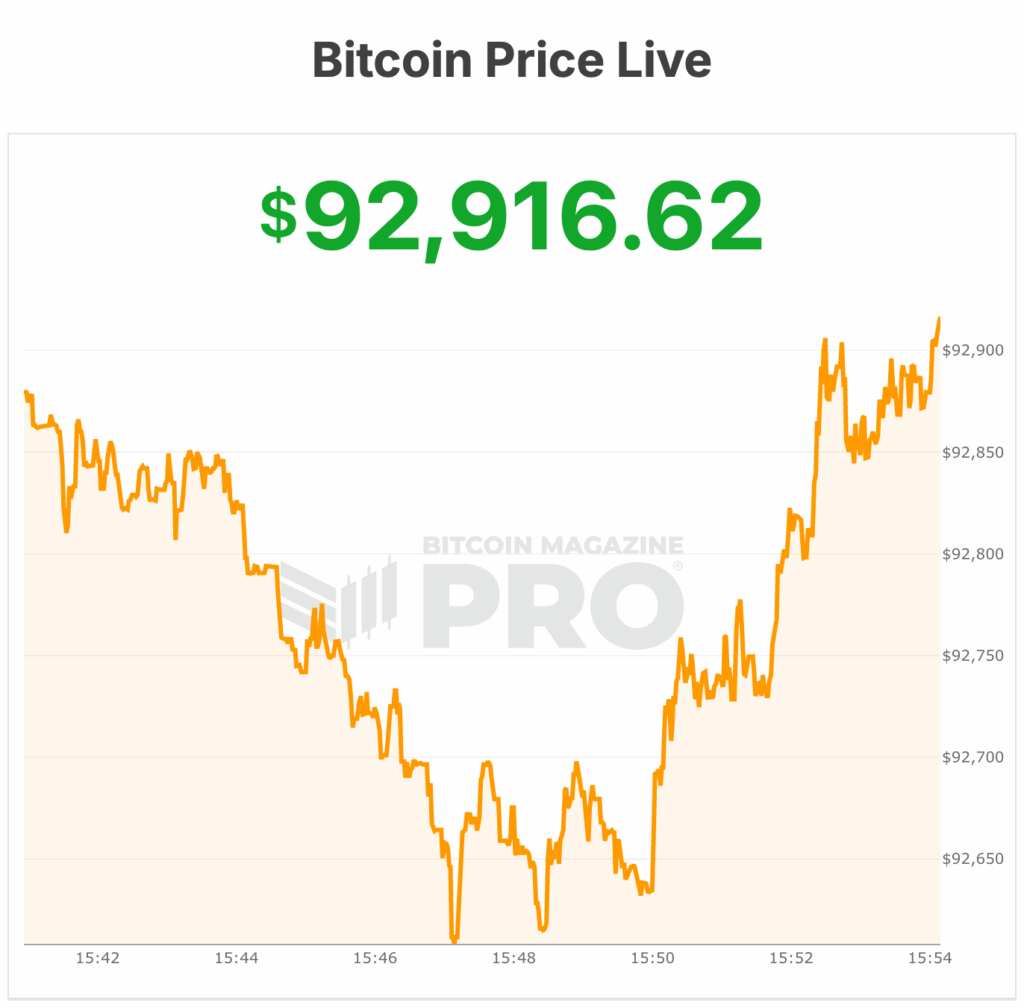

At the time of writing, the bitcoin price is 92,916. It’s 24-hour lows is $89,183 according to BM Pro data.

This post Bitcoin Price Teeters at $93,000 as Bears Press Their Advantage first appeared on Bitcoin Magazine and is written by Micah Zimmerman.