Bitcoin Magazine

The Return Of The Tontine – A Natural Retirement Option For Bitcoiners?

When it comes to pensions and retirement, we have a clear pensions adequacy issue in much of the world given that the population is living longer and many individuals have inadequate savings for a comfortable retirement. Bitcoin fixes this – in part – by offering a form of savings which can’t be debased and should hold its value into the long term. Lowering our collective time preference as a society also wouldn’t hurt, as we’d prioritise our later years more than we do so at present.

It’s sometimes remarked though that Bitcoin doesn’t solve all the problems in the world, only half of them, and there is one huge aspect Bitcoin cannot help with in terms of retirement planning. Namely, none of us know how long we are going to live for, and if we live “too long” we face the risk of running out of money in old age. This is a problem which the pensions and insurance world defines as “longevity risk”.

I wrote an article for Bitcoin Magazine in 2022 on one solution, which can be viewed here. In short, it proposed a simple annuity product priced in Bitcoin and that would pay policyholders a Bitcoin income for life, allowing participants to pool their longevity risk in retirement.

Remarkably, there is now a product coming to market that allows bitcoiners to pool their longevity risk into a Bitcoin based trust and be paid an income for life, but with more transparency and likely a higher income than an annuity. Enter the Bitcoin Tontine by Tontine Trust.

Let’s run through the basics.

What is a Tontine and how does it work?

A Tontine is traditionally known as an investment linked to a living person that operates to pay them an income for as long as they live. Each participant pays into their own segregated trust. Each trust designates a Tontine Class as the beneficiary of their trust upon their death. The Tontine Class is comprised of a large number of others of similar age and sex. A varying income is then paid to each member out of their own account. When a member of the Tontine Class dies, the whole value leftover in their trust gets allocated proportionately into the individual trust accounts of all the remaining class members, thus helping to boost their retirement income over time. This process continues until the second last member dies.

The income paid is continuously updated, and is calculated to ensure an income for life for all participants based upon the following factors –

a) the members life expectancy which is largely based upon age / sex

b) the current value of their investment fund

c) the expected annual return on their fund

This method means the income could sometimes go down as well as up however it is this flexibility which in turn mathematically guarantees that members will never run out of income in retirement. The Tontine Trust cover the costs of running the tontine via a flat annual trustee fee of 1% levied on each trust account.

How does this differ to an Annuity?

An annuity guarantees a fixed income (or an income with defined increases, e.g. 3% per annum) for life at outset. If members live far longer than expected, it will fall on the insurer to absorb that cost (and conversely, they will profit if members die young). Due to this requirement, insurers have strict requirements to hold excess capital to cover all eventualities, and tend to price their annuities based on the return on fixed income government bonds. Their profits are opaque and are realised over many years.

By contrast the tontines offered by the Tontine Trust work in an extremely transparent and intuitive manner, and due to their nature can offer a range of trustee approved asset classes for the underlying investments. Moreover, members can change their investment strategy over time. Alongside a pure allocation to Bitcoin, they offer investment strategies for different risk appetites & circumstances, including a “Bold” fund (mix of Bitcoin and Gold), index funds, and money market funds.

The higher returns of underlying investments in combination with the mechanisms of a tontine should ensure that participants enjoy a higher income throughout retirement as a result, vs an annuity. The main trade-off is that income paid can fall as well as rise due to investment returns.

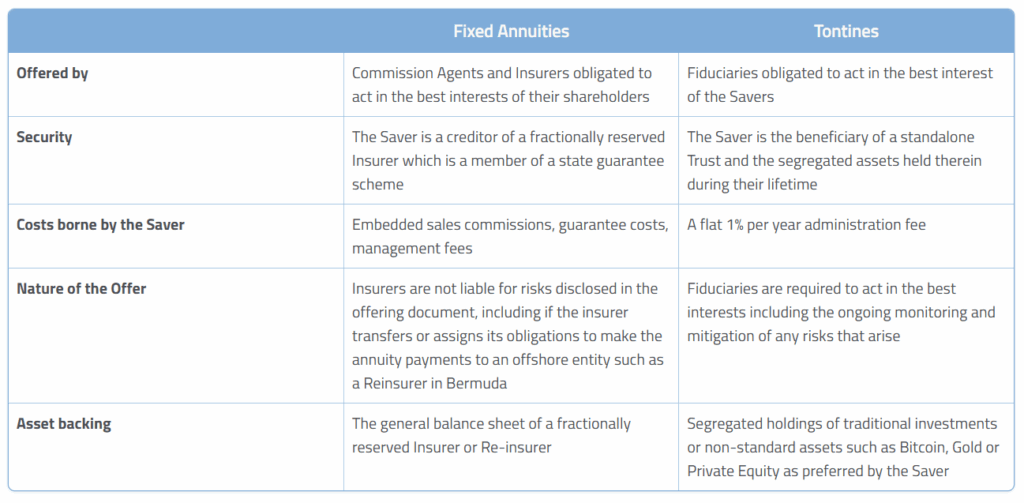

A comparison of Tontines and Fixed Annuities. Source: Tontine Trust Website

What are the downsides of Tontines?

In a Tontine the longevity of members will directly impact on the payouts to the rest of the group (rather than in an annuity, where how long members live for will impact on the profits of an insurer). Due to this, arguably the main risk for tontine fiduciaries is the potential for fraud, and relatives of members pretending they are still alive after their death (of course, insurers also bear this risk).

Tontine Trust has come up with a new technological way to combat the potential for fraud, patenting a new proof of life method whereby members demonstrate they are still alive via the Tontine Trust app to validate payments to them. In addition, as each member has their own segregated account, the Tontine Trust are able to follow a proof of reserves system, using blockchain to aid transparency and reflect all payments and charges in and out of members accounts.

It may be that a public relations campaign is required to educate the public on this new type of Tontine product. Tontines have a rich and varied history, dating back to the 17th century. Where covered in fiction, Tontines have often involved cloak and dagger tales of private Tontine arrangements, often whereby the last surviving member of a small group will inherit the lot. In reality, the modern day Tontine pools will operate at scale and with anonymity.

Grampa Simpson and Monty Burns – the last two survivors in a Tontine to wholly inherit stolen artwork in the Simpsons episode Raging Abe Simpson and His Grumbling Grandson in “The Curse of the Flying Hellfish” – see clip here

In addition, Tontines were restricted from sale in the United States on certain life insurance policies following the Armstrong investigation of 1905, as the terms of these policies led to certain forms of malpractice by many of the insurance companies of the time. There were some questionable terms for consumers with these products, such as a default on the policy for missing a single regular payment, and high commission rates payable to sales agents. These issues as summarised in the paper here were specific to the products and practices of the time, rather than a fundamental problem with a retirement Tontine as listed above.

How do Tontines sit with current regulation?

Tontines are very long term products managed in the best interests of members by fiduciaries and as such are similar to pensions and other trustee services. They don’t fall under insurance regimes, since the maintencance of a separate capital reserve isn’t needed to insulate against members living for a long time. Crucially, there have been recent developments in favour of Tontines yet again being launched as a product.

In 2022, the OECD (Organisation for Economic Co-operation and Development) published a legal instrument recommending that Defined Contribution pension plans (which are now the norm in most countries) ensure protection against longevity risk in retirement. This could be achieved by providing Lifetime income which “can be provided by annuities with guaranteed payments or by non-guaranteed arrangements where longevity risk is pooled among participants”. They note that the choice made will depend on the balance required between the cost of guarantees (i.e. annuities give a guarantee of an income, but may be worse value) and stability of retirement income (i.e. arrangements such as tontines may sometimes see income decrease over time from adverse investment returns).

Further to this, Donald Trump recently signed an executive order in August 2025 seeking to democratise access to alternative assets, which not only outlines access to include “holdings in actively managed investment vehicles that are investing in digital assets”, but also to “lifetime income investment strategies including longevity risk-sharing pools”. This essentially paves the way for Tontines as a retirement option, and for the underlying investment to be Bitcoin.

Arguably, this is the social security system of the future. National Tontines backed by Bitcoin could quickly become the most secure way for governments to ensure that their populations have an inflation proof income to take care of them in old age. The “pay as you go” model for state pensions as employed in many countries will continue to come under strain due to demographic shifts. Although a shift to a funded model is a large one, it then solves for inter generational fairness and comes at zero cost to the state.

Summary

17 years after the original Bitcoin whitepaper, we are about to see a natural retirement option launched for bitcoiners – a longevity risk sharing pool with the benefits of bitcoin returns and which enables bitcoiners to mathematically guarantee an income for life. This seems likely to pay a much higher income than an annuity can offer. A choice facing those seeking a lifetime retirement income will be from a) an annuity priced by returns on fixed income government debt, and b) a tontine powered by Bitcoin returns.

Over time, the market will decide.

This is a guest post by BitcoinActuary. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine. None of the content in this article should be construed as financial advice. The author owns shares in Tontine Trust.

This post The Return Of The Tontine – A Natural Retirement Option For Bitcoiners? first appeared on Bitcoin Magazine and is written by Bitcoinactuary.